Answered step by step

Verified Expert Solution

Question

1 Approved Answer

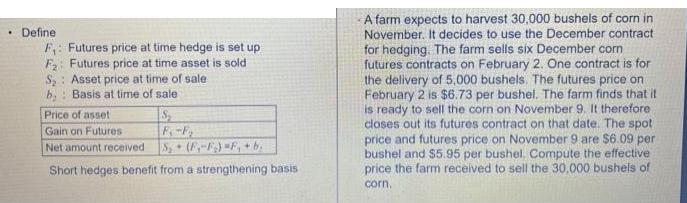

Define F: Futures price at time hedge is set up F2: Futures price at time asset is sold S: Asset price at time of

Define F: Futures price at time hedge is set up F2: Futures price at time asset is sold S: Asset price at time of sale b. Basis at time of sale Price of asset Gain on Futures Net amount received $ F-F S (F-F) F, + b Short hedges benefit from a strengthening basis A farm expects to harvest 30,000 bushels of corn in November. It decides to use the December contract for hedging. The farm sells six December corn futures contracts on February 2. One contract is for the delivery of 5,000 bushels. The futures price on February 2 is $6.73 per bushel. The farm finds that it is ready to sell the corn on November 9. It therefore closes out its futures contract on that date. The spot price and futures price on November 9 are $6.09 per bushel and $5.95 per bushel Compute the effective price the farm received to sell the 30,000 bushels of corn.

Step by Step Solution

★★★★★

3.43 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION F Futures price at time hedge is set up F2 Futures price at time asset is sold S Spot ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started