Question

Dec. 31 Salaries Expense 67.000 Salaries Payable 67.000 To record accrued salaries at December 31. 31 Depreciation Expense: Furniture and Fixtures 781.25 Accumulated Depreciation: Furn.

Dec. | 31 | Salaries Expense | 67.000 | ||

Salaries Payable | 67.000 | ||||

To record accrued salaries at December 31. | |||||

31 | Depreciation Expense: Furniture and Fixtures | 781.25 | ||

Accumulated Depreciation: Furn. & fixtures | 781.25 | |||

To record December depreciation expense | ||||

($187,500 ÷ 240 months). | ||||

31 | Insurance Expense | 383.33 | ||

Unexpired Insurance | 383,33 | |||

To record December insurance expense | ||||

($4,600 x 1/12). | ||||

31 | Interest Expense | 40000 | ||

Interest Payable | 40000 | |||

To record accrued interest expense in December | ||||

($1,200,000 x 5% x 8/12). | ||||

31 | Income Taxes Expense | 844,30 | ||

Income Taxes Payable | 844,30 | |||

To record income taxes accrued in December. 202.631,25 x 25% / 12 | ||||

31 | Unearned Revenue / new contract | 13.500 | ||

Revenue / new contract | 13.500 | |||

To record the portion of annual membership dues | ||||

earned in December. 450000 x 30% | ||||

31 | Cash earned | 330.000 |

Building sold | 330.000 |

Prepare an after-adjusting entries trial balance.

Prepare an income statement for the year ended December 31, current year.

Prepare an after closing Balance Sheet.

Briefly evaluate the company’s profitability and liquidity.

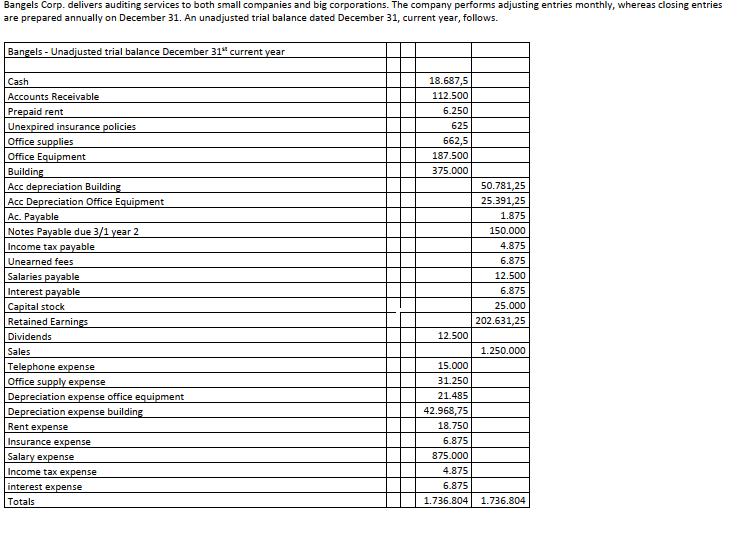

Bangels Corp. delivers auditing services to both small companies and big corporations. The company performs adjusting entries monthly, whereas closing entries are prepared annually on December 31. An unadjusted trial balance dated December 31, current year, follows. Bangels - Unadjusted trial balance December 31st current year Cash Accounts Receivable Prepaid rent Unexpired insurance policies Office supplies Office Equipment Building Acc depreciation Building Acc Depreciation Office Equipment Ac. Payable Notes Payable due 3/1 year 2 Income tax payable Unearned fees Salaries payable Interest payable Capital stock Retained Earnings Dividends Sales Telephone expense Office supply expense Depreciation expense office equipment Depreciation expense building Rent expense Insurance expense Salary expense Income tax expense interest expense Totals 18.687,5 112.500 6.250 625 662,5 187.500 375.000 12.500 50.781,25 25.391,25 1.875 150.000 4.875 6.875 12.500 6.875 25.000 202.631,25 1.250.000 15.000 31.250 21.485 42.968,75 18.750 6.875 875.000 4.875 6.875 1.736.804 1.736.804

Step by Step Solution

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Statements of Profit and Loss and Other Comprehensive Income Sales HK620000 A082 A508400 Cost of Sal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started