deadline : 16:00 today 9 / 7 / 2020

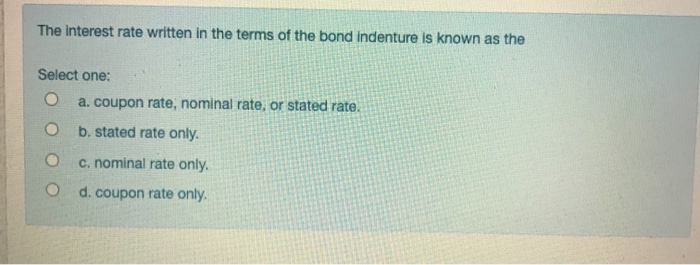

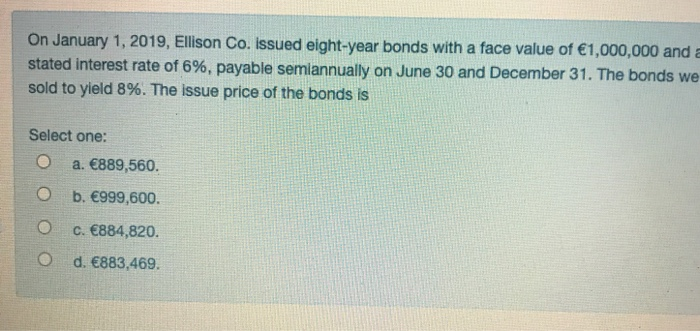

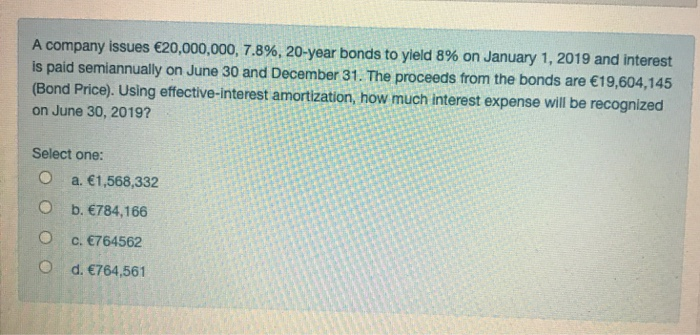

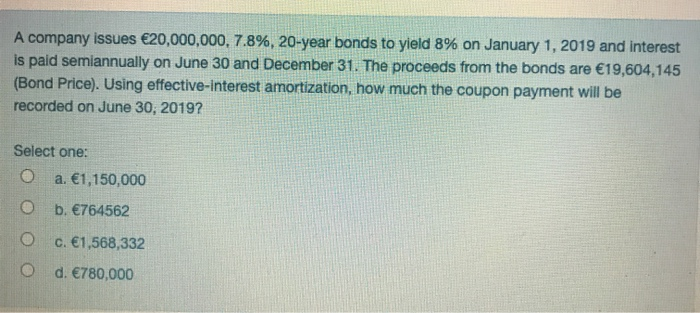

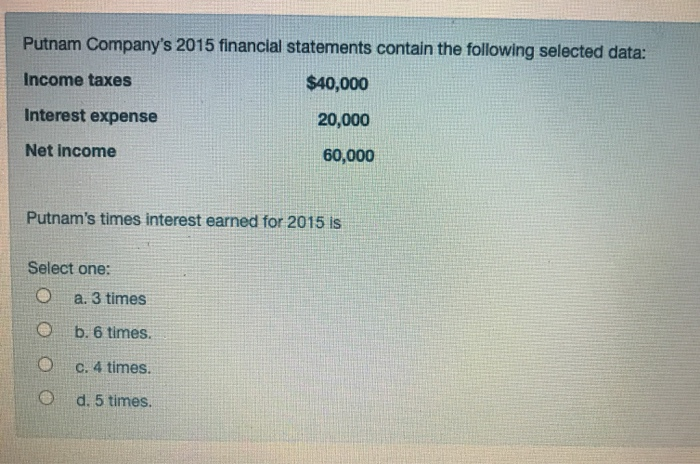

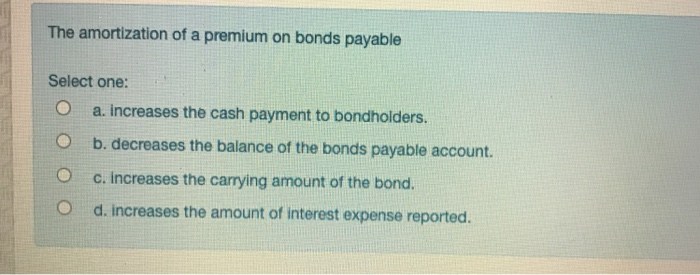

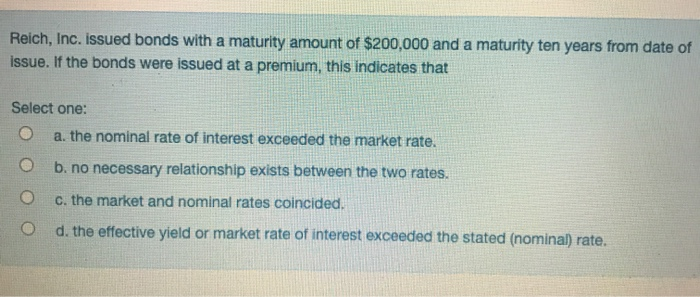

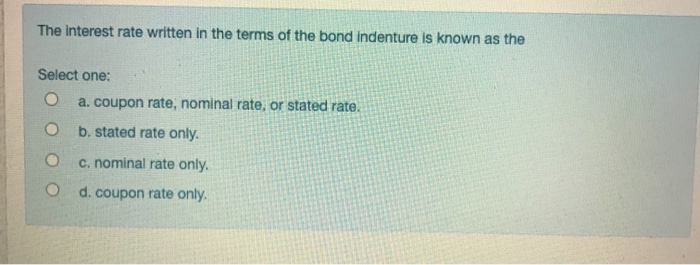

On January 1, 2019, Ellison Co. Issued eight-year bonds with a face value of 1,000,000 and a stated interest rate of 6%, payable semiannually on June 30 and December 31. The bonds we sold to yield 8%. The issue price of the bonds is Select one: a. 889,560. b. 999,600. C. 884,820. d. 883,469. A company issues 20,000,000, 7.8%, 20-year bonds to yield 8% on January 1, 2019 and interest is paid semiannually on June 30 and December 31. The proceeds from the bonds are 19,604,145 (Bond Price). Using effective-interest amortization, how much interest expense will be recognized on June 30, 2019? Select one: a. 1,568,332 O b. 784,166 O c. 764562 d. 764,561 A company issues 20,000,000, 7.8%, 20-year bonds to yield 8% on January 1, 2019 and interest is paid semiannually on June 30 and December 31. The proceeds from the bonds are 19,604,145 (Bond Price). Using effective-interest amortization, how much the coupon payment will be recorded on June 30, 2019? Select one: O a. 1,150,000 b. 764562 c. 1,568,332 d. 780,000 Putnam Company's 2015 financial statements contain the following selected data: Income taxes $40,000 Interest expense 20,000 Net income 60,000 Putnam's times interest earned for 2015 is Select one: a. 3 times b. 6 times. c. 4 times. d. 5 times. The amortization of a premium on bonds payable Select one: a. Increases the cash payment to bondholders. b. decreases the balance of the bonds payable account. c. Increases the carrying amount of the bond. d. increases the amount of interest expense reported. Reich, Inc. issued bonds with a maturity amount of $200,000 and a maturity ten years from date of issue. If the bonds were issued at a premium, this indicates that Select one: a. the nominal rate of interest exceeded the market rate. b. no necessary relationship exists between the two rates. c. the market and nominal rates coincided. d. the effective yield or market rate of interest exceeded the stated (nominal) rate. The interest rate written in the terms of the bond Indenture is known as the Select one: O a. coupon rate, nominal rate, or stated rate. O b. stated rate only. c. nominal rate only. O d. coupon rate only

deadline : 16:00 today 9 / 7 / 2020

deadline : 16:00 today 9 / 7 / 2020