Question

Davis Industries, a manufacturing firm, has experienced modest sales growth over the past three years but has had difficulty translating the expansion of sales into

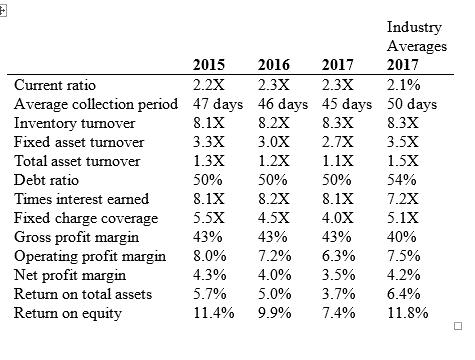

Davis Industries, a manufacturing firm, has experienced modest sales growth over the past three years but has had difficulty translating the expansion of sales into improved profitability. Using three years' financial statements, you have developed the following ratio calculations and industry comparisons.

1. Show the breakout of the ROE (3-factor DuPont Identity) for both Davis and the industry.

2. Based on the above breakout, in conjunction with any other ratios given, explain what major issues are contributing to Davis declining profitability and ROE.

Current ratio Average collection period Inventory turnover Fixed asset turnover Total asset turnover Debt ratio Times interest earned Fixed charge coverage Gross profit margin Operating profit margin Net profit margin Return on total assets Return on equity 2015 2.2X 47 days 8.1X 3.3X Industry Averages 2016 2017 2017 2.3X 2.3X 2.1% 46 days 45 days 50 days 8.2X 8.3X 8.3X 3.0X 2.7X 3.5X 1.3X 1.2X 1.1X 1.5X 50% 50% 50% 54% 8.1X 8.2X 8.1X 7.2X 5.5X 4.5X 4.0X 5.1X 43% 43% 43% 40% 8.0% 7.2% 6.3% 7.5% 4.3% 4.0% 3.5% 4.2% 5.7% 5.0% 3.7% 6.4% 11.4% 9.9% 7.4% 11.8%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution Based on the given information we can see that Davis Industries has been experiencing modes...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started