Answered step by step

Verified Expert Solution

Question

1 Approved Answer

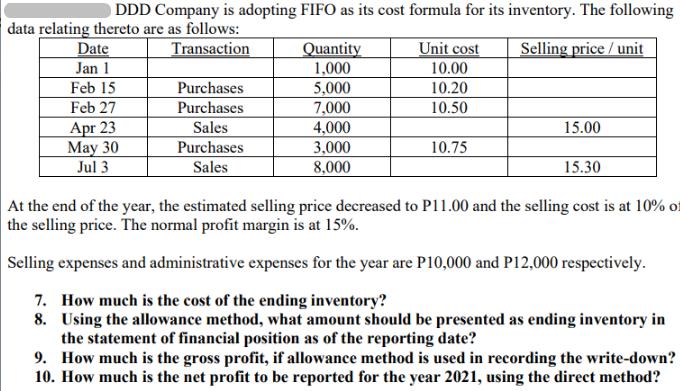

DDD Company is adopting FIFO as its cost formula for its inventory. The following Selling price / unit data relating thereto are as follows:

DDD Company is adopting FIFO as its cost formula for its inventory. The following Selling price / unit data relating thereto are as follows: Transaction Date Jan 1 Feb 15 Feb 27 Apr 23 May 30 Jul 3 Purchases Purchases Sales Purchases Sales Quantity 1,000 5,000 7,000 4,000 3,000 8,000 Unit cost 10.00 10.20 10.50 10.75 15.00 15.30 At the end of the year, the estimated selling price decreased to P11.00 and the selling cost is at 10% of the selling price. The normal profit margin is at 15%. Selling expenses and administrative expenses for the year are P10,000 and P12,000 respectively. 7. How much is the cost of the ending inventory? 8. Using the allowance method, what amount should be presented as ending inventory in the statement of financial position as of the reporting date? 9. How much is the gross profit, if allowance method is used in recording the write-down? 10. How much is the net profit to be reported for the year 2021, using the direct method?

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION 7 Cost of ending inventory Beginning inventory 1000 units P1020 P10200 Feb purchases 5000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started