Question

Deciphering Financial Statements (Wells Fargo & Company) Wells Fargo & Company is the fourth largest bank in the United States (based on consolidated asset data

Deciphering Financial Statements (Wells Fargo & Company)

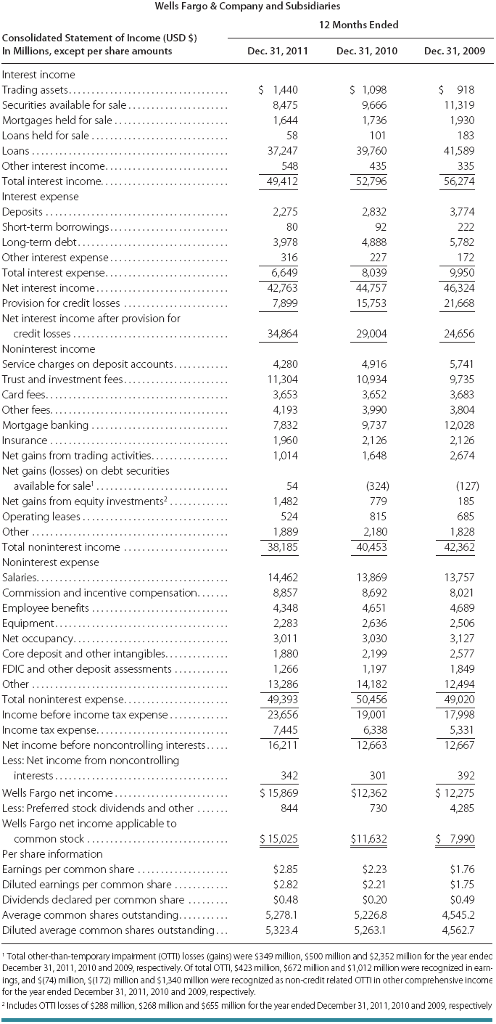

Wells Fargo & Company is the fourth largest bank in the United States (based on consolidated asset data gathered by the Federal Reserve as of March 31, 2012). Its consolidated statement of income follows.

The accompanying notes are an integral part of these statements.

1. How is this income statement different from all the other income statements illustrated in this chapter?

2. For a merchandising firm, gross profit represents sales less cost of goods sold. For Wells Fargo, what component of the income statement would be similar to gross profit?

3. Compute the following ratios for each of the years 20092011:

a. Total interest expense/Total interest income,

b. Incentive compensation/Salaries, and

c. Employee benefits/Salaries.

4. Comment on the ratios you computed in part (3), particularly any trends.

5. The average loans receivable balance for Wells Fargo during 2011 was $742,252 million. The average amount of deposits during 2011 was $884,006 million. Using the income statement data, comment on the average interest rate Wells Fargo pays to its depositors, the average interest rate Wells Fargo earns on its loans receivable, and the spread between these two rates.

6. The market value of Wells Fargos stock at the end of each year was $27.56, $30.99, and $26.99 for the years 2011, 2010, and 2009, respectively. Compute the firms price-earnings ratio for each year. Use diluted earnings per share. Is it increasing or decreasing over time?

Wells Fargo & Company and Subsidiaries 12 Months Ended Consolidated Statement of Income (USDs) In Millions, except per share amounts Dec. 31, 20 Dec. 31, 2010 Dec. 31, 2009 Interest income Trading assets, Securities available for sale Mortgages held for sale. Loans held for sale $ 1A40 8475 $ 918 319 58 37247 $ 1098 9666 1,726 101 39,760 435 52,796 41,589 Other interest income Total interest income Interest expense Deposits, Short-term borrowings. Long-term debt Other interest expense. Total interest expense. Net interest income Provision for credit losses Net interest income after provision for 49,412 56,274 3774 4888 227 8039 44757 15753 172 42763 46324 21,568 34864 24,656 Noninterest income Service charges on deposit accounts Trust and investment fees Card fees. Other fees. Mortgage banking Insurance Net gains from trading activities. Net gains (losses) on debt securities available for sale Net gains from equity investments? Operating leases Other Total noninterest income Noninterest expense Salaries. Commission and incentive compensation....... Employee benefits Equipment. Net occupancy. Core deposit and other intangibles. FDIC and other deposit assessments. 4,280 4,916 10,934 3,652 3,990 9,737 5,74 9,735 3653 4,193 12028 960 2,674 (324 179 815 127 482 524 1889 38,185 4053 685 828 42362 4,46 13,869 8692 465 2636 13,757 4,348 3,0 4689 2506 3,127 257 Total noninterest expense. Income before income tax expense. ........... Income tax expense. Net income before noncontrolling interests..... Less: Net income from noncontrolling 13286 49393 14, 182 50456 7445 162 12494 49020 17998 533 Wells Fargo net income Less: Prefeed stock dividends and other Wells Fargo net income applicable to common stock Per share information Earnings per common share Diluted earnings per common share Dividends dedared per common share Averages common shares outstanding . Diluted average common shares outstanding 342 S 15869 $12362 730 392 $ 12,275 $ 15,025 $11632 $285 $282 S048 5,278. 5,3234 $223 $2.2 so.20 5,2268 5263. $0.49 4545.2 4,562.7 Total otherthan-temporary impairment (OTT) losses (gains) were s349 million, $500 million and $2352 million for the year endec December 31, 2011, 2010 and 2009, respectively. of total oTMI, 5423 million, $672 million and $1,012 million were recognized in eam ings, and S74) motionsa72 million and $1340 million were recognized as noncredit related or in other comprehensive income for the year ended December 312011, 2010 and 2009, respectively. a Includes Om losses of $288 million, $268 million and $655 million for the year ended December 31, 2011, 2010 and 2009, respectively

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started