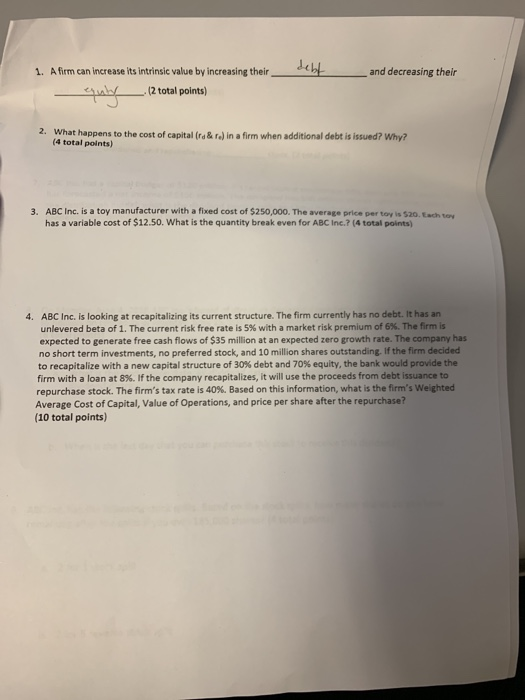

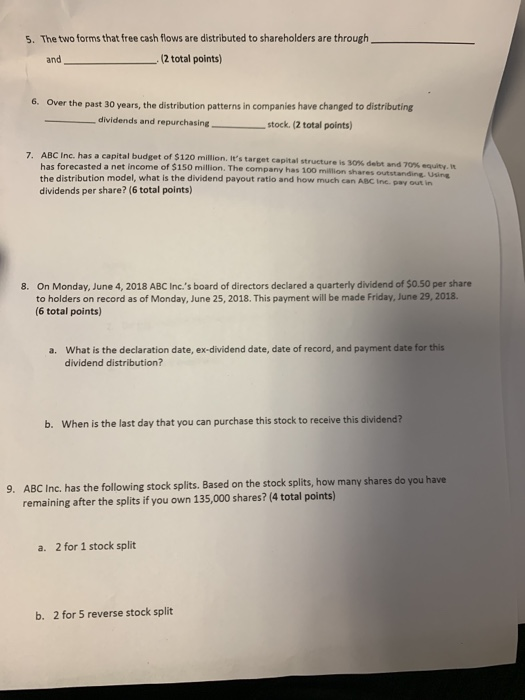

debl A firm can increase its intrinsic value by increasing their , and decreasing their 1. (2 total points) What happens to the cost of capital (rd & r) in a firm when additional debt is issued? Why? (4 total points) 2. 3. ABC Inc. is a toy manufacturer with a fixed cost of $250,000. The average price per toy is $2o. Each toy has a variable cost of $12.50. What is the quantity break even for ABC Inc.? (4 total points) 4. ABC Inc. is looking at recapitalizing its current structure. The firm currently has no debt. It has an unlevered beta of 1. The current risk free rate is 5 % with a market risk premium of 6 %. The firm is expected to generate free cash flows of $35 million at an expected zero growth rate. The company has no short term investments, no preferred stock, and 10 million shares outstanding. If the firm decided to recapitalize with a new capital structure of 30 % debt and 70 % equity , the bank would provide the firm with a loan at 8 %. If the company recapitalizes, it will use the proceeds from debt issuance to repurchase stock. The firm's tax rate is 40%. Based on this information, what is the firm's Weighted Average Cost of Capital, Value of Operations, and price per share after the repurchase? (10 total points) 5. The two forms that free cash flows are distributed to shareholders are through (2 total points) and 6. Over the past 30 years, the distribution patterns in companies have changed to distributing dividends and repurchasing. stock. (2 total points) 7. ABC Inc, has a capital budget of $120 million. It's target capital structure is 30% debt and 70% equity, It has forecasted a net income of $150 million. The company has 100 million shares outstanding, Using the distribution model, what is the dividend payout ratio and how much can ABC Inc. pay out in dividends per share? (6 total points) 8. On Monday, June 4, 2018 ABC Inc. 's board of directors declared a quartery dividend of $0.50 per share to holders on record as of Monday, June 25, 2018. This payment will be made Friday, June 29, 2018. (6 total points) What is the declaration date, ex-dividend date, date of record, and payment date for this dividend distribution? a. When is the last day that you can purchase this stock to receive this dividend? b. 9. ABC Inc. has the following stock splits. Based on the stock splits, how many shares do you have remaining after the splits if you own 135,000 shares? (4 total points) 2 for 1 stock split a. b. 2 for 5 reverse stock split