Question

David is concerned that his wife, Ceri, may have been taxed incorrectly in her new job. He says that Ceris P60 form for the year

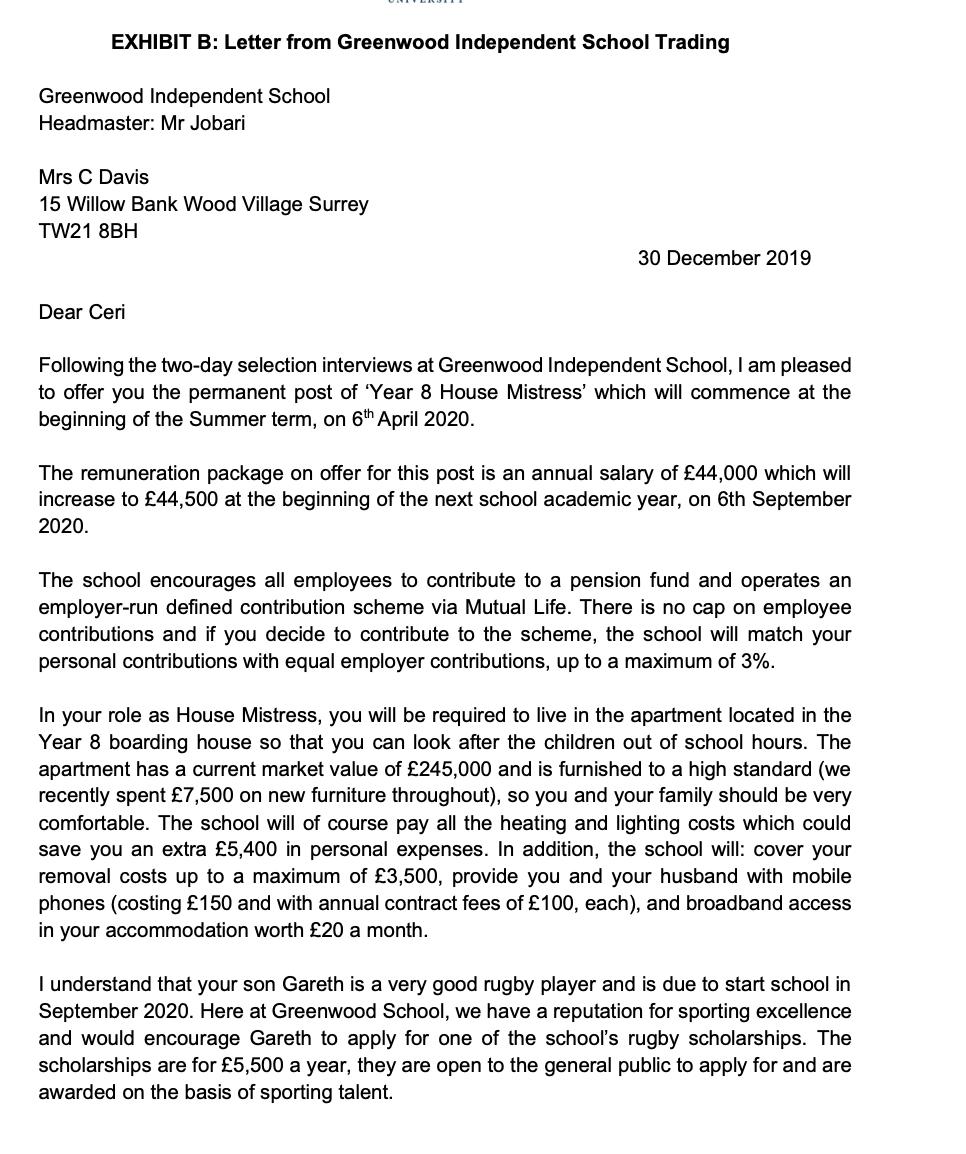

David is concerned that his wife, Ceri, may have been taxed incorrectly in her new job. He says that Ceri’s P60 form for the year to 5th April 2021 shows she paid £4,590 income tax and £2,815 national insurance contributions.

David explains that Ceri has chosen to make 5% employee contributions to her pension fund, the school makes a further 3% contribution. Ceri took all the other benefits offered in the school’s letter dated 30 December 2019.

David also tells you that Ceri has received £3,250 Building Society interest and a dividend of £450 from Scottish Newcastle plc.

During the year David bought some land, built a property ‘Rose House’ on the land and

sold it for a profit. David asks your advice on how this profit will be taxed.

Required:

Use the series of Badges of Trade tests to analyse if David is carrying out a trade for tax purposes.

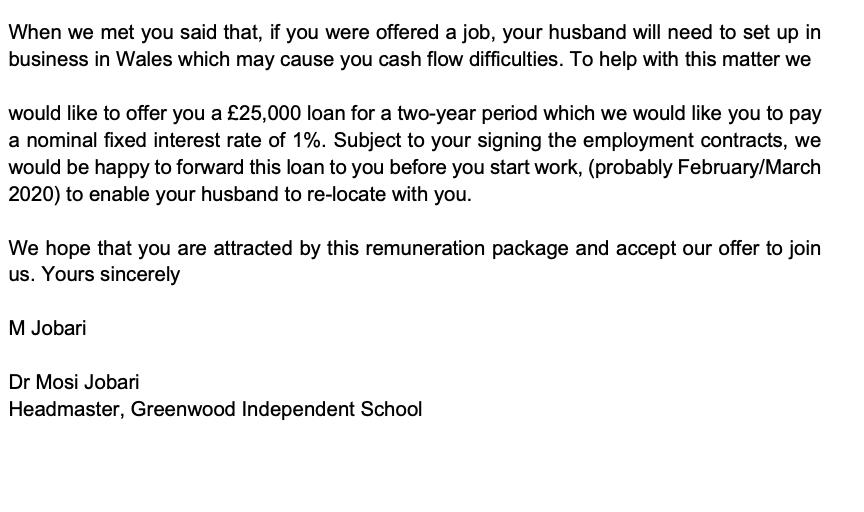

Assuming you conclude David is carrying on a ‘building trade’ which means the profits from his development are taxable under the Income Tax (Trading and Other Income) Act 2005; David asks how much profit will actually be taxable.

Calculate taxable trading profit for David’s ‘building trade’ for the year ended 5 April 2021.

[ answer should indicate by the use of zero (0) where items have been considered but no tax adjustment is required.]

Calculate David’s income tax payable for the 2020/21 tax year.

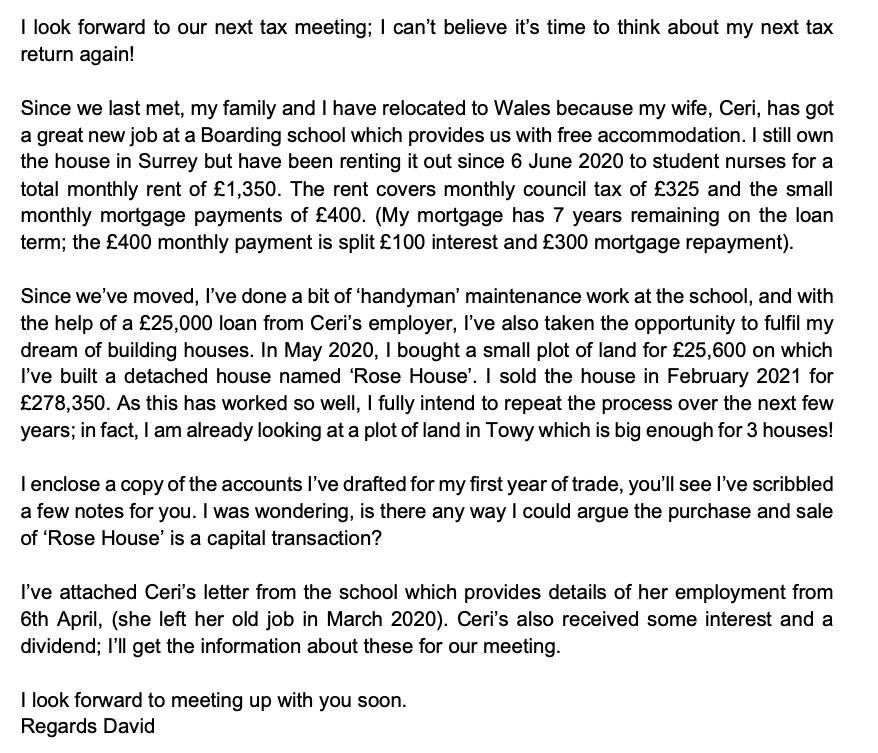

I look forward to our next tax meeting; I can't believe it's time to think about my next tax return again! Since we last met, my family and I have relocated to Wales because my wife, Ceri, has got a great new job at a Boarding school which provides us with free accommodation. I still own the house in Surrey but have been renting it out since 6 June 2020 to student nurses for a total monthly rent of 1,350. The rent covers monthly council tax of 325 and the small monthly mortgage payments of 400. (My mortgage has 7 years remaining on the loan term; the 400 monthly payment is split 100 interest and 300 mortgage repayment). Since we've moved, I've done a bit of 'handyman' maintenance work at the school, and with the help of a 25,000 loan from Ceri's employer, I've also taken the opportunity to fulfil my dream of building houses. In May 2020, I bought a small plot of land for 25,600 on which I've built a detached house named 'Rose House'. I sold the house in February 2021 for 278,350. As this has worked so well, I fully intend to repeat the process over the next few years; in fact, I am already looking at a plot of land in Towy which is big enough for 3 houses! I enclose a copy of the accounts I've drafted for my first year of trade, you'll see I've scribbled a few notes for you. I was wondering, is there any way I could argue the purchase and sale of 'Rose House' is a capital transaction? I've attached Ceri's letter from the school which provides details of her employment from 6th April, (she left her old job in March 2020). Ceri's also received some interest and a dividend; I'll get the information about these for our meeting. I look forward to meeting up with you soon. Regards David

Step by Step Solution

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started