Answered step by step

Verified Expert Solution

Question

1 Approved Answer

DCF with Terminal P / E There are many ways to value an asset. Valuation is a science, but it is also an art. Each

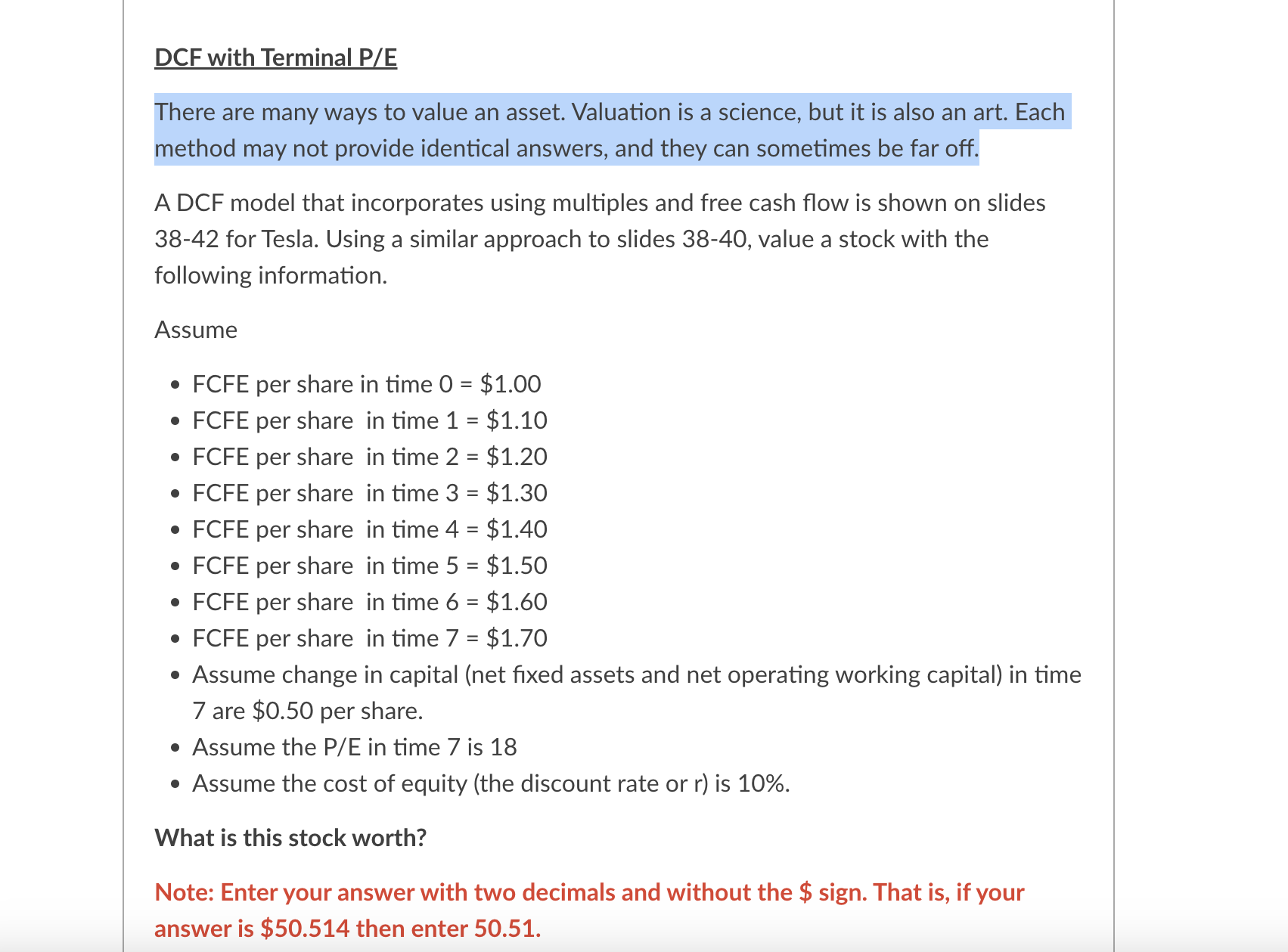

DCF with Terminal PE

There are many ways to value an asset. Valuation is a science, but it is also an art. Each

method may not provide identical answers, and they can sometimes be far off.

A DCF model that incorporates using multiples and free cash flow is shown on slides

for Tesla. Using a similar approach to slides value a stock with the

following information.

Assume

FCFE per share in time $

FCFE per share in time $

FCFE per share in time $

FCFE per share in time $

FCFE per share in time $

FCFE per share in time $

FCFE per share in time $

FCFE per share in time $

Assume change in capital net fixed assets and net operating working capital in time

are $ per share.

Assume the PE in time is

Assume the cost of equity the discount rate or is

What is this stock worth?

Note: Enter your answer with two decimals and without the $ sign. That is if your

answer is $ then enter

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started