Question

Days before her death, Cassie sold domestic shares costing P6,500,000 to a buyer when its fair value is P12,700,000. The capital gains tax on the

Days before her death, Cassie sold domestic shares costing P6,500,000 to a buyer when its fair value is P12,700,000. The capital gains tax on the transaction was P240,000.

- What amount should be included in Cassie's gross estate?

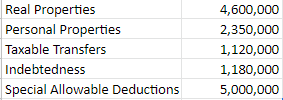

Juli died single leaving the following:

Real Properties Personal Properties Taxable Transfers Indebtedness Special Allowable Deductions 4,600,000 2,350,000 1,120,000 1,180,000 5,000,000

Step by Step Solution

3.44 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

WORKINGS To calculate the amount that should be included in Cassies gross estate we need to determin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Beechy Thomas, Conrod Joan, Farrell Elizabeth, McLeod Dick I

Volume 1, 6th Edition

1259103250, 978-1259103254, 978-0071339476

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App