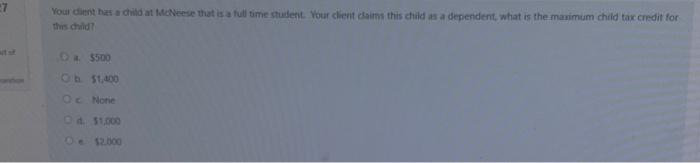

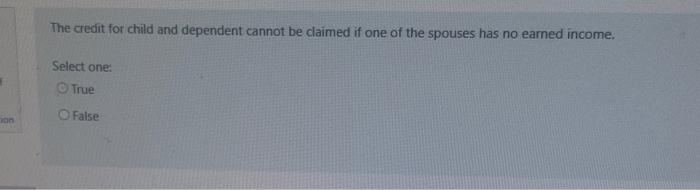

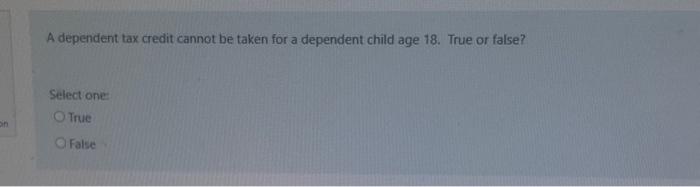

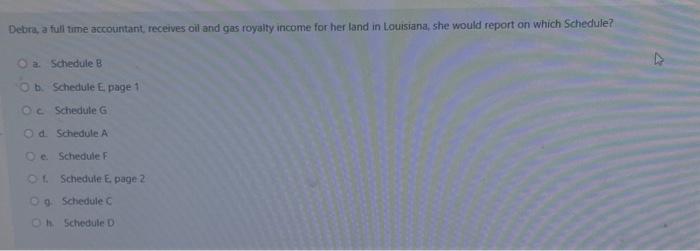

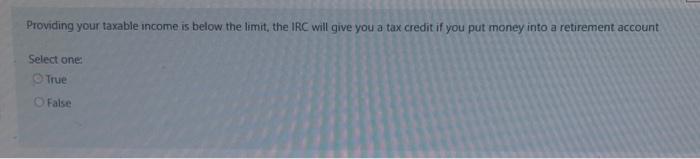

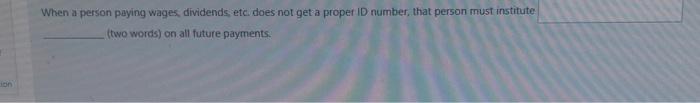

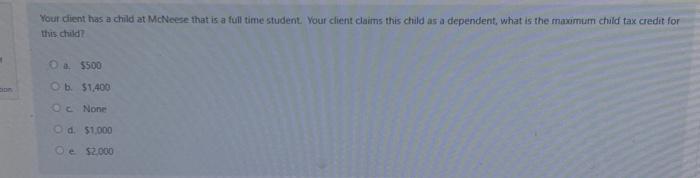

Deductions are better than credits if they are the same dollar amount. Select one: True False Debra, a full time accountant, receives oil and gas toyalty income for her land in Louisiana, she would report on which Schedule? a. Schedule B b. Schedule E page 1 c: Schedule G d. Schedule A e. Schedule F 1. Schedule f, poge: 2 9. Schedule C h. Schedule D 7 Whan a person paying wages, dividendx etc does not get a proper ID number, that person must institute tweo words) on all future psytnents. Your dient hat a dild at MaNeese that is a full time stuident. Your client chims this child as a dependent, what is the manimum child tax credit for this chald? 1. 590 k. 51,000 Wioric d. 11,000 e 12000 The credit for child and dependent cannot be claimed if one of the spouses has no earned income. Select one: True False A dependent tax credit cannot be taken for a dependent child age 18. True or false? Selectione: True False Deductions are better than credits if they are the same dollar amount. Select one: True False Debra, a full time accountant, receives oil and gas royaity income for her land in Louisiana, she would report on which Schedule? a. Schedule 8 b. Schedule Ei page 1 c Schedule G a. Schedule A e. Schedule F 6. Schedule E, page? 9. Schedule C 14. Sehedule D Providing your taxable income is below the limit, the IRC will give you a tax credit if you put money into a retirement account Select one: Irue False When a person paying wages, dividends, etci does not get a propet ID number, that person must institute. (two words) on all future payments. Your ciient has a child at McNeese that is a full time student. Your client claims this child as a dependent, what is the maximum chuld tax credit for this chuid? a. 5500 b. 51,400 Ic None d. 51,000 le $2,000 The credit for child and dependent cannot be claimed if one of the spouses has no earned income. Select one: True False A dependent tax credit cannot be taken for a dependent child age 18. True or false? Select one: True False Deductions are better than credits if they are the same dollar amount. Select one: True False Debra, a full time accountant, receives oil and gas toyalty income for her land in Louisiana, she would report on which Schedule? a. Schedule B b. Schedule E page 1 c: Schedule G d. Schedule A e. Schedule F 1. Schedule f, poge: 2 9. Schedule C h. Schedule D 7 Whan a person paying wages, dividendx etc does not get a proper ID number, that person must institute tweo words) on all future psytnents. Your dient hat a dild at MaNeese that is a full time stuident. Your client chims this child as a dependent, what is the manimum child tax credit for this chald? 1. 590 k. 51,000 Wioric d. 11,000 e 12000 The credit for child and dependent cannot be claimed if one of the spouses has no earned income. Select one: True False A dependent tax credit cannot be taken for a dependent child age 18. True or false? Selectione: True False Deductions are better than credits if they are the same dollar amount. Select one: True False Debra, a full time accountant, receives oil and gas royaity income for her land in Louisiana, she would report on which Schedule? a. Schedule 8 b. Schedule Ei page 1 c Schedule G a. Schedule A e. Schedule F 6. Schedule E, page? 9. Schedule C 14. Sehedule D Providing your taxable income is below the limit, the IRC will give you a tax credit if you put money into a retirement account Select one: Irue False When a person paying wages, dividends, etci does not get a propet ID number, that person must institute. (two words) on all future payments. Your ciient has a child at McNeese that is a full time student. Your client claims this child as a dependent, what is the maximum chuld tax credit for this chuid? a. 5500 b. 51,400 Ic None d. 51,000 le $2,000 The credit for child and dependent cannot be claimed if one of the spouses has no earned income. Select one: True False A dependent tax credit cannot be taken for a dependent child age 18. True or false? Select one: True False