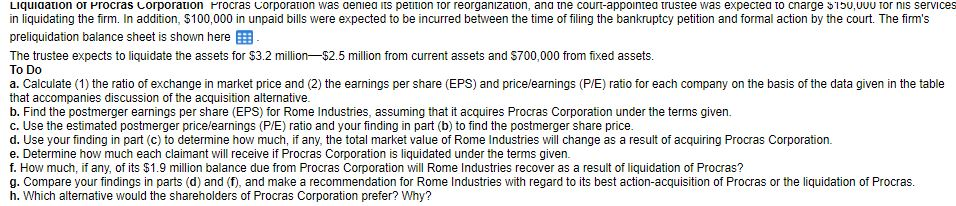

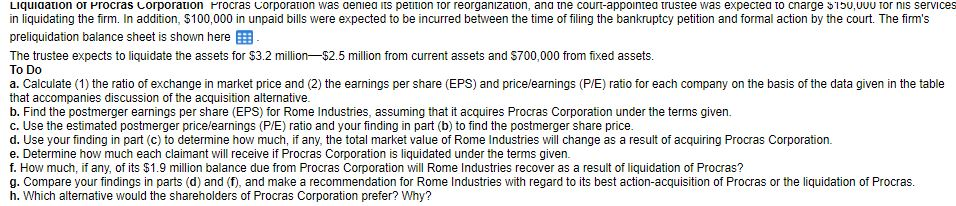

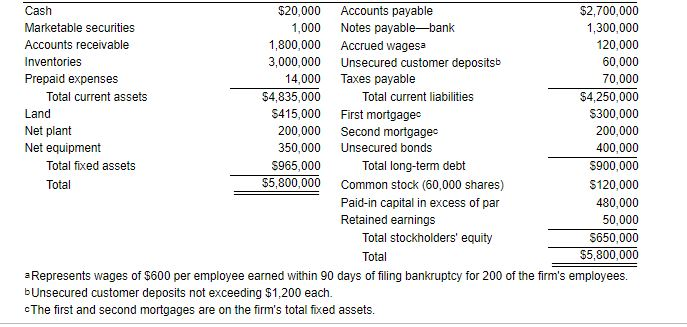

Deciding Whether to Acquire or Liquidate Procras Corporation Sharon Scotia, CFO of Rome Industries, must decide what to do about Procras Corporation, a major customer that is bankrupt. Rome Industries is a large plastic-injection-molding firm that produces plastic products to customer order. Procras Corporation is a major customer of Rome Industries that designs and markets a variety of plastic toys. As a result of mismanagement and inventory problems, Procras has become bankrupt. Among its unsecured debts are total past-due accounts of $1.9 million owed to Rome Industries Recognizing that it probably cannot recover the full $1.9 million that Procras Corporation owes it, the management of Rome Industries has isolated two mutually exclusive alternative actions: (1) acquire Procras through an exchange of stock or (2) let Procras be liquidated and recover Rome Industries' proportionate claim against any funds available for unsecured creditors. Rome's management feels that acquisition of Procras would have appeal in that it would allow Rome to integrate vertically and expand its business from strictly industrial manufacturing to include product development and marketing. Of course, the firm wants to select the alternative that will making a recommendation as to whether Rome should acquire Procras Corporation or allow it to be liquidated, Ms. Scotia gathered the following data. Acquire Procras Corporation Negotiations with Procras management have resulted in a planned ratio of exchange of 0.6 share of Rome Industries for each share of Procras Corporation common stock. The following table reflects current data for Rome Industries and Rome's expectations of the data values for Procras Corporation with proper management in place create the most value for its shareholders. Charged with Deciding Whether to Acquire or Liquidate Procras Corporation Sharon Scotia, CFO of Rome Industries, must decide what to do about Procras Corporation, a major customer that is bankrupt. Rome Industries is a large plastic-injection-molding firm that produces plastic products to customer order. Procras Corporation is a major customer of Rome Industries that designs and markets a variety of plastic toys. As a result of mismanagement and inventory problems, Procras has become bankrupt. Among its unsecured debts are total past-due accounts of $1.9 million owed to Rome Industries Recognizing that it probably cannot recover the full $1.9 million that Procras Corporation owes it, the management of Rome Industries has isolated two mutually exclusive alternative actions: (1) acquire Procras through an exchange of stock or (2) let Procras be liquidated and recover Rome Industries' proportionate claim against any funds available for unsecured creditors. Rome's management feels that acquisition of Procras would have appeal in that it would allow Rome to integrate vertically and expand its business from strictly industrial manufacturing to include product development and marketing. Of course, the firm wants to select the alternative that will making a recommendation as to whether Rome should acquire Procras Corporation or allow it to be liquidated, Ms. Scotia gathered the following data. Acquire Procras Corporation Negotiations with Procras management have resulted in a planned ratio of exchange of 0.6 share of Rome Industries for each share of Procras Corporation common stock. The following table reflects current data for Rome Industries and Rome's expectations of the data values for Procras Corporation with proper management in place create the most value for its shareholders. Charged with