Dear all

Could shares the question of this problem .thanks

About 6.2

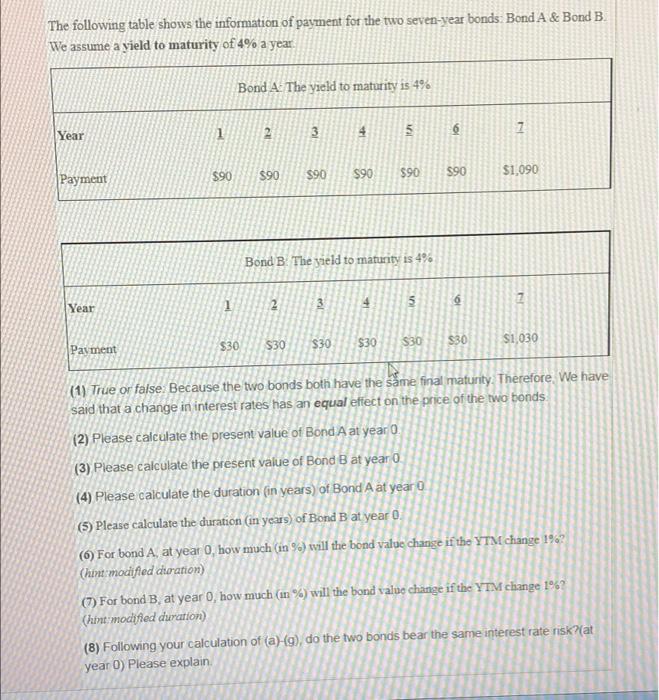

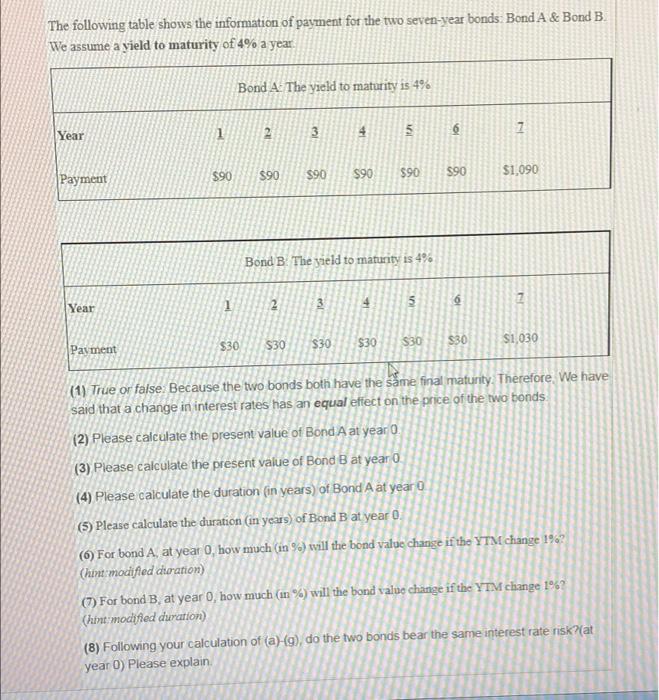

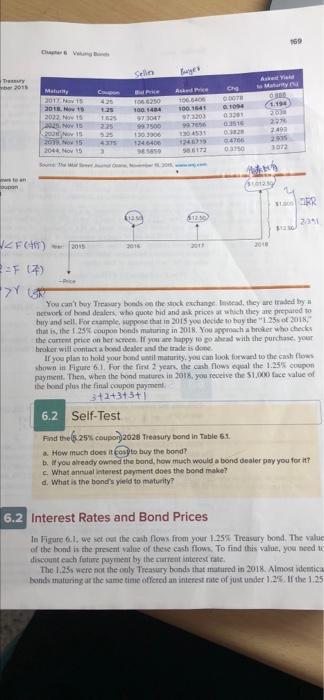

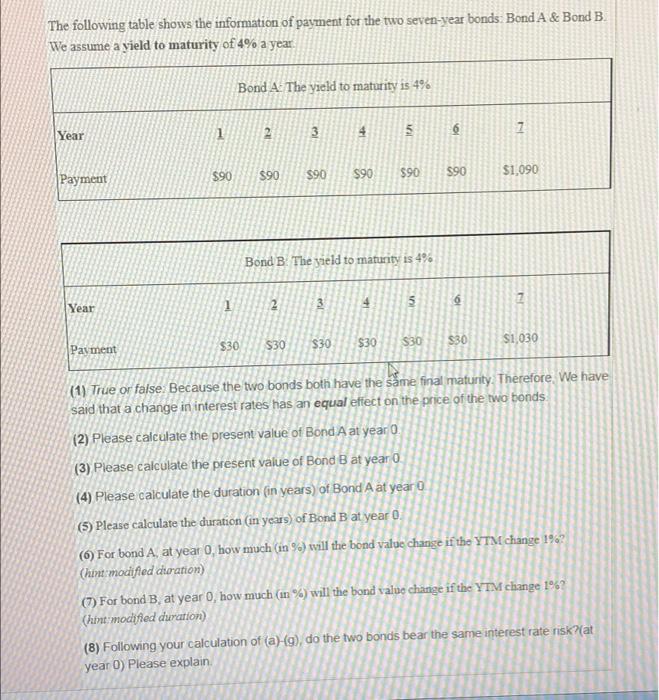

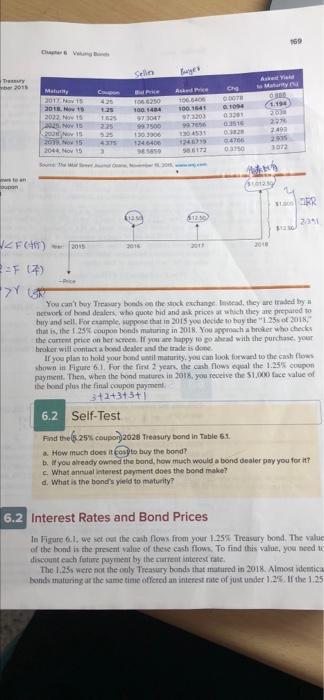

The following table shows the information of payment for the two seven-year bonds. Bond A & Bond B. We assume a vield to maturity of 4% a year Bond A. The yield to maturity is 4% 1 Year 2 CU 3 3 4 5 7 6 $90 Paymem $90 $90 $90 $90 $90 $1,090 Bond B. The yield to maturity is 4% Year 1 3 6 2 5 4 2 $30 $30 $30 $30 $30 Payment $30 $1,030 (1) True or false. Because the two bonds both have the same final maturity. Therefore we have said that a change in interest rates has an equal effect on the price of the two bonds (2) Please calculate the present value of Bond A at year 0. (3) Please calculate the present value of Bond B at year 0 (4) Please calculate the duration (in years) of Bond A at year (5) Please calculate the duration in years) of Bond B at year 0 (6) For bond A, at year 0. how much (in %) will the bond value change if the YTM change 1% (han modified duration) (7) For bond B. at year, how much (in %) will the bond value change if the YTM change 1 (hte modified duration) (8) Following your calculation of (a)-g), do the two bonds bear the same interest rate risk(at year D) Please explain 159 OV Selle Bunge A Wat 2015 C Andre 100161 07320) 2017 NOV 2018. Not 202215 2025, No 15 2001 15 2015 2004 Nov 15 . 1.03 225 5.25 10.250 100.1484 01007 99.500 130.000 124.6400 9658 DOT 1054 03301 0510 012 4700 03150 194 2010 2 2493 1304531 12 5861 an moon ER 112 JZFC4) 2015 2015 E F 17) -7YUR You can't buy Trasy boods the stock exchanged they are traded by network of bond dealers, who quote hid and ask prices at which they are prepared to buy and sell or crample, suppose that in 2015 you decide to hay the 25 of 2018, that is the 1.256 coupon bonds maturing in 2018. You prochbroker who checks the current price on her screen. If you are happy to go ahead with the purchase your broker will contact dealer the trade is die If you plan to hold your band til maturity, you can look forward to the cash flow shown in Figure 6.1. For the first 2 years, the cash flows equal the 1.25 coupon payment. Then, when the hond matures in 2015, you receive the $1.000 face value of the bood plus the final coupon payment 3+2+3+3+1 6.2 Self-Test Find the ls 29% coupor)2028 Treasury bond in Table 61 25 How much does it cost to buy the bond? b. If you already owned the band how much would abond dealer pay you for it? What annual interest payment does the bond make? d. What is the band's yield to maturity? 6.2 Interest Rates and Bond Prices In Figure 6.1. we set out the cash flows from your 1.25% Treasury bond. The value of the bond is the present value of these cash flow. To find this value, you need to discount each future paymear by the current interest rate. The 1.25s were not the only Treasury bonds that matured in 2018. Almost identica bony maturing at the same time offered an interest rate of just under 1.2. If the 1.25 The following table shows the information of payment for the two seven-year bonds. Bond A & Bond B. We assume a vield to maturity of 4% a year Bond A. The yield to maturity is 4% 1 Year 2 CU 3 3 4 5 7 6 $90 Paymem $90 $90 $90 $90 $90 $1,090 Bond B. The yield to maturity is 4% Year 1 3 6 2 5 4 2 $30 $30 $30 $30 $30 Payment $30 $1,030 (1) True or false. Because the two bonds both have the same final maturity. Therefore we have said that a change in interest rates has an equal effect on the price of the two bonds (2) Please calculate the present value of Bond A at year 0. (3) Please calculate the present value of Bond B at year 0 (4) Please calculate the duration (in years) of Bond A at year (5) Please calculate the duration in years) of Bond B at year 0 (6) For bond A, at year 0. how much (in %) will the bond value change if the YTM change 1% (han modified duration) (7) For bond B. at year, how much (in %) will the bond value change if the YTM change 1 (hte modified duration) (8) Following your calculation of (a)-g), do the two bonds bear the same interest rate risk(at year D) Please explain 159 OV Selle Bunge A Wat 2015 C Andre 100161 07320) 2017 NOV 2018. Not 202215 2025, No 15 2001 15 2015 2004 Nov 15 . 1.03 225 5.25 10.250 100.1484 01007 99.500 130.000 124.6400 9658 DOT 1054 03301 0510 012 4700 03150 194 2010 2 2493 1304531 12 5861 an moon ER 112 JZFC4) 2015 2015 E F 17) -7YUR You can't buy Trasy boods the stock exchanged they are traded by network of bond dealers, who quote hid and ask prices at which they are prepared to buy and sell or crample, suppose that in 2015 you decide to hay the 25 of 2018, that is the 1.256 coupon bonds maturing in 2018. You prochbroker who checks the current price on her screen. If you are happy to go ahead with the purchase your broker will contact dealer the trade is die If you plan to hold your band til maturity, you can look forward to the cash flow shown in Figure 6.1. For the first 2 years, the cash flows equal the 1.25 coupon payment. Then, when the hond matures in 2015, you receive the $1.000 face value of the bood plus the final coupon payment 3+2+3+3+1 6.2 Self-Test Find the ls 29% coupor)2028 Treasury bond in Table 61 25 How much does it cost to buy the bond? b. If you already owned the band how much would abond dealer pay you for it? What annual interest payment does the bond make? d. What is the band's yield to maturity? 6.2 Interest Rates and Bond Prices In Figure 6.1. we set out the cash flows from your 1.25% Treasury bond. The value of the bond is the present value of these cash flow. To find this value, you need to discount each future paymear by the current interest rate. The 1.25s were not the only Treasury bonds that matured in 2018. Almost identica bony maturing at the same time offered an interest rate of just under 1.2. If the 1.25