Answered step by step

Verified Expert Solution

Question

1 Approved Answer

DeeDee Double Entry, Incorporated creates accounting games and literature to enhance accounting education and financial literacy. Their business has been quite successful since their

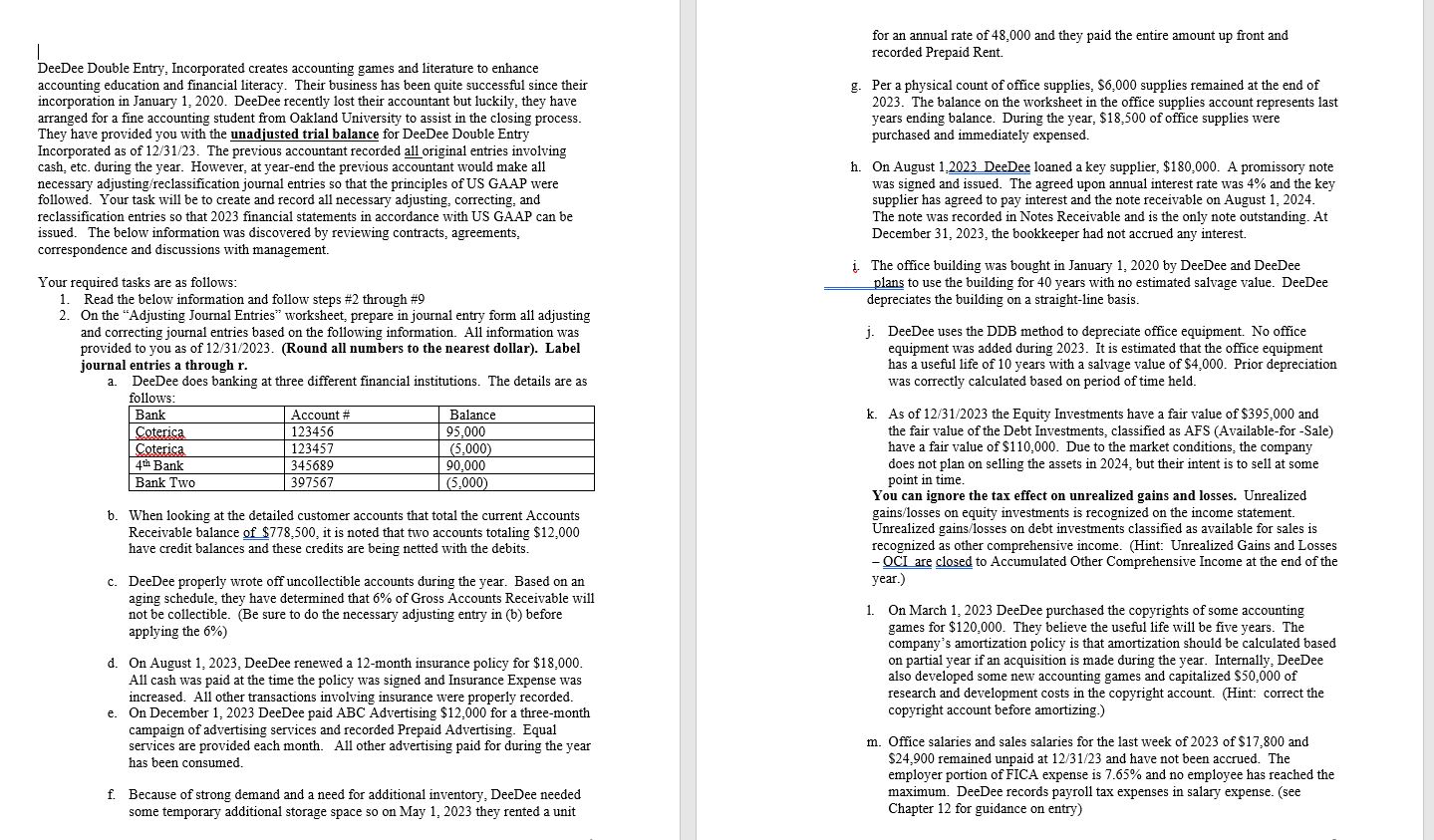

DeeDee Double Entry, Incorporated creates accounting games and literature to enhance accounting education and financial literacy. Their business has been quite successful since their incorporation in January 1, 2020. DeeDee recently lost their accountant but luckily, they have arranged for a fine accounting student from Oakland University to assist in the closing process. They have provided you with the unadjusted trial balance for DeeDee Double Entry Incorporated as of 12/31/23. The previous accountant recorded all original entries involving cash, etc. during the year. However, at year-end the previous accountant would make all necessary adjusting/reclassification journal entries so that the principles of US GAAP were followed. Your task will be to create and record all necessary adjusting, correcting, and reclassification entries so that 2023 financial statements in accordance with US GAAP can be issued. The below information was discovered by reviewing contracts, agreements, correspondence and discussions with management. Your required tasks are as follows: 1. Read the below information and follow steps #2 through #9 2. On the "Adjusting Journal Entries" worksheet, prepare in journal entry form all adjusting and correcting journal entries based on the following information. All information was provided to you as of 12/31/2023. (Round all numbers to the nearest dollar). Label journal entries a through r. a. DeeDee does banking at three different financial institutions. The details are as follows: Bank Coterica Coterica 4th Bank Bank Two Account # 123456 123457 345689 397567 Balance 95,000 (5,000) 90,000 (5,000) b. When looking at the detailed customer accounts that total the current Accounts Receivable balance of $778,500, it is noted that two accounts totaling $12,000 have credit balances and these credits are being netted with the debits. c. DeeDee properly wrote off uncollectible accounts during the year. Based on an aging schedule, they have determined that 6% of Gross Accounts Receivable will not be collectible. (Be sure to do the necessary adjusting entry in (b) before applying the 6%) d. On August 1, 2023, DeeDee renewed a 12-month insurance policy for $18,000. All cash was paid at the time the policy was signed and Insurance Expense was increased. All other transactions involving insurance were properly recorded. e. On December 1, 2023 DeeDee paid ABC Advertising $12,000 for a three-month campaign of advertising services and recorded Prepaid Advertising. Equal services are provided each month. All other advertising paid for during the year has been consumed. f. Because of strong demand and a need for additional inventory, DeeDee needed some temporary additional storage space so on May 1, 2023 they rented a unit for an annual rate of 48,000 and they paid the entire amount up front and recorded Prepaid Rent. g. Per a physical count of office supplies, $6,000 supplies remained at the end of 2023. The balance on the worksheet in the office supplies account represents last years ending balance. During the year, $18,500 of office supplies were purchased and immediately expensed. h. On August 1.2023 DeeDee loaned a key supplier, $180,000. A promissory note was signed and issued. The agreed upon annual interest rate was 4% and the key supplier has agreed to pay interest and the note receivable on August 1, 2024. The note was recorded in Notes Receivable and is the only note outstanding. At December 31, 2023, the bookkeeper had not accrued any interest. . The office building was bought in January 1, 2020 by DeeDee and DeeDee plans to use the building for 40 years with no estimated salvage value. DeeDee depreciates the building on a straight-line basis. j. DeeDee uses the DDB method to depreciate office equipment. No office equipment was added during 2023. It is estimated that the office equipment has a useful life of 10 years with a salvage value of $4,000. Prior depreciation was correctly calculated based on period of time held. k. As of 12/31/2023 the Equity Investments have a fair value of $395,000 and the fair value of the Debt Investments, classified as AFS (Available-for-Sale) have a fair value of $110,000. Due to the market conditions, the company does not plan on selling the assets in 2024, but their intent is to sell at some point in time. You can ignore the tax effect on unrealized gains and losses. Unrealized gains/losses on equity investments is recognized on the income statement. Unrealized gains/losses on debt investments classified as available for sales is recognized as other comprehensive income. (Hint: Unrealized Gains and Losses - OCI are closed to Accumulated Other Comprehensive Income at the end of the year.) 1. On March 1, 2023 DeeDee purchased the copyrights of some accounting games for $120,000. They believe the useful life will be five years. The company's amortization policy is that amortization should be calculated based on partial year if an acquisition is made during the year. Internally, DeeDee also developed some new accounting games and capitalized $50,000 of research and development costs in the copyright account. (Hint: correct the copyright account before amortizing.) m. Office salaries and sales salaries for the last week of 2023 of $17,800 and $24,900 remained unpaid at 12/31/23 and have not been accrued. The employer portion of FICA expense is 7.65% and no employee has reached the maximum. DeeDee records payroll tax expenses in salary expense. (see Chapter 12 for guidance on entry)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started