Dear Expert, If font size is still too small, please feel free to zoom in to view the text; as there is no other way to screenshot/capture this problem.

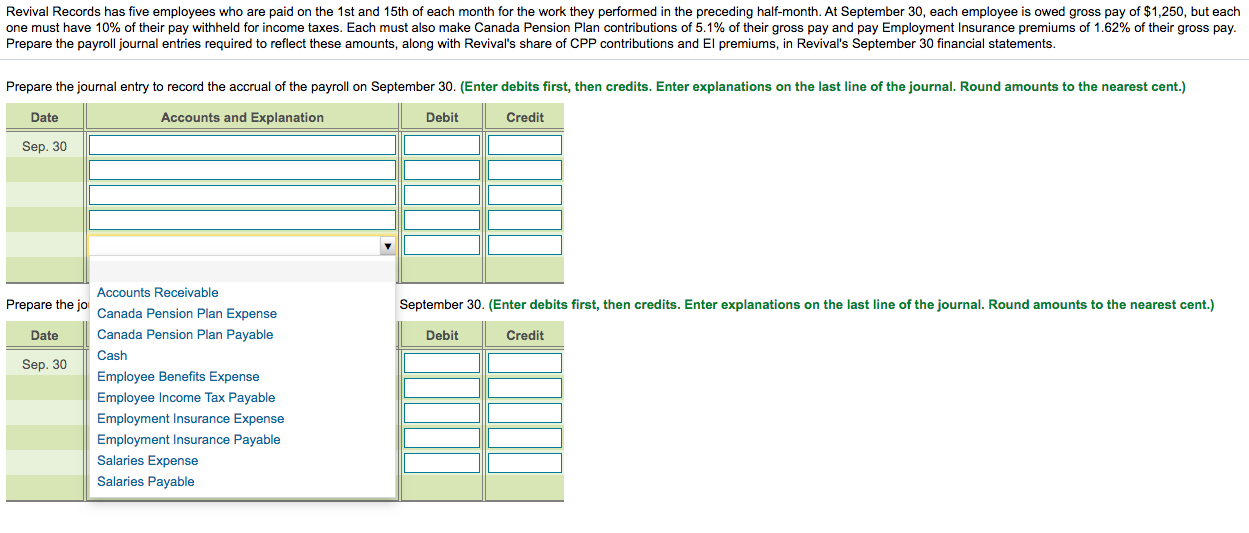

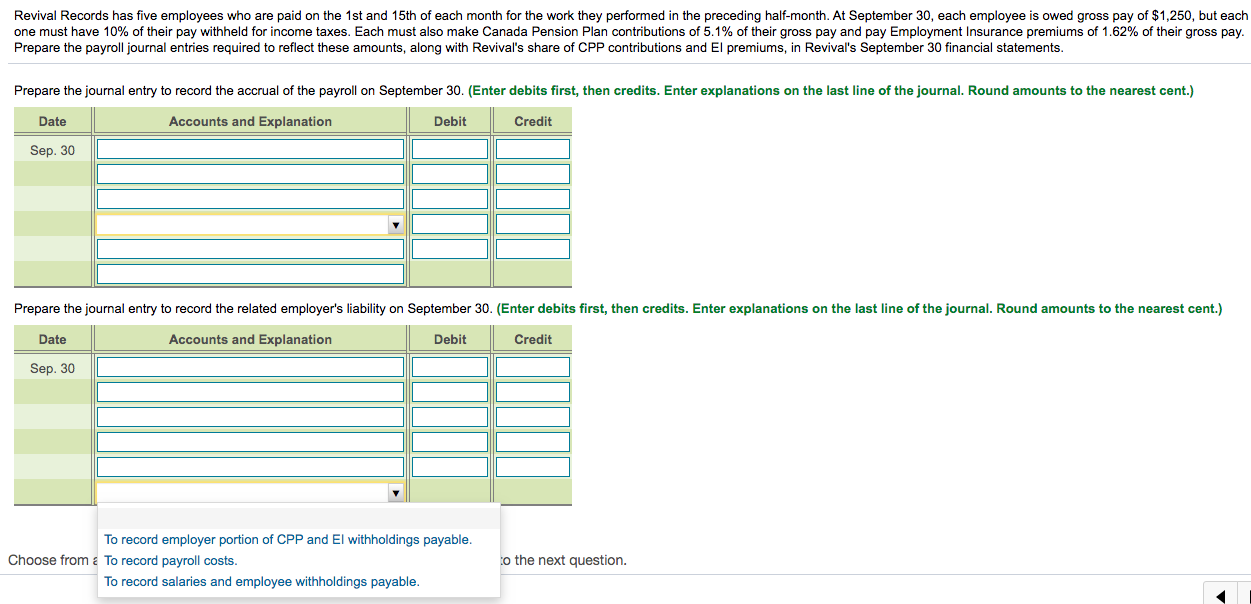

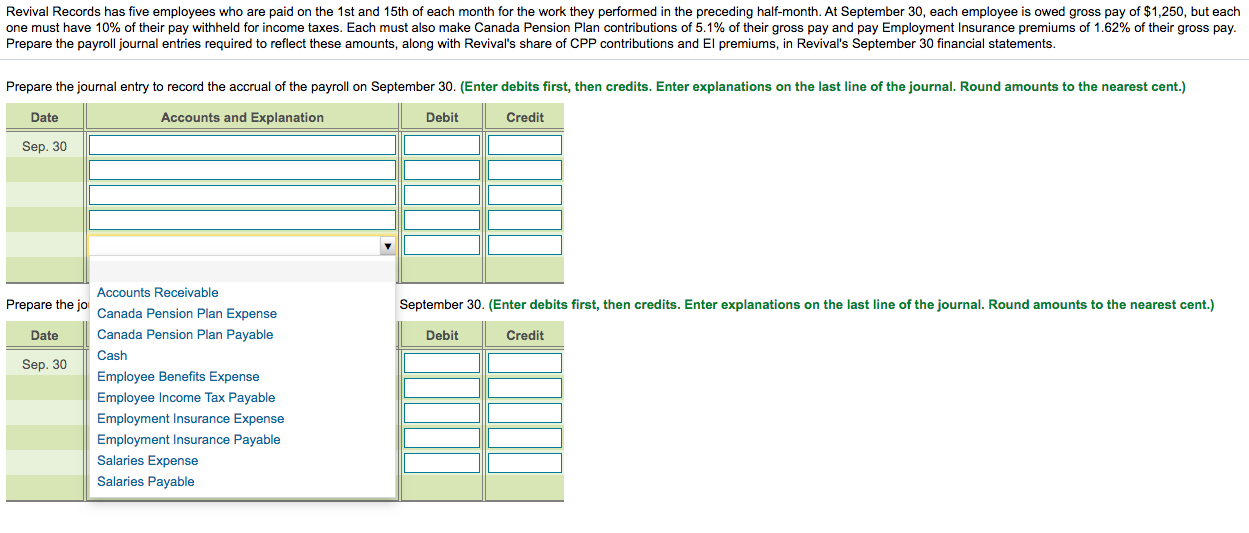

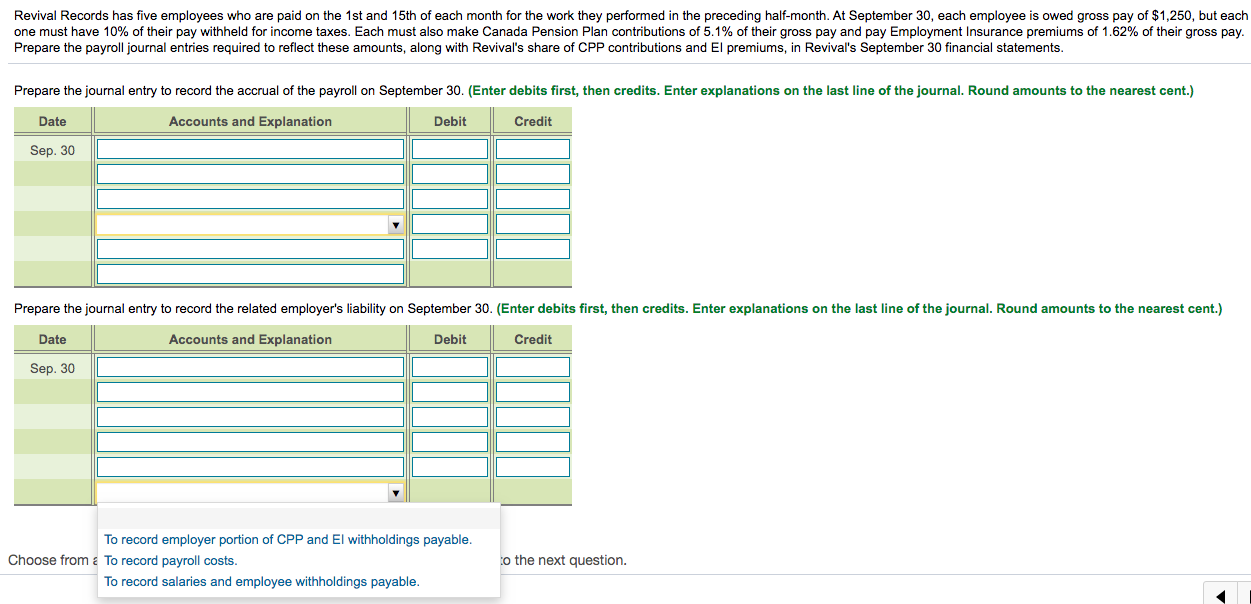

Revival Records has five employees who are paid on the 1st and 15th of each month for the work they performed in the preceding half-month. At September 30, each employee is owed gross pay of $1,250, but each one must have 10% of their pay withheld for income taxes. Each must also make Canada Pension Plan contributions of 5.1% of their gross pay and pay Employment Insurance premiums of 1.62% of their gross pay. Prepare the payroll journal entries required to reflect these amounts, along with Revival's share of CPP contributions and El premiums, in Revival's September 30 financial statements. Prepare the journal entry to record the accrual of the payroll on September 30. (Enter debits first, then credits. Enter explanations on the last line of the journal. Round amounts to the nearest cent.) Date Accounts and Explanation Debit Credit Sep. 30 September 30. (Enter debits first, then credits. Enter explanations on the last line of the journal. Round amounts to the nearest cent.) Debit Credit Accounts Receivable Prepare the jo Canada Pension Plan Expense Date Canada Pension Plan Payable Cash Sep. 30 Employee Benefits Expense Employee Income Tax Payable Employment Insurance Expense Employment Insurance Payable Salaries Expense Salaries Payable Revival Records has five employees who are paid on the 1st and 15th of each month for the work they performed in the preceding half-month. At September 30, each employee is owed gross pay of $1,250, but each one must have 10% of their pay withheld for income taxes. Each must also make Canada Pension Plan contributions of 5.1% of their gross pay and pay Employment Insurance premiums of 1.62% of their gross pay. Prepare the payroll journal entries required to reflect these amounts, along with Revival's share of CPP contributions and El premiums, in Revival's September 30 financial statements. Prepare the journal entry to record the accrual of the payroll on September 30. (Enter debits first, then credits. Enter explanations on the last line of the journal. Round amounts to the nearest cent.) Date Accounts and Explanation Debit Credit Sep. 30 Prepare the journal entry to record the related employer's liability on September 30. (Enter debits first, then credits. Enter explanations on the last line of the journal. Round amounts to the nearest cent.) Date Accounts and Explanation Debit Credit Sep. 30 To record employer portion of CPP and El withholdings payable. Choose from a To record payroll costs. To record salaries and employee withholdings payable. to the next