Answered step by step

Verified Expert Solution

Question

1 Approved Answer

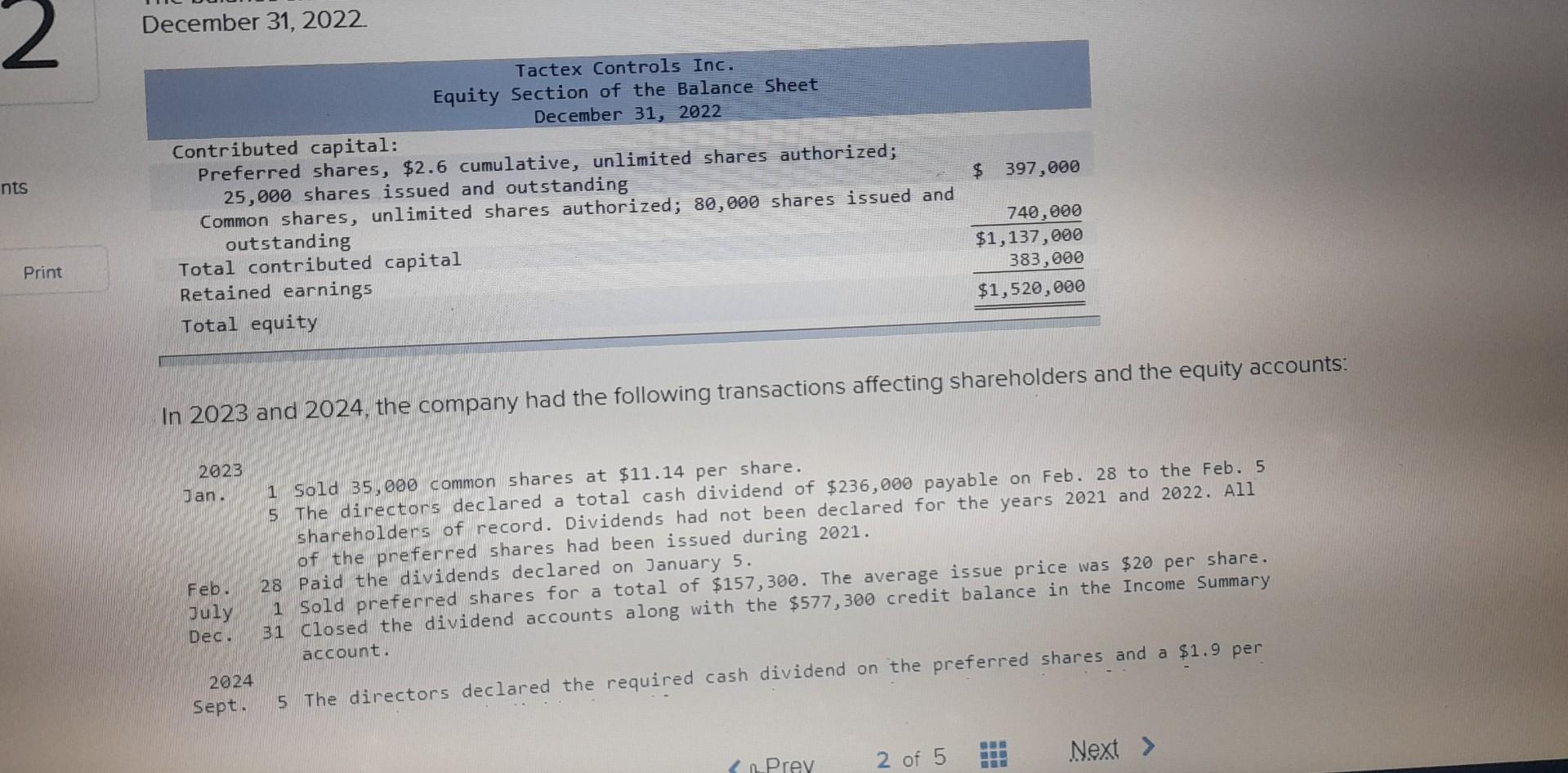

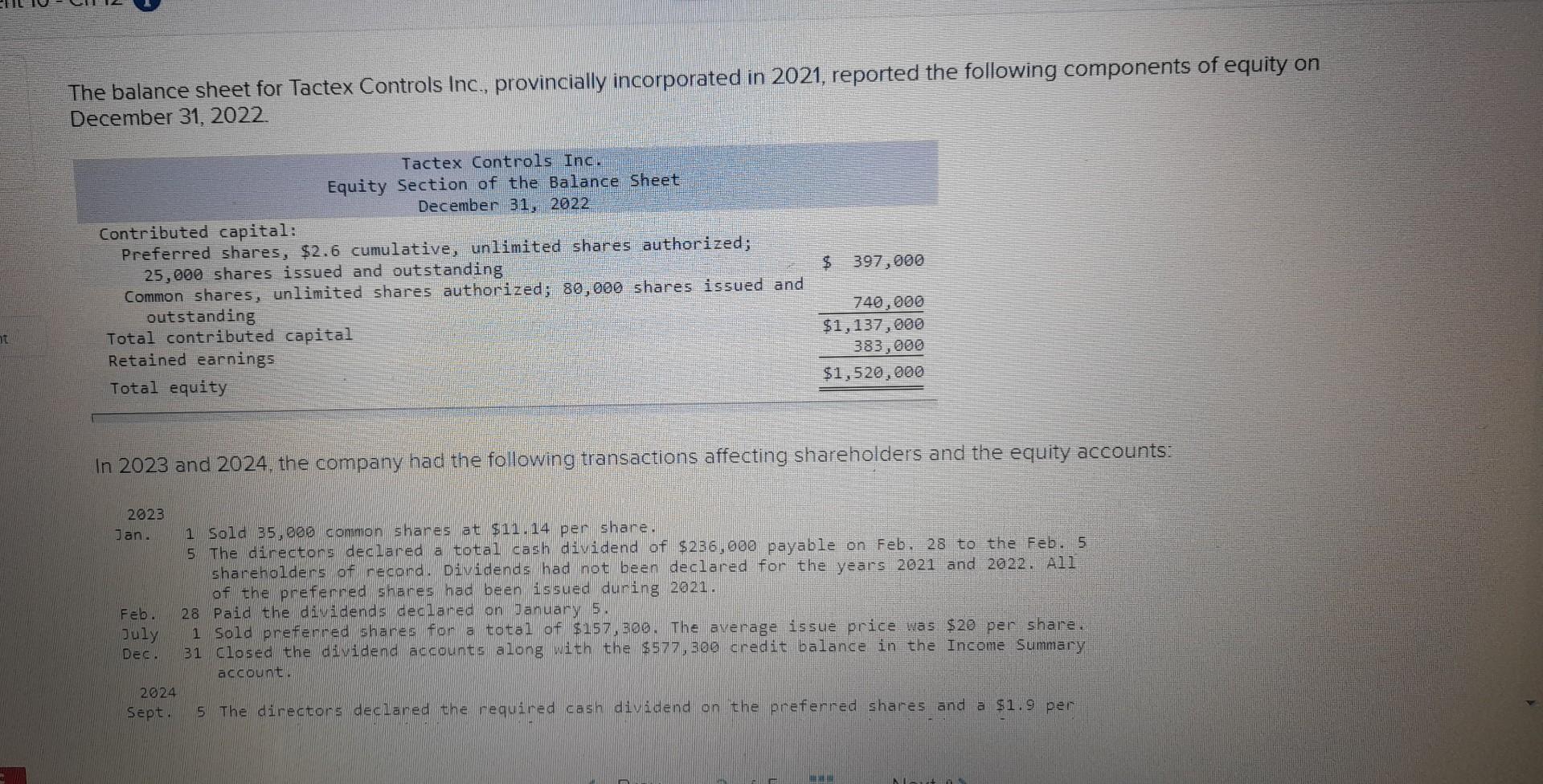

December 31, 2022 In 2023 and 2024 , the company had the following transactions affecting shareholders and the equity accounts: 5 The directors declared a

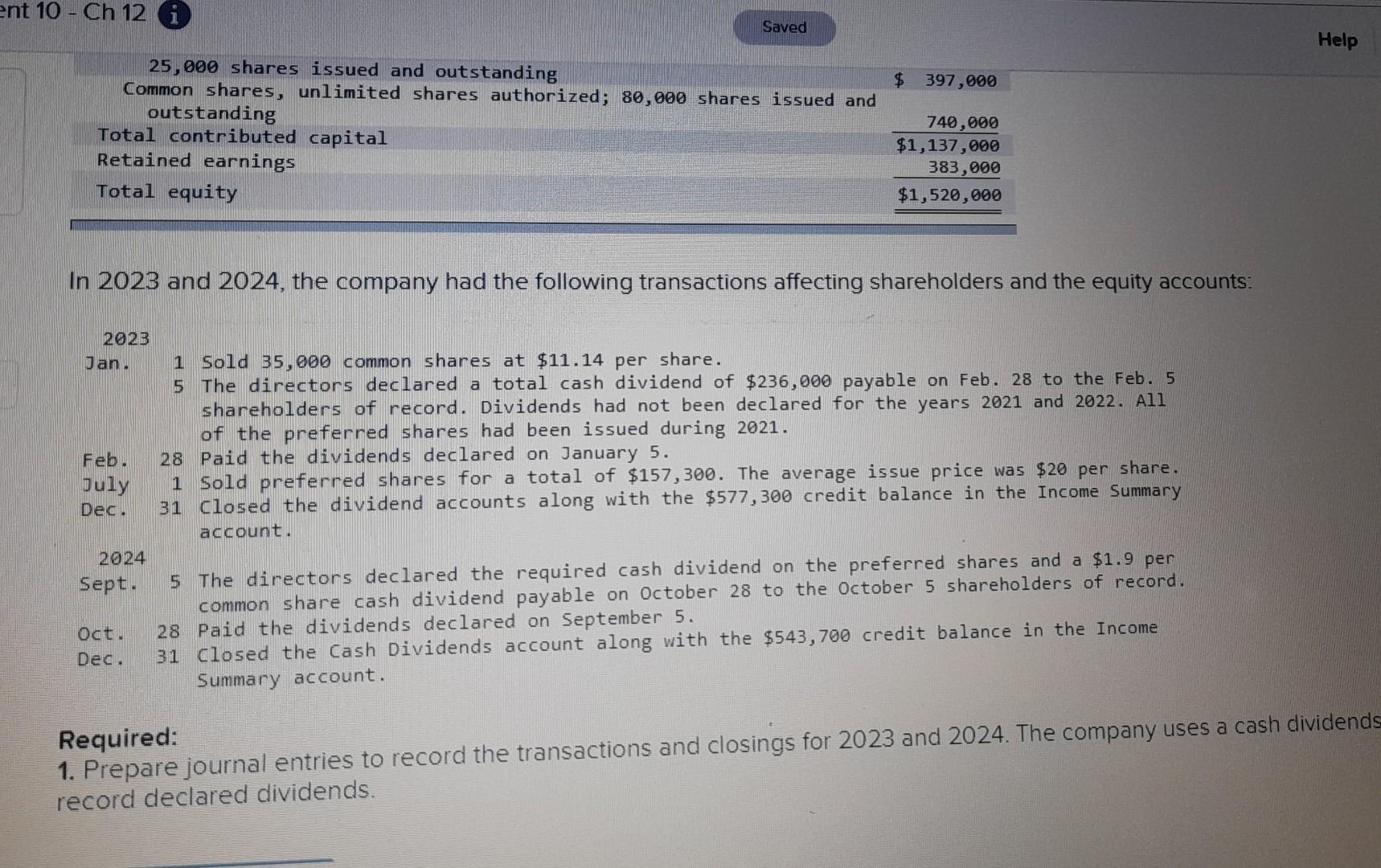

December 31, 2022 In 2023 and 2024 , the company had the following transactions affecting shareholders and the equity accounts: 5 The directors declared a total cash dividend of $236,000 payable on Feb. 28 to the Feb. 5 Jan. 1 Sold 35,000 common shares at $11.14 per share. 2023 shareholders of record. Dividends had not been declared for the years 2021 and 2022. of the preferred shares had been issued during 2021. July 1 Sold preferred shares for a total of $157,300. The average issue price was $20 per share. Feb. 28 Paid the dividends declared on January 5. Dec. 31 Closed the dividend accounts along with the $577,300 credit balance in the Income Summary Sept. 5 The directors declared the required cash dividend on the preferred shares and a $1.9 per 2024 The balance sheet for Tactex Controls Inc., provincially incorporated in 2021, reported the following components of equity on December 31, 2022. In 2023 and 2024 , the company had the following transactions affecting shareholders and the equity accounts: 2023 Jan. 1 Sold 35,000 common shares at $11.14 per share. 5 The directors declared a total cash dividend of $236,000 payable on Feb. 28 to the Feb. 5 shareholders of record. Dividends had not been declared for the years 2021 and 2022. All of the preferred shares had been issued during 2021. Feb. 28 Paid the dividends declared on January 5. July 1 Sold preferred shares for a total of $157,300. The average issue price was $20 per share. Dec. 31 Closed the dividend accounts along with the $577,300 credit balance in the Income Summary account. 2024 The directors declared the required cash dividend on the preferred shares and a $1.9 per common share cash dividend payable on October 28 to the October 5 shareholders of record. Oct. 28 Paid the dividends declared on September 5. Dec. 31 closed the Cash Dividends account along with the $543,700 credit balance in the Income summary account. 1. Prepare journal entries to record the transactions and closings for 2023 and 2024 . The company uses a cash dividends Required: record declared dividends

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started