Answered step by step

Verified Expert Solution

Question

1 Approved Answer

? ? Ever Markets prepares marketing plans for growing businesses. For 2017, budgeted revenues are $800,000 based on 400 marketing plans at an average rate

?

?

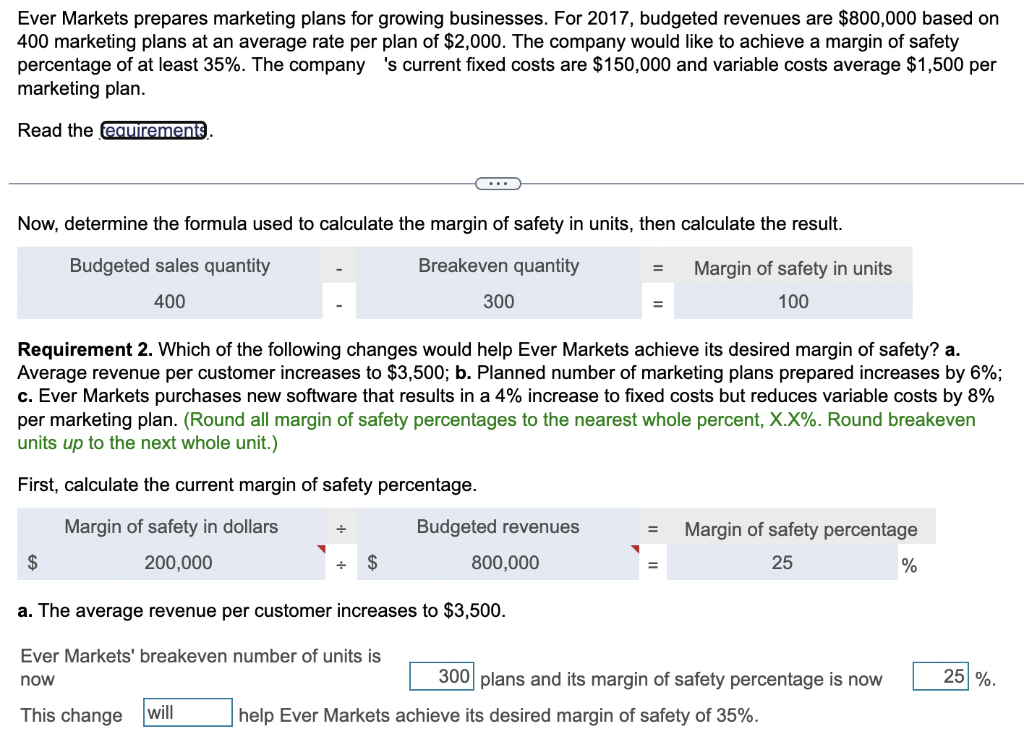

Ever Markets prepares marketing plans for growing businesses. For 2017, budgeted revenues are $800,000 based on 400 marketing plans at an average rate per plan of $2,000. The company would like to achieve a margin of safety percentage of at least 35%. The company 's current fixed costs are $150,000 and variable costs average $1,500 per marketing plan. Read the requirements Now, determine the formula used to calculate the margin of safety in units, then calculate the result. Budgeted sales quantity Breakeven quantity 400 + 300 Requirement 2. Which of the following changes would help Ever Markets achieve its desired margin of safety? a. Average revenue per customer increases to $3,500; b. Planned number of marketing plans prepared increases by 6%; c. Ever Markets purchases new software that results in a 4% increase to fixed costs but reduces variable costs by 8% per marketing plan. (Round all margin of safety percentages to the nearest whole percent, X.X%. Round breakeven units up to the next whole unit.) First, calculate the current margin of safety percentage. Margin of safety in dollars 200,000 $ Budgeted revenues $ a. The average revenue per customer increases to $3,500. Ever Markets' breakeven number of units is now This change will = 800,000 Margin of safety in units 100 = Margin of safety percentage 25 300 plans and its margin of safety percentage is now help Ever Markets achieve its desired margin of safety of 35%. % 25%.

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer aAccumulated depreciation Equipment 515800148001215 400800 Depreciati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started