Answered step by step

Verified Expert Solution

Question

1 Approved Answer

debt to equity is there. can you the ones that doesnt require it? Hearty Plc is currently considering buying another company in a completely new

debt to equity is there. can you the ones that doesnt require it?

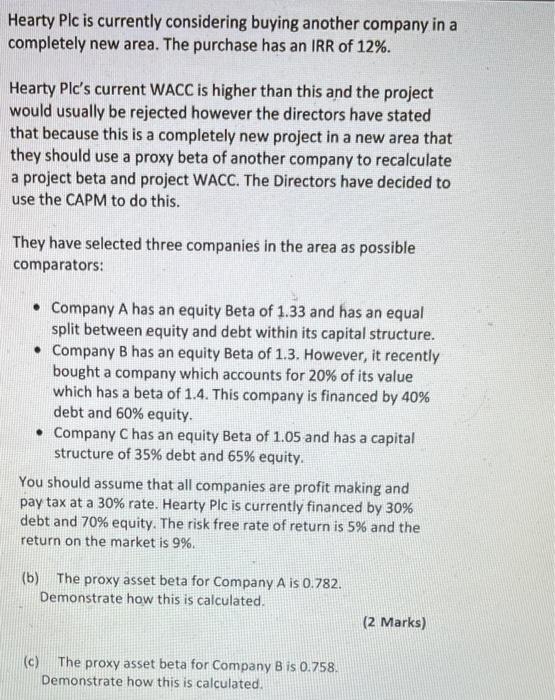

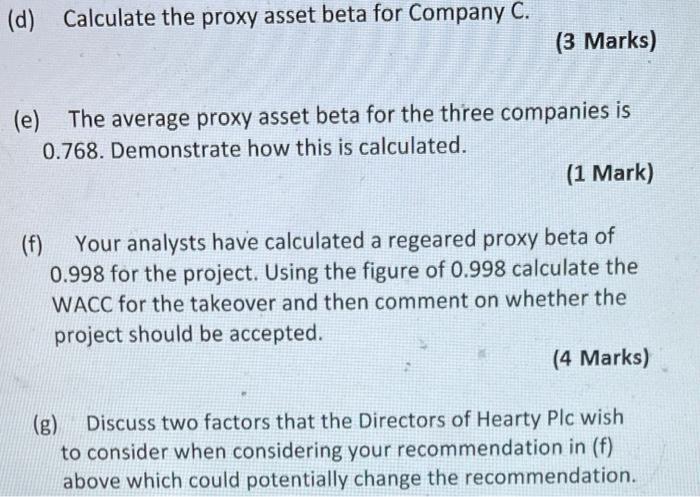

Hearty Plc is currently considering buying another company in a completely new area. The purchase has an IRR of 12%. Hearty Plc's current WACC is higher than this and the project would usually be rejected however the directors have stated that because this is a completely new project in a new area that they should use a proxy beta of another company to recalculate a project beta and project WACC. The Directors have decided to use the CAPM to do this. They have selected three companies in the area as possible comparators: Company A has an equity Beta of 1.33 and has an equal split between equity and debt within its capital structure. Company B has an equity Beta of 1.3. However, it recently bought a company which accounts for 20% of its value which has a beta of 1.4. This company is financed by 40% debt and 60% equity. Company C has an equity Beta of 1.05 and has a capital structure of 35% debt and 65% equity. You should assume that all companies are profit making and pay tax at a 30% rate. Hearty Plc is currently financed by 30% debt and 70% equity. The risk free rate of return is 5% and the return on the market is 9%. (b) The proxy asset beta for Company A is 0.782. Demonstrate how this is calculated. (2 Marks) (c) The proxy asset beta for Company B is 0.758. Demonstrate how this is calculated. (d) Calculate the proxy asset beta for Company C. (3 Marks) (e) The average proxy asset beta for the three companies is 0.768. Demonstrate how this is calculated. (1 Mark) Your analysts have calculated a regeared proxy beta of 0.998 for the project. Using the figure of 0.998 calculate the WACC for the takeover and then comment on whether the project should be accepted. (4 Marks) (g) Discuss two factors that the Directors of Hearty Plc wish to consider when considering your recommendation in (f) above which could potentially change the recommendation. Hearty Plc is currently considering buying another company in a completely new area. The purchase has an IRR of 12%. Hearty Plc's current WACC is higher than this and the project would usually be rejected however the directors have stated that because this is a completely new project in a new area that they should use a proxy beta of another company to recalculate a project beta and project WACC. The Directors have decided to use the CAPM to do this. They have selected three companies in the area as possible comparators: Company A has an equity Beta of 1.33 and has an equal split between equity and debt within its capital structure. Company B has an equity Beta of 1.3. However, it recently bought a company which accounts for 20% of its value which has a beta of 1.4. This company is financed by 40% debt and 60% equity. Company C has an equity Beta of 1.05 and has a capital structure of 35% debt and 65% equity. You should assume that all companies are profit making and pay tax at a 30% rate. Hearty Plc is currently financed by 30% debt and 70% equity. The risk free rate of return is 5% and the return on the market is 9%. (b) The proxy asset beta for Company A is 0.782. Demonstrate how this is calculated. (2 Marks) (c) The proxy asset beta for Company B is 0.758. Demonstrate how this is calculated. (d) Calculate the proxy asset beta for Company C. (3 Marks) (e) The average proxy asset beta for the three companies is 0.768. Demonstrate how this is calculated. (1 Mark) Your analysts have calculated a regeared proxy beta of 0.998 for the project. Using the figure of 0.998 calculate the WACC for the takeover and then comment on whether the project should be accepted. (4 Marks) (g) Discuss two factors that the Directors of Hearty Plc wish to consider when considering your recommendation in (f) above which could potentially change the recommendation Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started