Answered step by step

Verified Expert Solution

Question

1 Approved Answer

David and Mary Smith together earn $72,000 per year, David and Mary would like to buy a home for $225,000. The new mortgage will

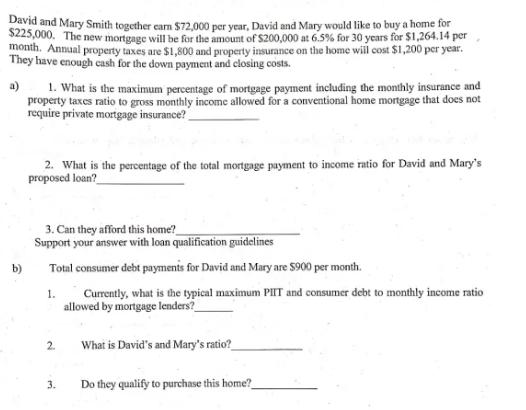

David and Mary Smith together earn $72,000 per year, David and Mary would like to buy a home for $225,000. The new mortgage will be for the amount of $200,000 at 6.5% for 30 years for $1,264.14 per month. Annual property taxes are $1,800 and property insurance on the home will cost $1,200 per year. They have enough cash for the down payment and closing costs. a) 1. What is the maximum percentage of mortgage payment including the monthly insurance and property taxes ratio to gross monthly income allowed for a conventional home mortgage that does not require private mortgage insurance? 2. What is the percentage of the total mortgage payment to income ratio for David and Mary's proposed loan? 3. Can they afford this home? Support your answer with loan qualification guidelines Total consumer debt payments for David and Mary are $900 per month. b) 1. Currently, what is the typical maximum PIIT and consumer debt to monthly income ratio allowed by mortgage lenders? 2. What is David's and Mary's ratio? 3. Do they qualify to purchase this home?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a 1 The maximum percentage of mortgage payment including monthly insurance and property taxes to gro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started