Question

David Copperfield, a calendar-year taxpayer, was employed and resided in Philadelphia. On February 1, Copperfield was permanently transferred to Dallas by his employer. Copperfield

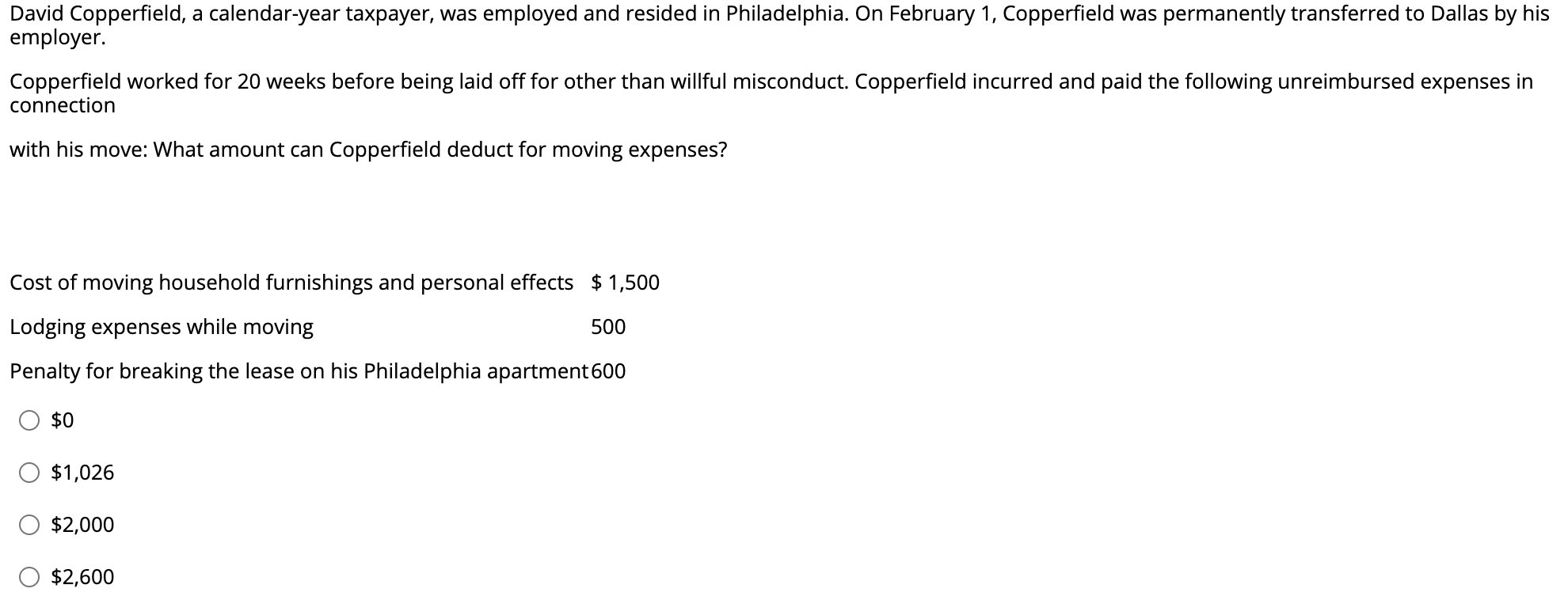

David Copperfield, a calendar-year taxpayer, was employed and resided in Philadelphia. On February 1, Copperfield was permanently transferred to Dallas by his employer. Copperfield worked for 20 weeks before being laid off for other than willful misconduct. Copperfield incurred and paid the following unreimbursed expenses in connection with his move: What amount can Copperfield deduct for moving expenses? Cost of moving household furnishings and personal effects $1,500 Lodging expenses while moving 500 Penalty for breaking the lease on his Philadelphia apartment 600 $0 $1,026 $2,000 $2,600

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer 0 No moving expenses r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals Of Taxation 2018

Authors: Ana M. Cruz Dr., Michael Deschamps, Frederick Niswander, Debra Prendergast, Dan Schisler

11th Edition

1259713736, 1259713733, 978-1259713736

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App