Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Deferred Perpetuity and Selling Price Carrie will receive her grandfather's farm when he dies. The farm is expected to earn $ 9 5 0 ,

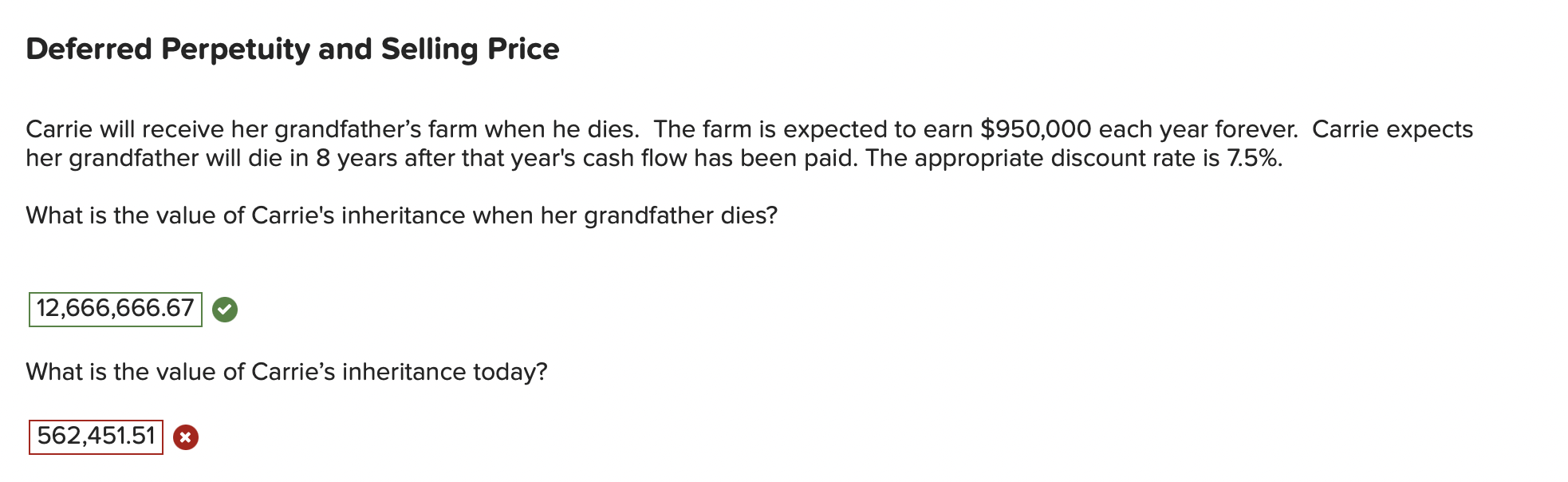

Deferred Perpetuity and Selling Price

Carrie will receive her grandfather's farm when he dies. The farm is expected to earn $ each year forever. Carrie expects

her grandfather will die in years after that year's cash flow has been paid. The appropriate discount rate is

What is the value of Carrie's inheritance when her grandfather dies?

What is the value of Carrie's inheritance today?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started