Answered step by step

Verified Expert Solution

Question

1 Approved Answer

de 30 You are required to provide an independent assessment of the potential impact of the Coronavirus three types of financial institutions in Glara; Lniversal

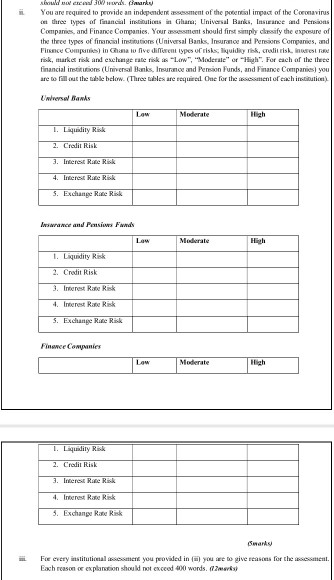

de 30 You are required to provide an independent assessment of the potential impact of the Coronavirus three types of financial institutions in Glara; Lniversal Barks, Instance and Persons Companies and Finance Companies. Your assessment should first simply classify the exposure of the three types of financial institutions (Universal Banks. Insurance and Persons Companies, and Finance Companies in a five different types of risks, liquidiy risk, crolitisk, Inser risk, murks risk and exchange rate risk as "Low", "Moderate" or "High"For each of the there financial institutions (Universal Banks. Insurance and Pension Funds, and Finance Companies, you are to fill out the whole below. (Three bales are required One for the sessment of each institutice) Universal Banks Low Moderate High 1. Liquidity Risk 2. Credit Risk 3. Interest Rate Risk 4. Interest Rate Risk 5. Exchange Rate Risk rance and Prix de Low Moderate 1. Liquidity Risk 2. Credit Risk 3. Interest Rate Risk 4. Interest Rate Risk S. Exchange Rate Risk Finance Connier Low Moderate 1. Liquidity RR 2. Credit Risk 3. Interest Rate Risk 4. Interest Rate Risk 5. Exchange Rate Risk For every institutional assistent you provided in you get to give reasons for the setten Bach reason or explanation should not exceed words. (12) de 30 You are required to provide an independent assessment of the potential impact of the Coronavirus three types of financial institutions in Glara; Lniversal Barks, Instance and Persons Companies and Finance Companies. Your assessment should first simply classify the exposure of the three types of financial institutions (Universal Banks. Insurance and Persons Companies, and Finance Companies in a five different types of risks, liquidiy risk, crolitisk, Inser risk, murks risk and exchange rate risk as "Low", "Moderate" or "High"For each of the there financial institutions (Universal Banks. Insurance and Pension Funds, and Finance Companies, you are to fill out the whole below. (Three bales are required One for the sessment of each institutice) Universal Banks Low Moderate High 1. Liquidity Risk 2. Credit Risk 3. Interest Rate Risk 4. Interest Rate Risk 5. Exchange Rate Risk rance and Prix de Low Moderate 1. Liquidity Risk 2. Credit Risk 3. Interest Rate Risk 4. Interest Rate Risk S. Exchange Rate Risk Finance Connier Low Moderate 1. Liquidity RR 2. Credit Risk 3. Interest Rate Risk 4. Interest Rate Risk 5. Exchange Rate Risk For every institutional assistent you provided in you get to give reasons for the setten Bach reason or explanation should not exceed words. (12)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started