Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Decision 3 Prechem Limited, also a subsidiary of Precizion, produces a chemical product which is sold to Cleaning products manufacturers. In 2022, the company incurred

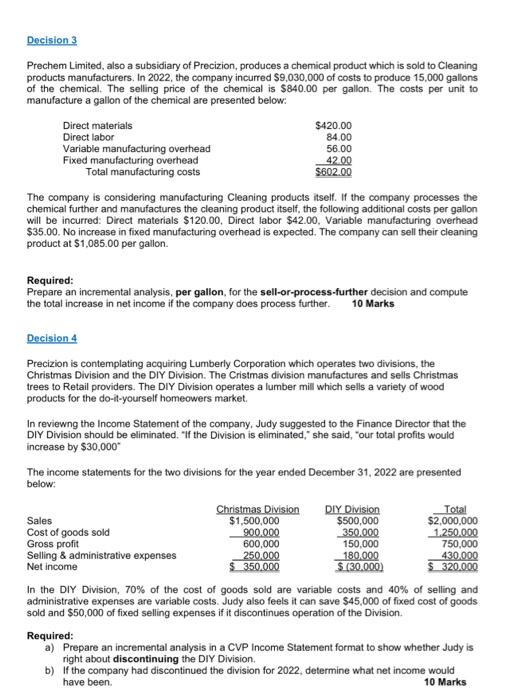

Decision 3 Prechem Limited, also a subsidiary of Precizion, produces a chemical product which is sold to Cleaning products manufacturers. In 2022, the company incurred $9,030,000 of costs to produce 15,000 gallons of the chemical. The selling price of the chemical is $840.00 per gallon. The costs per unit to manufacture a gallon of the chemical are presented below: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total manufacturing costs The company is considering manufacturing Cleaning products itself. If the company processes the chemical further and manufactures the cleaning product itself, the following additional costs per gallon will be incurred: Direct materials $120.00, Direct labor $42.00, Variable manufacturing overhead $35.00. No increase in fixed manufacturing overhead is expected. The company can sell their cleaning product at $1,085.00 per gallon. Required: Prepare an incremental analysis, per gallon, for the sell-or-process-further decision and compute the total increase in net income if the company does process further. 10 Marks Decision 4 $420.00 84.00 56.00 42.00 $602.00 Precizion is contemplating acquiring Lumberly Corporation which operates two divisions, the Christmas Division and the DIY Division. The Cristmas division manufactures and sells Christmas trees to Retail providers. The DIY Division operates a lumber mill which sells a variety of wood products for the do-it-yourself homeowers market. In reviewng the Income Statement of the company, Judy suggested to the Finance Director that the DIY Division should be eliminated. "If the Division is eliminated," she said, "our total profits would increase by $30,000" The income statements for the two divisions for the year ended December 31, 2022 are presented below: Sales Cost of goods sold Gross profit Selling & administrative expenses Net income Christmas Division $1,500,000 900,000 600,000 250,000 $350,000 DIY Division $500,000 350,000 150,000 180,000 $ (30,000) Total $2,000,000 1,250,000 750,000 430,000 $ 320,000 In the DIY Division, 70% of the cost of goods sold are variable costs and 40% of selling and administrative expenses are variable costs. Judy also feels it can save $45,000 of fixed cost of goods sold and $50,000 of fixed selling expenses if it discontinues operation of the Division. Required: a) Prepare an incremental analysis in a CVP Income Statement format to show whether Judy is right about discontinuing the DIY Division. b) If the company had discontinued the division for 2022, determine what net income would have been. 10 Marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started