Question

Dean plans to retire at the age of 62. He wants an annual income of $60,000 per year. He has 15 years of annual

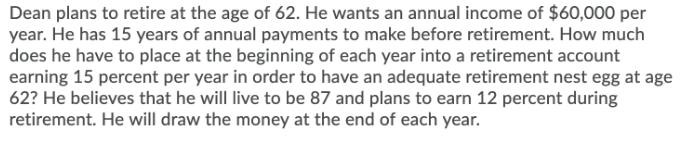

Dean plans to retire at the age of 62. He wants an annual income of $60,000 per year. He has 15 years of annual payments to make before retirement. How much does he have to place at the beginning of each year into a retirement account earning 15 percent per year in order to have an adequate retirement nest egg at age 62? He believes that he will live to be 87 and plans to earn 12 percent during retirement. He will draw the money at the end of each year.

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Entrepreneurial Finance

Authors: Philip J. Adelman; Alan M. Marks

6th edition

9780133099096, 133140512, 133099091, 978-0133140514

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App