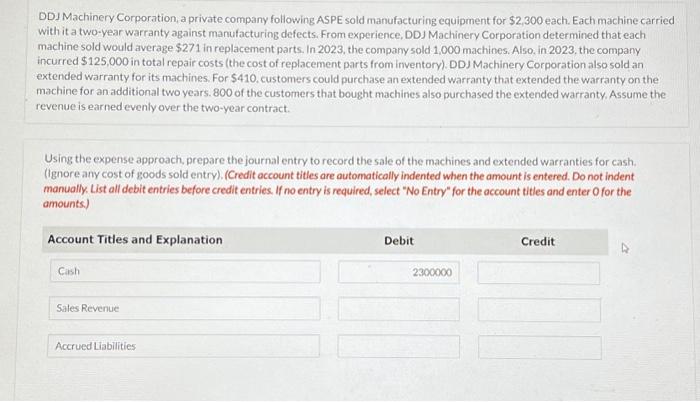

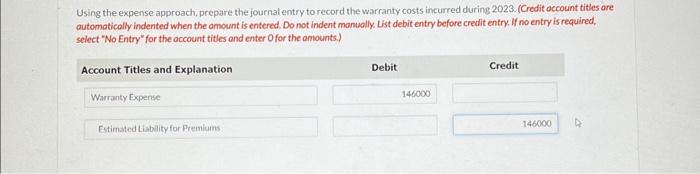

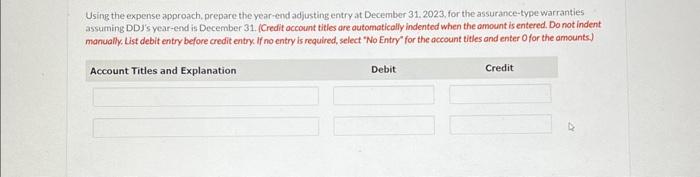

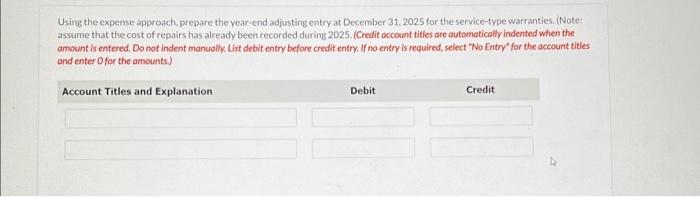

DD1 Machinery Corporation, a private company following ASPE sold manufacturing equipment for $2,300 each. Each machine carried with it a two-year warranty against manufacturing defects. From experience, DDJ Machinery Corporation determined that each machine sold would average $271 in replacement parts. In 2023, the company sold 1,000 machines. Also, in 2023, the company incurred $125,000 in total repair costs (the cost of replacement parts from inventory). DDJ Machinery Corporation also sold an extended warranty for its machines. For $410. customers could purchase an extended warranty that extended the warranty on the machine for an additional two years. 800 of the customers that bought machines also purchased the extended warranty. Assume the revenue is earned evenly over the two-year contract. Using the expense approach, prepare the journal entry to record the sale of the machines and extended warranties for cash. (Ignore any cost of goods sold entry). (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select "No Entry" for the occount titles and enter O for the amounts.) Using the expense approach, prepare the journal entry to record the warranty costs incurred during 2023. (Credit occount titles are automatically indented when the amount is entered. Do not indent manuolly. List debit entry before credit entry. If no entry is required, select "No Entry" for the occount titles and enter Ofor the amounts.) Using the expense approach, prepare the year-endadjusting entry at December 31.2023 , for the assurance-type warranties assuming DDJ's year-end is December 31. (Credit occount titles are outomatically indented when the omount is entered. Do not indent manually. List debit entry before credit entry. If no entry is required, select "No Entry" for the account titles and enter Ofor the amounts.) Using the expense approach, prepare the year-end adjusting entry at December 31, 2025 for the service-type warranties. (Note: assume that the cost of repairs has already been recorded during 2025. (Credit occount titles ore outomoticolly indented when the amount is entered, Do not indent manually. List debit entry before credit entry. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)