Answered step by step

Verified Expert Solution

Question

1 Approved Answer

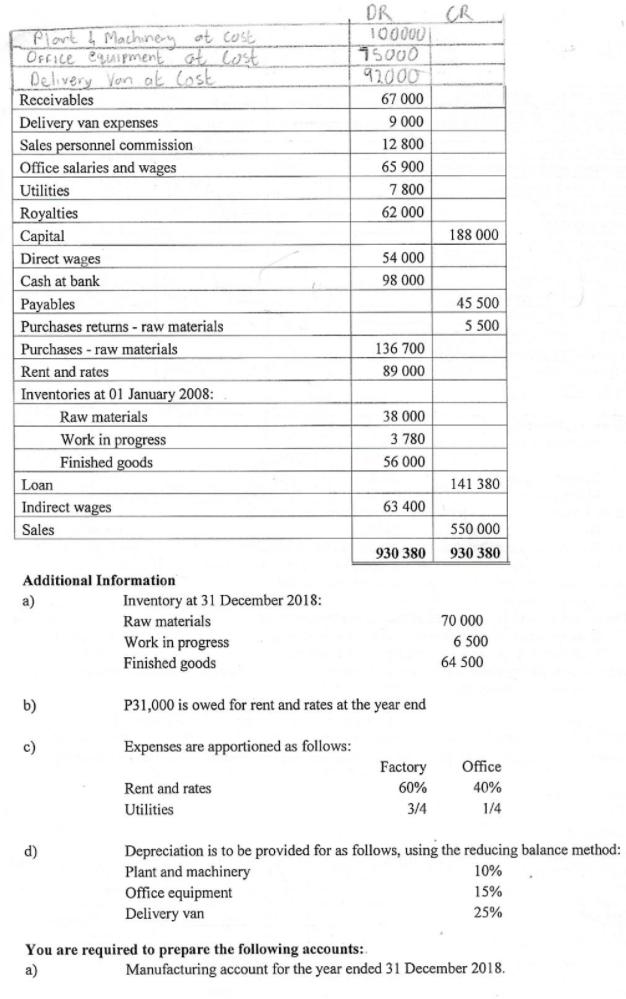

Davis is manufacturer. His trial balance at 31/12118 DR Plart Machiney at cost OFFICE equipment at Cost Delivery Von ak Cost Receivables CR 100000 75000

Davis is manufacturer. His trial balance at 31/12118

DR Plart Machiney at cost OFFICE equipment at Cost Delivery Von ak Cost Receivables CR 100000 75000 92000 67 000 Delivery van expenses 9 000 Sales personnel commission Office salaries and wages 12 800 65 900 Utilities 7 800 Royalties Capital 62 000 188 000 Direct wages 54 000 Cash at bank 98 000 Payables 45 500 Purchases returns - raw materials 5 500 Purchases - raw materials 136 700 Rent and rates 89 000 Inventories at 01 January 2008: Raw materials 38 000 Work in progress Finished goods 3 780 56 000 Loan 141 380 Indirect wages 63 400 Sales 550 000 930 380 930 380 Additional Information Inventory at 31 December 2018: Raw materials a) 70 000 Work in progress Finished goods 6 500 64 500 b) P31,000 is owed for rent and rates at the year end c) Expenses are apportioned as follows: Factory Office Rent and rates 60% 40% Utilities 3/4 1/4 Depreciation is to be provided for as follows, using the reducing balance method: Plant and machinery Office equipment Delivery van d) 10% 15% 25% You are required to prepare the following accounts: a) Manufacturing account for the year ended 31 December 2018.

Step by Step Solution

★★★★★

3.33 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 1 attachment)

622ee45c30d8e_march14.xlsx

300 KBs Excel File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started