Answered step by step

Verified Expert Solution

Question

1 Approved Answer

December Wages earned from July 1 s t through December 3 1 s t was $ 5 2 8 , 5 0 0 . Wages

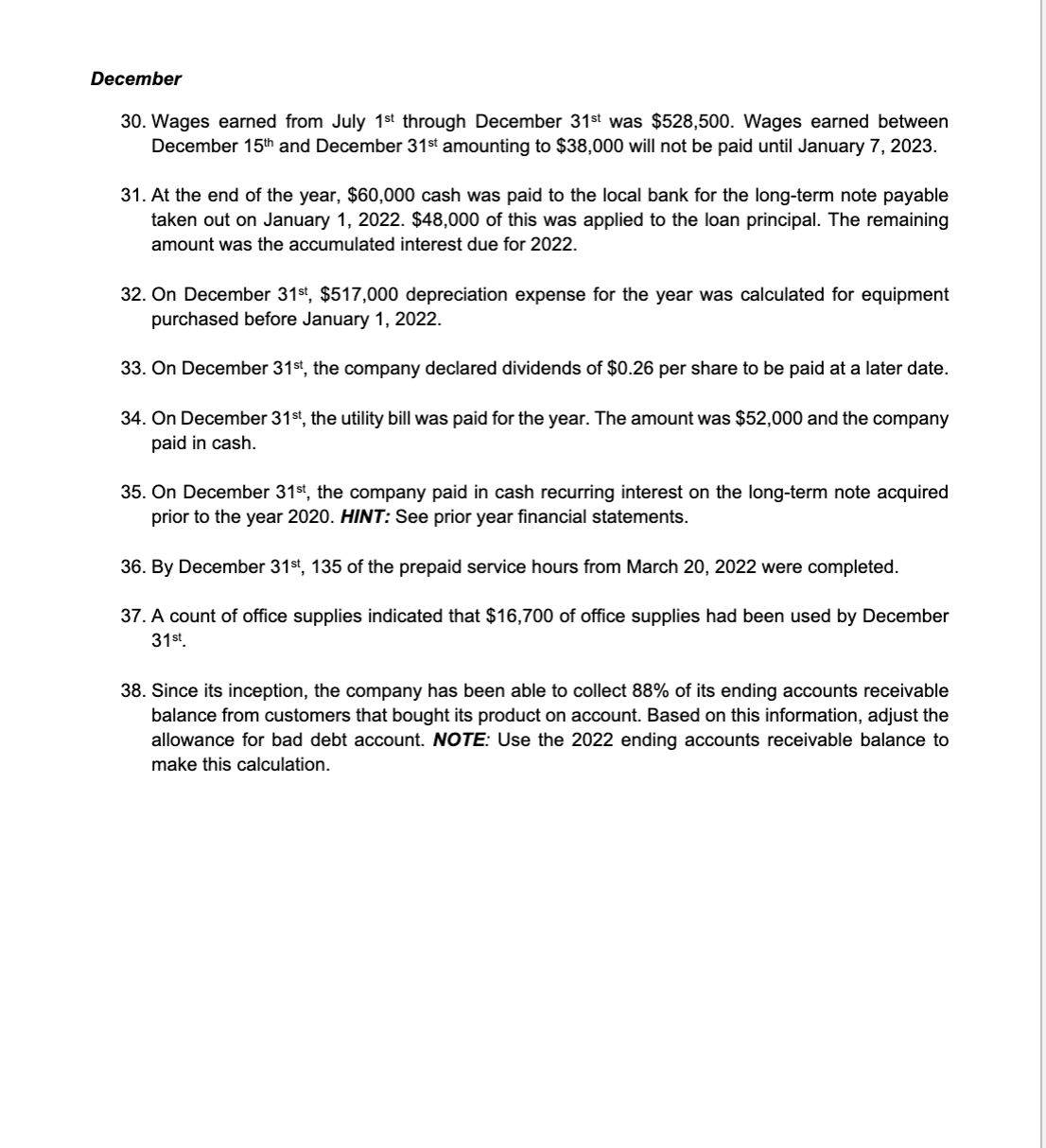

December

Wages earned from July through December was $ Wages earned between

December and December amounting to $ will not be paid until January

At the end of the year, $ cash was paid to the local bank for the longterm note payable

taken out on January $ of this was applied to the loan principal. The remaining

amount was the accumulated interest due for

On December $ depreciation expense for the year was calculated for equipment

purchased before January

On December the company declared dividends of $ per share to be paid at a later date.

On December the utility bill was paid for the year. The amount was $ and the company

paid in cash.

On December the company paid in cash recurring interest on the longterm note acquired

prior to the year HINT: See prior year financial statements.

By December st of the prepaid service hours from March were completed.

A count of office supplies indicated that $ of office supplies had been used by December

Since its inception, the company has been able to collect of its ending accounts receivable

balance from customers that bought its product on account. Based on this information, adjust the

allowance for bad debt account. NOTE: Use the ending accounts receivable balance to

make this calculation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started