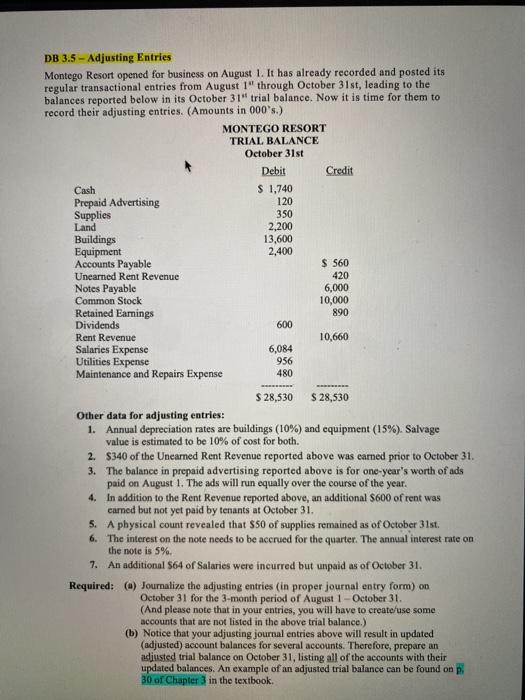

DB 3.5 - Adjusting Entries Montego Resort opened for business on August 1. It has already recorded and posted its regular transactional entries from August 1" through October 31st, leading to the balances reported below in its October 31" trial balance. Now it is time for them to record their adjusting entries. (Amounts in 000's.) MONTEGO RESORT TRIAL BALANCE October 31st Debit Credit Cash S 1,740 Prepaid Advertising 120 Supplies 350 Land 2,200 Buildings 13,600 Equipment 2,400 Accounts Payable $ 560 Unearned Rent Revenue 420 Notes Payable 6,000 Common Stock 10,000 Retained Earings 890 Dividends 600 Rent Revenue 10,660 Salaries Expense 6,084 Utilities Expense 956 Maintenance and Repairs Expense 480 $ 28,530 $ 28,530 Other data for adjusting entries: 1. Annual depreciation rates are buildings (10%) and equipment (15%). Salvage value is estimated to be 10% of cost for both. 2. $340 of the Unearned Rent Revenue reported above was earned prior to October 31. 3. The balance in prepaid advertising reported above is for one-year's worth of ads paid on August 1. The ads will run equally over the course of the year. 4. In addition to the Rent Revenue reported above, an additional $600 of rent was carned but not yet paid by tenants at October 31. 5. A physical count revealed that $50 of supplies remained as of October 31st. 6. The interest on the note needs to be accrued for the quarter. The annual interest rate on the note is 5%. 7. An additional $64 of Salaries were incurred but unpaid as of October 31. Required: () Journalize the adjusting entries (in proper journal entry form) on October 31 for the 3-month period of August 1 - October 31. (And please note that in your entries, you will have to create/use some accounts that are not listed in the above trial balance.) (b) Notice that your adjusting journal entries above will result in updated (adjusted) account balances for several accounts. Therefore, prepare an adiusted trial balance on October 31, listing all of the accounts with their updated balances. An example of an adjusted trial balance can be found on 30 of Chapter 3 in the textbook