Answered step by step

Verified Expert Solution

Question

1 Approved Answer

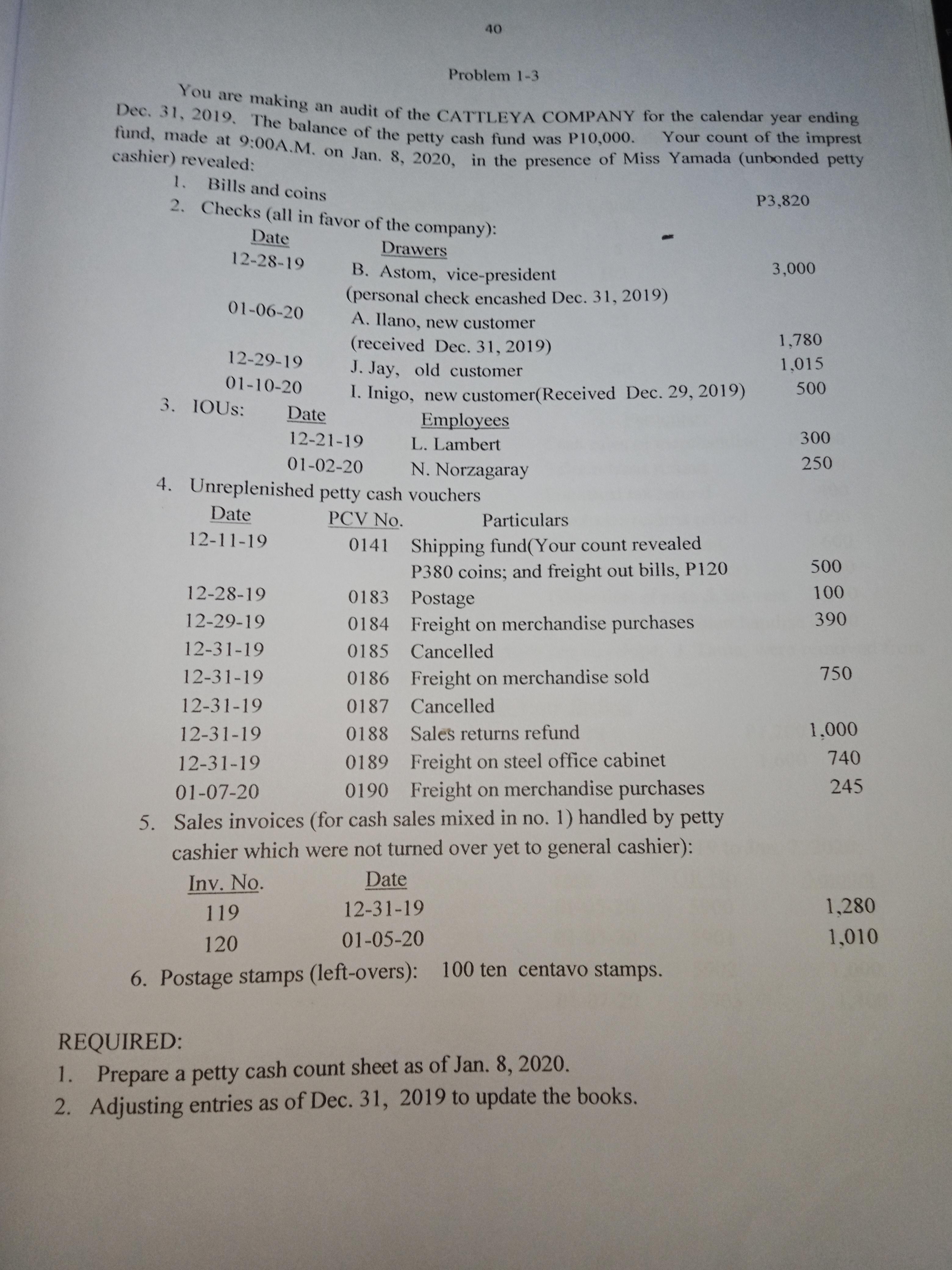

You are making an audit of the CATTLEYA COMPANY for the calendar year ending Dec. 31, 2019. The balance of the petty cash fund

You are making an audit of the CATTLEYA COMPANY for the calendar year ending Dec. 31, 2019. The balance of the petty cash fund was P10,000. fund, made at 9:00A.M. on Jan. 8, 2020, in the presence of Miss Yamada (unbonded petty Your count of the imprest cashier) revealed: 01-06-20 1. Bills and coins 2. Checks (all in favor of the company): Date 12-28-19 12-29-19 01-10-20 3. IOUS: Date Date 12-11-19 12-28-19 12-29-19 12-31-19 12-31-19 12-31-19 12-31-19 12-31-19 01-07-20 40 Problem 1-3 12-21-19 01-02-20 4. Unreplenished petty cash vouchers PCV No. 0141 Drawers B. Astom, vice-president (personal check encashed Dec. 31, 2019) A. Ilano, new customer (received Dec. 31, 2019) J. Jay, old customer I. Inigo, new customer(Received Dec. 29, 2019) 119 120 Employees L. Lambert N. Norzagaray Particulars Shipping fund(Your count revealed P380 coins; and freight out bills, P120 0183 Postage 0184 Freight on merchandise purchases 0185 Cancelled 0186 Freight on merchandise sold 0187 Cancelled 0188 Sales returns refund 0189 Freight on steel office cabinet 0190 Freight on merchandise purchases 5. Sales invoices (for cash sales mixed in no. 1) handled by petty cashier which were not turned over yet to general cashier): Inv. No. Date 12-31-19 01-05-20 6. Postage stamps (left-overs): 100 ten centavo stamps. REQUIRED: 1. Prepare a petty cash count sheet as of Jan. 8, 2020. 2. Adjusting entries as of Dec. 31, 2019 to update the books. P3,820 3,000 1,780 1,015 500 300 250 500 100 390 750 1.000 740 245 1,280 1,010

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Preparation of the petty cash count sheet as of January 8 2020 and providing the adjusting entries a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started