Answered step by step

Verified Expert Solution

Question

1 Approved Answer

David retired from MT Sdn. Bhd. on 31.12.2023 at the age of 55. Salary for the period from 1.1.2023 to 31.12.2023 amounting to RM72,000.

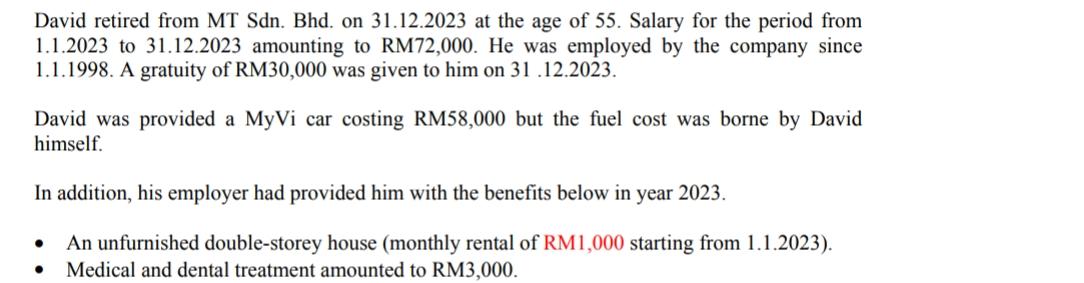

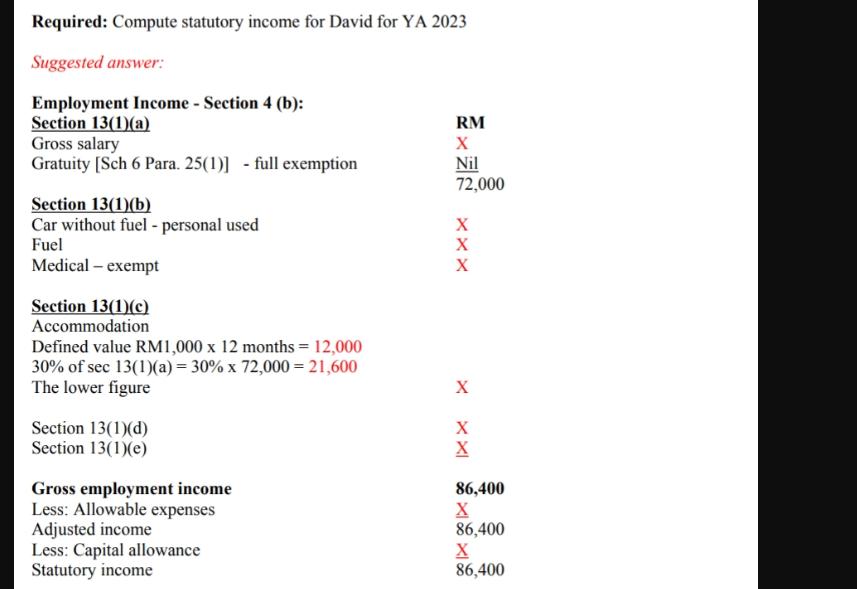

David retired from MT Sdn. Bhd. on 31.12.2023 at the age of 55. Salary for the period from 1.1.2023 to 31.12.2023 amounting to RM72,000. He was employed by the company since 1.1.1998. A gratuity of RM30,000 was given to him on 31.12.2023. David was provided a MyVi car costing RM58,000 but the fuel cost was borne by David himself. In addition, his employer had provided him with the benefits below in year 2023. An unfurnished double-storey house (monthly rental of RM1,000 starting from 1.1.2023). Medical and dental treatment amounted to RM3,000. Required: Compute statutory income for David for YA 2023 Suggested answer: Employment Income - Section 4 (b): Section 13(1)(a) Gross salary Gratuity [Sch 6 Para. 25(1)] - full exemption Section 13(1)(b) Car without fuel - personal used Fuel Medical - exempt Section 13(1)(c) Accommodation Defined value RM1,000 x 12 months = 12,000 30% of sec 13(1)(a) = 30% x 72,000 = 21,600 The lower figure Section 13(1)(d) Section 13(1)(e) Gross employment income Less: Allowable expenses Adjusted income Less: Capital allowance Statutory income RM X Nil 72,000 X X X X X 86,400 X 86,400 X 86,400

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information provided I will help you compute the statutory income for David ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started