Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Debra owns a small apple orchard and press operation. After picking and selling the high-grade apples in their fresh state, she presses the remaining

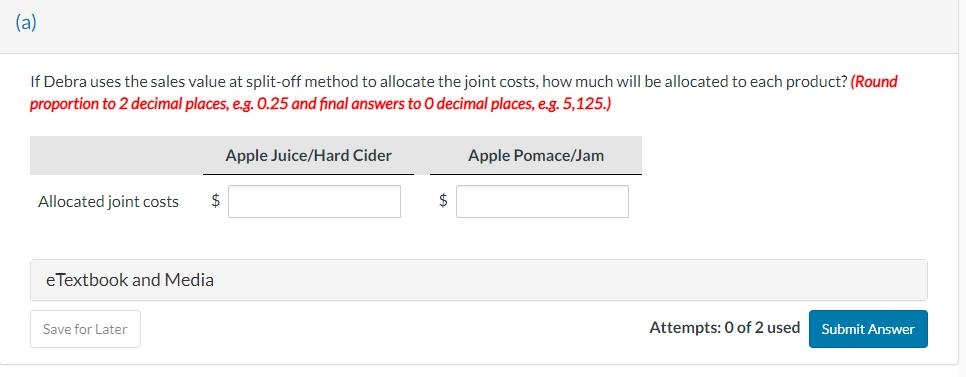

Debra owns a small apple orchard and press operation. After picking and selling the high-grade apples in their fresh state, she presses the remaining apples into juice. This process also yields pomace (a pulp like product). There is a market for both the juice and the pomace immediately after this joint pressing process is complete. The joint processing costs are $29,000. Both of these products can be processed further: the juice can be turned into hard cider, while the pomace can be turned into jam. The values of each product at different stages of completion, along with the additional costs that will be incurred if the products are processed further, are as follows. Apple juice/hard cider Apple pomace/jam Sales Value at Split-Off $39,750 13,250 Additional Processing Cost $14,548 5,152 Final Sales Value $103,000 22,000 (a) If Debra uses the sales value at split-off method to allocate the joint costs, how much will be allocated to each product? (Round proportion to 2 decimal places, e.g. 0.25 and final answers to O decimal places, e.g. 5,125.) Allocated joint costs $ eTextbook and Media Save for Later Apple Juice/Hard Cider $ Apple Pomace/Jam Attempts: 0 of 2 used Submit Answer

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Lets proceed with the calculations Step 1 Calculate the total sales value at splitoff for both produ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started