Answered step by step

Verified Expert Solution

Question

1 Approved Answer

David, Chris and John formed a partnership on July 31, 2019. They decided to share profits equally, but inserted a clause in the partnership

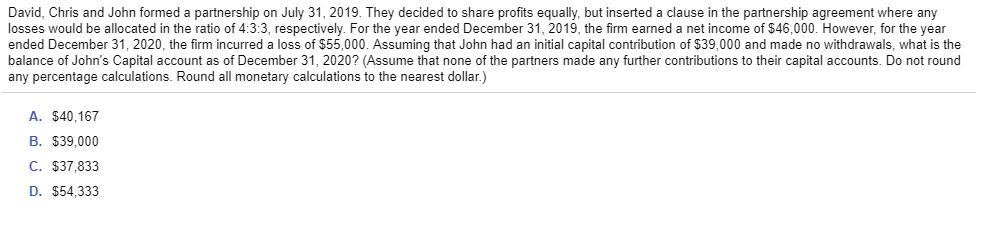

David, Chris and John formed a partnership on July 31, 2019. They decided to share profits equally, but inserted a clause in the partnership agreement where any losses would be allocated in the ratio of 4:3:3, respectively. For the year ended December 31, 2019, the firm earned a net income of $46,000. However, for the year ended December 31, 2020, the firm incurred a loss of $55,000. Assuming that John had an initial capital contribution of $39,000 and made no withdrawals, what is the balance of John's Capital account as of December 31, 2020? (Assume that none of the partners made any further contributions to their capital accounts. Do not round any percentage calculations. Round all monetary calculations to the nearest dollar.) A. $40,167 B. $39,000 C. $37,833 D. $54,333

Step by Step Solution

★★★★★

3.49 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

The correct answer is C 37833 Calculation ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started