Answered step by step

Verified Expert Solution

Question

1 Approved Answer

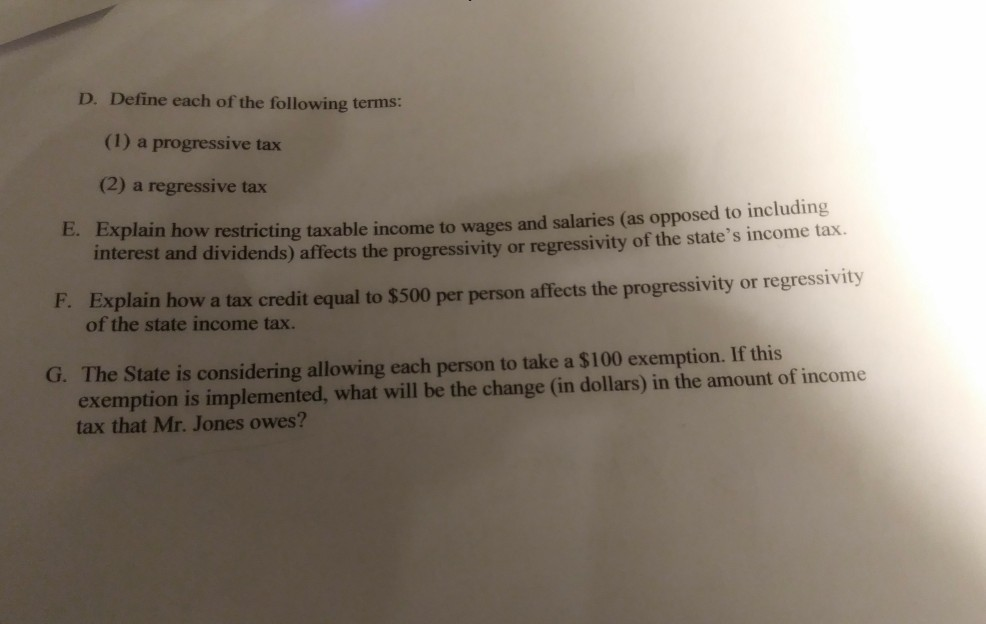

Define each of the following terms: (1) a progressive tax (2) a regressive tax D. E. Explain how restricting taxable income to wages and salaries

Define each of the following terms: (1) a progressive tax (2) a regressive tax D. E. Explain how restricting taxable income to wages and salaries (as opposed to including F. Explain how a tax credit equal to $500 per person affects the progressivity or regressivity G. The State is considering allowing each person to take a $100 exemption. If this interest and dividends) affects the progressivity or regressivity of the state's income tax of the state income tax. exemption is implemented, what will be the change (in dollars) in the amount of income tax that Mr. Jones owes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started