Answered step by step

Verified Expert Solution

Question

1 Approved Answer

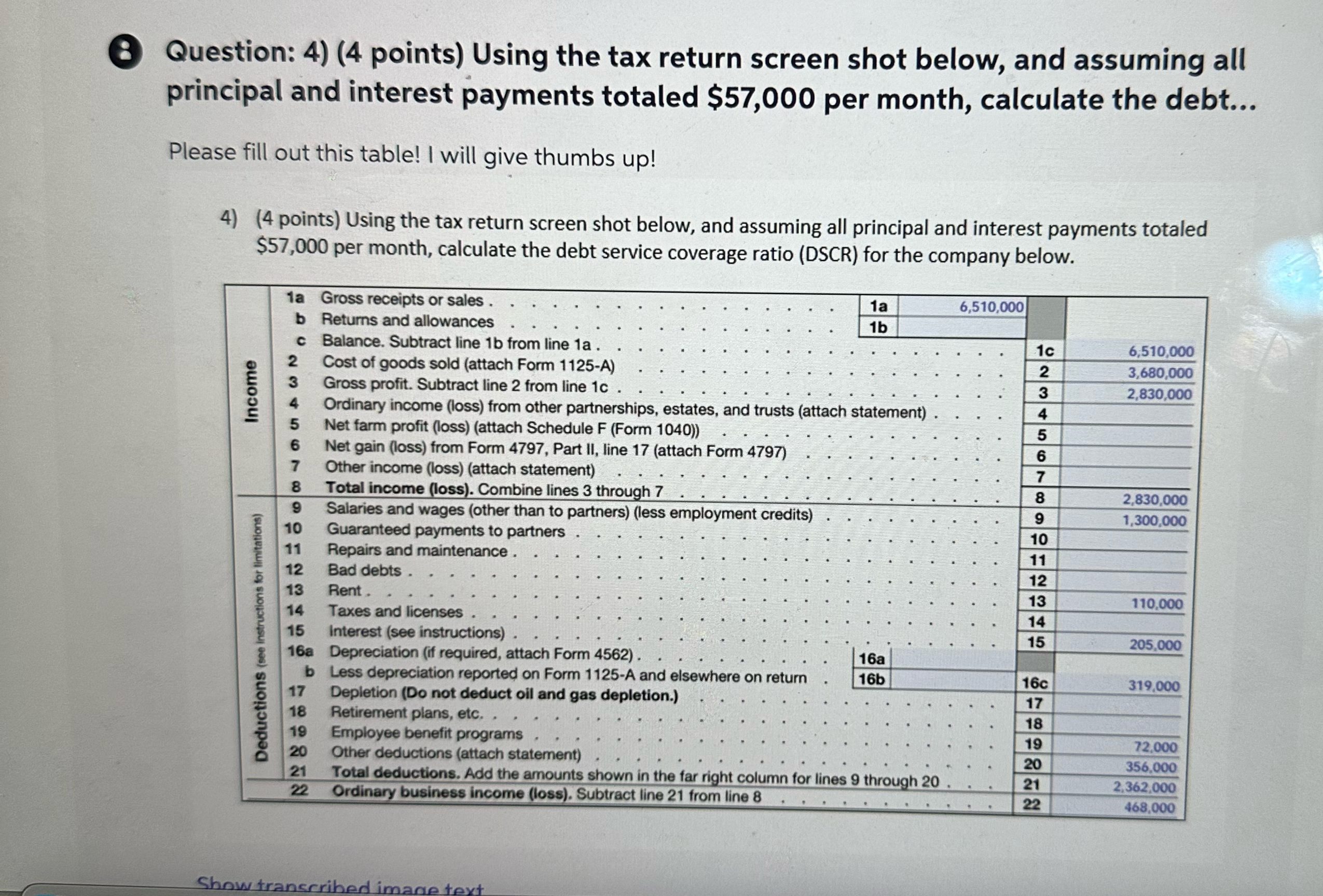

Deductions (see instructions for limitations) Income Question: 4) (4 points) Using the tax return screen shot below, and assuming all principal and interest payments

Deductions (see instructions for limitations) Income Question: 4) (4 points) Using the tax return screen shot below, and assuming all principal and interest payments totaled $57,000 per month, calculate the debt... Please fill out this table! I will give thumbs up! 4) (4 points) Using the tax return screen shot below, and assuming all principal and interest payments totaled $57,000 per month, calculate the debt service coverage ratio (DSCR) for the company below. 1a Gross receipts or sales. b Returns and allowances C Balance. Subtract line 1b from line 1a. 2 Cost of goods sold (attach Form 1125-A) 1a 6,510,000 1b 4 3 Gross profit. Subtract line 2 from line 1c. Ordinary income (loss) from other partnerships, estates, and trusts (attach statement) 5 Net farm profit (loss) (attach Schedule F (Form 1040)) 6 Net gain (loss) from Form 4797, Part II, line 17 (attach Form 4797) 7 Other income (loss) (attach statement) 8 Total income (loss). Combine lines 3 through 7 9 Salaries and wages (other than to partners) (less employment credits) 23456789 1c 6,510,000 3,680,000 2,830,000 2,830,000 1,300,000 10 11 Guaranteed payments to partners Repairs and maintenance. 10 11 12 Bad debts. 12 13 Rent. 13 110,000 14 Taxes and licenses 14 15 Interest (see instructions). 15 205,000 16a Depreciation (if required, attach Form 4562). 16a b 17 Less depreciation reported on Form 1125-A and elsewhere on return Depletion (Do not deduct oil and gas depletion.) 16b 16c 319,000 17 18 Retirement plans, etc. 18 19 Employee benefit programs 19 72,000 20 Other deductions (attach statement) 20 356,000 21 22 Total deductions. Add the amounts shown in the far right column for lines 9 through 20 Ordinary business income (loss). Subtract line 21 from line 8 21 . 2,362,000 22 . 468,000 Show transcribed image text

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started