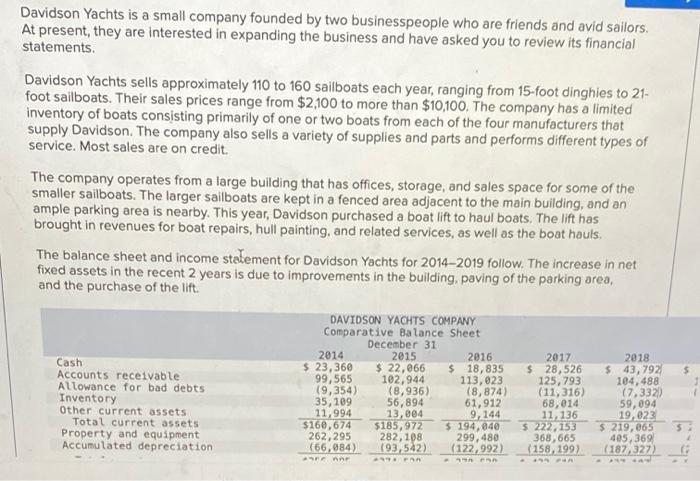

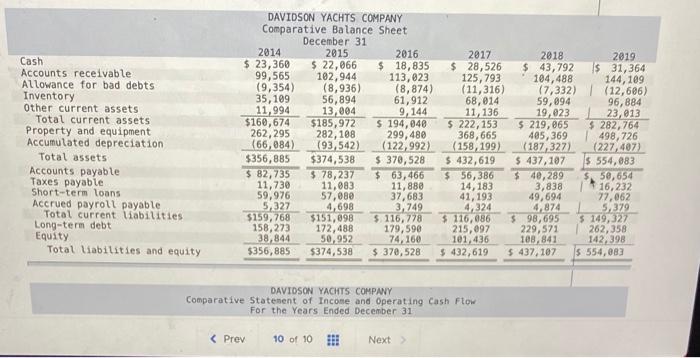

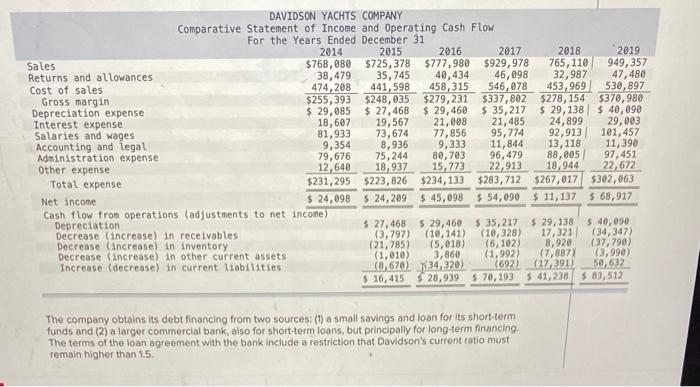

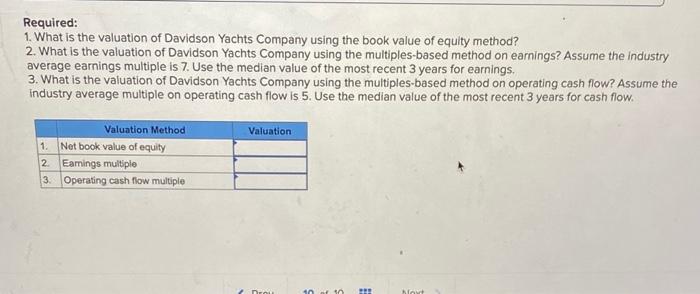

Davidson Yachts is a small company founded by two businesspeople who are friends and avid sailors. At present, they are interested in expanding the business and have asked you to review its financial statements. Davidson Yachts sells approximately 110 to 160 sailboats each year, ranging from 15-foot dinghies to 21- foot sailboats. Their sales prices range from $2,100 to more than $10,100. The company has a limited inventory of boats consisting primarily of one or two boats from each of the four manufacturers that supply Davidson. The company also sells a variety of supplies and parts and performs different types of service. Most sales are on credit. The company operates from a large building that has offices, storage, and sales space for some of the smaller sailboats. The larger Sailboats are kept in a fenced area adjacent to the main building, and an ample parking area is nearby. This year, Davidson purchased a boat lift to haul boats. The lift has brought in revenues for boat repairs, hull painting, and related services, as well as the boat houls. The balance sheet and income statement for Davidson Yachts for 2014-2019 follow. The increase in net fixed assets in the recent 2 years is due to improvements in the building, paving of the parking area, and the purchase of the lift. DAVIDSON YACHTS COMPANY Comparative Balance Sheet December 31 2014 2015 2016 Cash $ 23,360 $ 22,066 $ 18,835 $ 28,526 $ 43,792 Accounts receivable 99,565 102,944 113,023 125, 793 104, 488 Allowance for bad debts (9,354) (8,936) (8,874) (11,316) Inventory 35,109 56,894 61,912 Other current assets 13,004 9,144 11, 136 19,023 Total current assets $160,674 $185,972 $ 194,840 $ 222, 153 Property and equipment 282,1 299,480 368,665 Accumulated depreciation (66,084) (93,542) (122,992) (158, 199) (187/3272 2017 2018 68,014 (7,3320 59,094 11,994 52 262,295 $ 219,065 405, 369 Onn -- - FR Cash Accounts receivable Allowance for bad debts Inventory Other current assets Total current assets Property and equipment Accumulated depreciation Total assets Accounts payable Taxes payable Short-term loans Accrued payroll payable Total current abilities Long-term debt Equity Total liabilities and equity DAVIDSON YACHTS COMPANY Comparative Balance Sheet December 31 2014 2015 2016 $ 23,360 $ 22,066 $ 18,835 99,565 102,944 113,023 (9,354) (8,936) (8,874) 35,109 56,894 61,912 11,994 13,004 9,144 $160,674 $185,972 $ 194,048 262,295 282, 108 299,480 (66, 084) (93,542) (122,992) $356,885 $374,538 $ 370,528 $ 82,735 $ 78,237 $ 63,466 11,730 11,083 11,880 59,976 57,089 37,683 5,327 4,698 3,749 $159,768 $151,098 $ 116,778 158.273 172,488 179,590 38,844 50,952 74,160 $356,885 $374,538 $ 370,528 2017 2018 2019 $ 28,526 $ 43,792 $ 31,364 125, 793 104,488 144,109 (11,316) (7,332) (12,606) 68,014 59,094 96,884 11,136 19,023 23,013 $ 222, 153 $ 219,065 $ 282,764 368,665 485,369 498,726 (158, 199) (187,327) (227,407) $ 432,619 $ 437,107 554,083 $ 56, 386 $ 40,289 58,654 14,183 3,838 16,232 41,193 49,694 27,062 4,324 4,874 5,379 5 116,086 $ 98,695 $ 149,327 215,097 229,571 262,358 101, 436 108,841 142,398 $ 432,619 $ 437, 107 $ 554,083 DAVIDSON YACHTS COMPANY Comparative Statement of Income and Operating Cash Flow For the Years Ended December 31 DAVIDSON YACHTS COMPANY Comparative Statement of Income and Operating Cash Flow For the Years Ended December 31 2014 2015 2016 2017 2018 2019 Sales $768,080 $725,378 $777,980 $929,978 765, 110 949, 357 Returns and allowances 38,479 35, 745 40,434 46,098 32,987 47, 480 Cost of sales 474,208 441,598 458,315 546, 078 453,9691 530,897 Gross margin $255, 393 $248,035 $279,231 $337,802 $278,154 $370, 980 Depreciation expense $ 29,085 $ 27,468 $ 29,460 $ 35,217 $ 29, 138 $ 40,090 Interest expense 18,607 19,567 21,008 21,485 24,899 29, 003 Salaries and wages 81,933 73,674 77,856 95,774 92,913 101,457 Accounting and legal 9,354 8,936 9,333 11,844 13,118 11,390 Administration expense 79,676 75,244 80,703 96,479 88,805 97,451 Other expense 12,640 18,937 15,773 22,913 18,944 22,672 Total expense $231,295 $223, 826 $234,133 $283,712 $267,017 $302, 063 Net income $ 24,098 $ 24,209 $ 45,098 $ 54,090 $ 11,137 $ 68,917 Cash flow from operations (adjustments to net income) Depreciation $ 27,468 529,460 535,217 $ 29,138 $ 40,090 Decrease increase) in receivables (3,797) (10,141) (10,328) 17,321 (34,347 Decrease increase) in Inventory (21,785) (5,018) (6,102) 8,920 (37,790) Decrease increase) in other current assets (1,010) 3,860 (1,992) (7,887) (3,990) Increase (decrease) in current liabilities (8,670) 134,320) (692) (12/391) 50,632 $ 16,415 28,939 $ 70,193 5 41,238 $ 83,512 The company obtains its debt financing from two sources: (1) a small savings and loan for its short-term funds and (2) a larger commercial bank, also for short-term loans, but principally for long-term financing The terms of the loan agreement with the bank include a restriction that Davidson's current ratio must remain higher than 15. Required: 1. What is the valuation of Davidson Yachts Company using the book value of equity method? 2. What is the valuation of Davidson Yachts Company using the multiples-based method on earnings? Assume the industry average earnings multiple is 7. Use the median value of the most recent 3 years for earnings, 3. What is the valuation of Davidson Yachts Company using the multiples-based method on operating cash flow? Assume the Industry average multiple on operating cash flow is 5. Use the median value of the most recent 3 years for cash flow. Valuation Valuation Method 1. Net book value of equity 2. Earings multiple 3. Operating cash flow multiple how