debt valued at $20 billion on its balance sheet, while the market value of its common...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

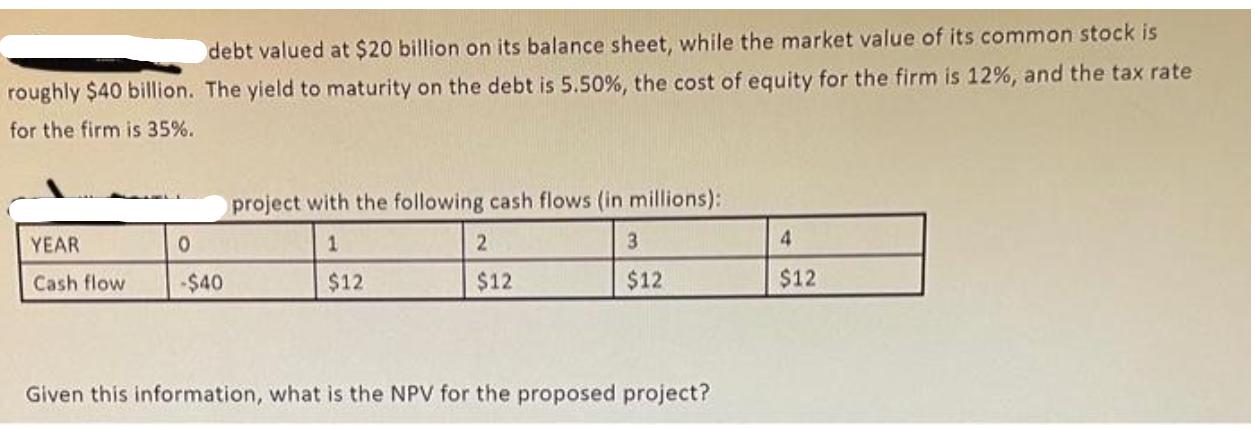

debt valued at $20 billion on its balance sheet, while the market value of its common stock is roughly $40 billion. The yield to maturity on the debt is 5.50%, the cost of equity for the firm is 12%, and the tax rate for the firm is 35%. YEAR 0 Cash flow -$40 project with the following cash flows (in millions): 1 $12 2 3 $12 $12 Given this information, what is the NPV for the proposed project? 4 $12 debt valued at $20 billion on its balance sheet, while the market value of its common stock is roughly $40 billion. The yield to maturity on the debt is 5.50%, the cost of equity for the firm is 12%, and the tax rate for the firm is 35%. YEAR 0 Cash flow -$40 project with the following cash flows (in millions): 1 $12 2 3 $12 $12 Given this information, what is the NPV for the proposed project? 4 $12

Expert Answer:

Answer rating: 100% (QA)

To calculate the net present value NPV for the proposed project we need to discount the cash flows a... View the full answer

Related Book For

Entrepreneurial Finance

ISBN: 978-1305968356

6th edition

Authors: J. Chris Leach, Ronald W. Melicher

Posted Date:

Students also viewed these finance questions

-

Thirty-four stock market analysts were asked to rate Intel Corporations stock using the standard stock rating system: 5Strong Buy; 4Buy; 3Hold; 2Underperform; 1Sell. Data from the survey are shown...

-

Why do some LEDs generate a photovoltage in some LEDs but not inother LEDs (Table 3)? Which color LED generated photovoltage in the most LEDs andwhy? Which color LED generated a photovoltage in the...

-

The owner of a trucking company wants to expand its business by purchasing new trucks. The owner considers two types of trucks: Peterbilt 579 or Kenworth T680. The owner has estimated that each...

-

The HaberBosch process for the production of ammonia is one of the key industrial processes in developed countries. N 2 (g) + 3 H 2 (g) 2 NH 3 (g) (a) Calculate r G for the reaction at 298 K, 800...

-

Dusit is financed 30% by debt yielding 8%. Investors require a return of 15% on Dusit's equity. a. What is the company's weighted-average cost of capital if the corporate tax rate is 35%? b. What...

-

A business buys two identical tangible personal property assets for the same identical price. It buys one at the beginning of the year and one at the end of year. Under what conditions would the...

-

Whether hearsay evidence may be admissible under a hearsay exception?

-

As part of the audit of different audit areas, auditors should be alert for the possibility of unrecorded liabilities. For each of the following audit areas or accounts, describe a liability that can...

-

Describe the consumer group(s) Bud Light was trying to pursue with its marketing efforts. How has this changed from their target market in the past? Focus on STP = Segmentation, Targeting., and...

-

Discuss the relationship between users and roles in databases. Explain why we use roles rather than simply assigning rights and privileges to each individual user. Consider how to handle new hires...

-

A copper wire has a diameter of \(0.20 \mathrm{~mm}\) and is \(\ell_{\text {wirc }}=10 \mathrm{~m}\) long. (a) What is the resistance of the wire? (b) The wire is cut into \(N\) identical pieces, and...

-

This problem is based on the information about the Murphy County General Fund budgeted and actual transactions and events described in Problem 4-2. Required 1. Prepare a budgetary comparison...

-

Jacqueline divides her income between coffee and croissants (both of which are normal goods). An early frost in Brazil causes a large increase in the price of coffee in France. a. Show how this early...

-

A politician makes a speech which is critical of the governments immigration policy, saying that it is too loose and encourages too many people to enter the country and take jobs away from local...

-

Request an interview with a health care executive and explore his perceptions of risk and disaster preparedness for his organization. Ask to see the health care organizations all hazards plan. Based...

-

Martin's maximum willingness to pay for an electric boat motor is $250. Because of a tax, the price of the motor increases from $230 to $280. The deadweight loss of the tax attributable to Martin is:...

-

Fill in each blank so that the resulting statement is true. 83 + 103 = ______ .

-

Describe how the relative value method is used to value a firms equity.

-

Locate a recent study covering venture capital fundraising (not investing) for the previous year. Determine what the current sources of funds tend to be.

-

Describe examples of customer funding used to reduce financing needs.

-

(a) Consider a normal distribution with mean 100 and variance 100. Write out the CDF of the threshold exceedance distribution with respect to 120 (two standard deviations above the mean). Just use...

-

(a) Let \(X\) be a random variable with a location-scale t distribution with 3 degrees of freedom, location 100, and scale 10. i. What is the probability that \(X\) is less than or equal to 110 ? ii....

-

Consider a random sample of size \(n\) from the unit Pareto distribution with PDF \[ f(x)=2 x^{-2} \quad \text { for } 0 \leq x \] that is, for the Pareto with \(\alpha=2\) and \(\gamma=1\). (a)...

Study smarter with the SolutionInn App