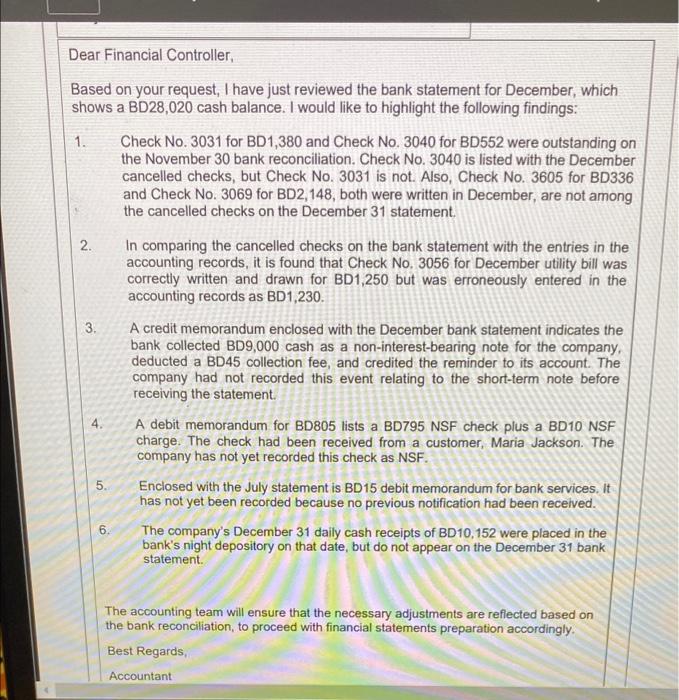

Dear Financial Controller, Based on your request, I have just reviewed the bank statement for December, which shows a BD28,020 cash balance. I would like to highlight the following findings: 1. Check No. 3031 for BD1,380 and Check No. 3040 for BD552 were outstanding on the November 30 bank reconciliation. Check No. 3040 is listed with the December cancelled checks, but Check No. 3031 is not. Also, Check No. 3605 for BD336 and Check No. 3069 for BD2,148, both were written in December, are not among the cancelled checks on the December 31 statement. 2. In comparing the cancelled checks on the bank statement with the entries in the accounting records, it is found that Check No. 3056 for December utility bill was correctly written and drawn for BD1,250 but was erroneously entered in the accounting records as BD1,230. 3. A credit memorandum enclosed with the December bank statement indicates the bank collected BD9,000 cash as a non-interest-bearing note for the company, deducted a BD45 collection fee, and credited the reminder to its account. The company had not recorded this event relating to the short-term note before receiving the statement. 4. A debit memorandum for BD805 lists a BD795 NSF check plus a BD10 NSF charge. The check had been received from a customer, Maria Jackson. The company has not yet recorded this check as NSF. 5. Enclosed with the July statement is BD15 debit memorandum for bank services. It has not yet been recorded because no previous notification had been received. 6. The company's December 31 daily cash receipts of BD10, 152 were placed in the bank's night depository on that date, but do not appear on the December 31 bank statement. The accounting team will ensure that the necessary adjustments are reflected based on the bank reconciliation, to proceed with financial statements preparation accordingly. Best Regards, Accountant Dear Financial Controller, Based on your request, I have just reviewed the bank statement for December, which shows a BD28,020 cash balance. I would like to highlight the following findings: 1. Check No. 3031 for BD1,380 and Check No. 3040 for BD552 were outstanding on the November 30 bank reconciliation. Check No. 3040 is listed with the December cancelled checks, but Check No. 3031 is not. Also, Check No. 3605 for BD336 and Check No. 3069 for BD2,148, both were written in December, are not among the cancelled checks on the December 31 statement. 2. In comparing the cancelled checks on the bank statement with the entries in the accounting records, it is found that Check No. 3056 for December utility bill was correctly written and drawn for BD1,250 but was erroneously entered in the accounting records as BD1,230. 3. A credit memorandum enclosed with the December bank statement indicates the bank collected BD9,000 cash as a non-interest-bearing note for the company, deducted a BD45 collection fee, and credited the reminder to its account. The company had not recorded this event relating to the short-term note before receiving the statement. 4. A debit memorandum for BD805 lists a BD795 NSF check plus a BD10 NSF charge. The check had been received from a customer, Maria Jackson. The company has not yet recorded this check as NSF. 5. Enclosed with the July statement is BD15 debit memorandum for bank services. It has not yet been recorded because no previous notification had been received. 6. The company's December 31 daily cash receipts of BD10, 152 were placed in the bank's night depository on that date, but do not appear on the December 31 bank statement. The accounting team will ensure that the necessary adjustments are reflected based on the bank reconciliation, to proceed with financial statements preparation accordingly. Best Regards, Accountant