Question

Deferred expenses (aka Prepayments): cash is paid before the expense is incurred. Happens when: 1) firm prepays for future goods or service and 2)

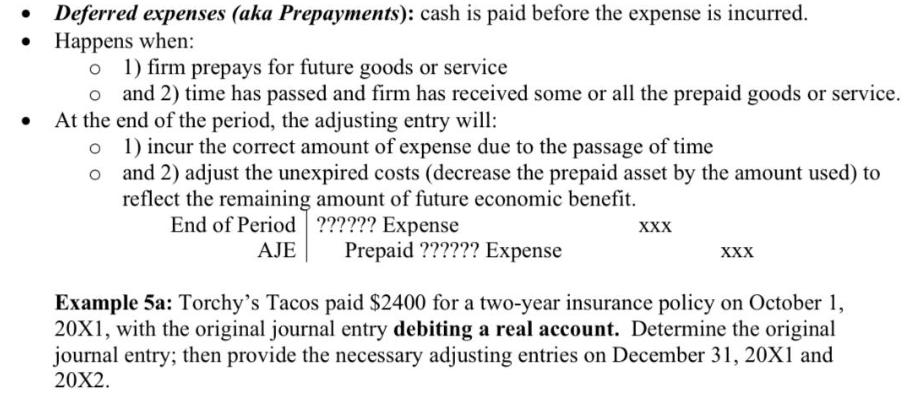

Deferred expenses (aka Prepayments): cash is paid before the expense is incurred. Happens when: 1) firm prepays for future goods or service and 2) time has passed and firm has received some or all the prepaid goods or service. At the end of the period, the adjusting entry will: 1) incur the correct amount of expense due to the passage of time and 2) adjust the unexpired costs (decrease the prepaid asset by the amount used) to reflect the remaining amount of future economic benefit. End of Period AJE ?????? Expense Prepaid ?????? Expense XXX XXX Example 5a: Torchy's Tacos paid $2400 for a two-year insurance policy on October 1, 20X1, with the original journal entry debiting a real account. Determine the original journal entry; then provide the necessary adjusting entries on December 31, 20X1 and 20X2.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial ACCT2

Authors: Norman H. Godwin, C. Wayne Alderman

2nd edition

9781285632544, 1111530769, 1285632540, 978-1111530761

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App