Answered step by step

Verified Expert Solution

Question

1 Approved Answer

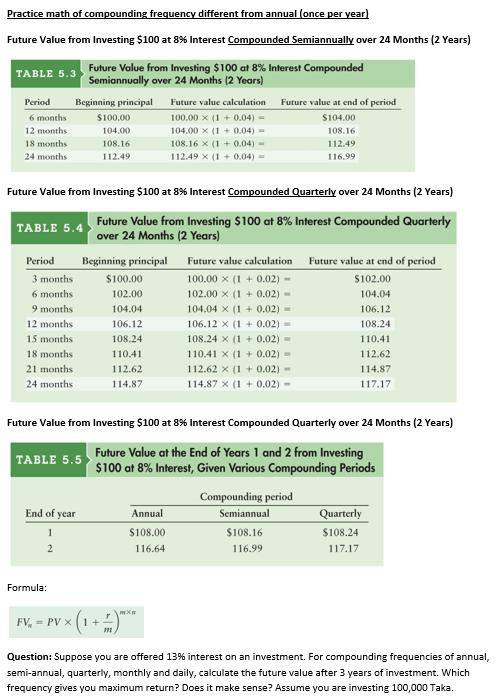

Practice math of compounding frequency different from annual (once per year) Future Value from Investing $100 at 8% Interest Compounded Semiannually over 24 Months

Practice math of compounding frequency different from annual (once per year) Future Value from Investing $100 at 8% Interest Compounded Semiannually over 24 Months (2 Years) TABLE 5.3 Period 6 months 12 months 18 months 24 months TABLE 5.4 Period Beginning principal $100,00 104.00 108.16 112.49 3 months 6 months 9 months 12 months 15 months 18 months 21 months 24 months Future Value from Investing $100 at 8% Interest Compounded Quarterly over 24 Months (2 Years) Future Value from Investing $100 at 8% Interest Compounded Quarterly over 24 Months (2 Years) Beginning principal Future Value from Investing $100 at 8% Interest Compounded Semiannually over 24 Months (2 Years) TABLE 5.5 End of year 1 2 Formula: $100.00 102.00 FV, = PV X (1+ 104.04 106.12 108.24 110.41 112.62 114.87 m Future value calculation 100.00x (1+0.04)= 104.00x (1+0.04) - 108.16x (1+0.04) - 112.49 x (1 + 0.04) = Future Value from Investing $100 at 8% Interest Compounded Quarterly over 24 Months (2 Years) Future Value at the End of Years 1 and 2 from Investing $100 at 8% Interest, Given Various Compounding Periods Annual $108.00 116.64 Future value at end of period $104.00 108.16 mXw Future value calculation 100.00 x (1 +0.02) - 102.00 x (1 + 0.02) 104.04 x (1 + 0.02)= 106.12 x (1 + 0.02)= 108.24 x (1 + 0.02) = 110.41 x (1 + 0.02) - 112.62 x (1 + 0.02) - 114.87 x (1 +0.02) - 112.49 116.99 Compounding period Semiannual $108.16 116.99 Future value at end of period $102.00 104.04 106.12 108.24 110.41 112.62 114.87 117.17 Quarterly $108.24 117.17 Question: Suppose you are offered 13% interest on an investment. For compounding frequencies of annual, semi-annual, quarterly, monthly and daily, calculate the future value after 3 years of investment. Which frequency gives you maximum return? Does it make sense? Assume you are investing 100,000 Taka.

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

First lets test the formula from the example given FV Future Value PV Present Value 1 r m m n Where ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started