Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Debt cost of capital using CAPM - PMJ Company: the PMJ company had debt on their books at the end of 2015 with a

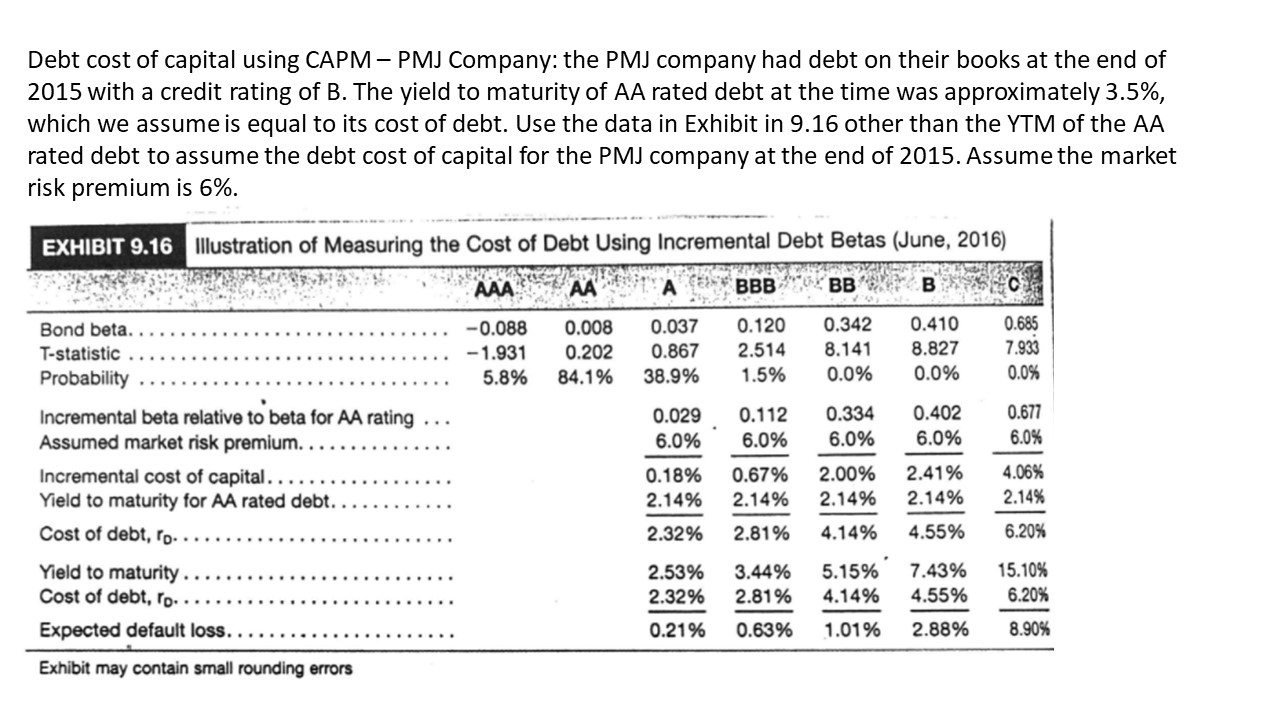

Debt cost of capital using CAPM - PMJ Company: the PMJ company had debt on their books at the end of 2015 with a credit rating of B. The yield to maturity of AA rated debt at the time was approximately 3.5%, which we assume is equal to its cost of debt. Use the data in Exhibit in 9.16 other than the YTM of the AA rated debt to assume the debt cost of capital for the PMJ company at the end of 2015. Assume the market risk premium is 6%. EXHIBIT 9.16 Illustration of Measuring the Cost of Debt Using Incremental Debt Betas (June, 2016) AAAAA A BBB BB B C Bond beta.. T-statistic -0.088 -1.931 0.008 0.037 0.202 0.867 0.120 2.514 8.141 0.342 0.410 8.827 0.685 7.933 Probability 5.8% 84.1% 38.9% 1.5% 0.0% 0.0% 0.0% Incremental beta relative to beta for AA rating Assumed market risk premium.. Incremental cost of capital... Yield to maturity for AA rated debt.. 0.029 0.112 0.334 6.0% 6.0% 6.0% 0.18% 0.67% 2.00% 2.41% 4.06% 2.14% 2.14% 2.14% 2.14% 2.14% 0.402 0.677 6.0% 6.0% Cost of debt, ro- 2.32% 2.81% 4.14% 4.55% 6.20% Yield to maturity. 2.53% 3.44% 5.15% 7.43% 15.10% Cost of debt, ro- 2.32% 2.81% 4.14% 4.55% 6.20% Expected default loss....... 0.21% 0.63% 1.01% 2.88% 8.90% Exhibit may contain small rounding errors

Step by Step Solution

★★★★★

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

To determine the debt cost of capital for the PMJ company at the end of 2015 we need to use the avai...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started