Answered step by step

Verified Expert Solution

Question

1 Approved Answer

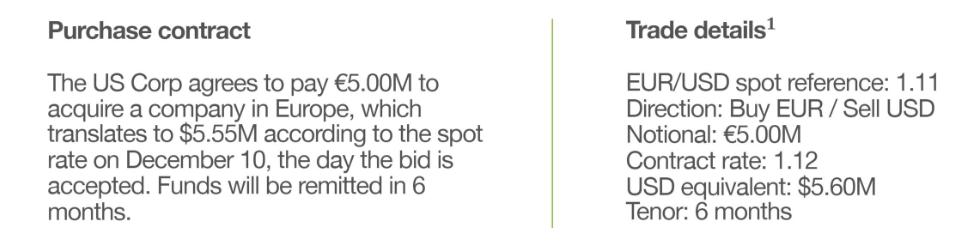

Define the option you will add to the forward explicitly (i.e. what are critical details of the option). What will you call the combined

Define the option you will add to the forward explicitly (i.e. what are critical details of the option). What will you call the combined product? Assume that the "cost" of the option is $200,000. This is one critical detail, you need 4 more. Describe how the the product works, in other words, assume spot rate ends at 1.00 or 1.20. What would happen under 3 different strategies: 1) Do nothing, 2) Execute forward only, 3) Execute your derivative creation. Summarize your analysis and findings in a memo aimed at professional audience (i.e. assume you are a trader at a bank, and you are seeking new product approval from the Head of Trading to be able to offer this product. Purchase contract The US Corp agrees to pay 5.00M to acquire a company in Europe, which translates to $5.55M according to the spot rate on December 10, the day the bid is accepted. Funds will be remitted in 6 months. Trade details EUR/USD spot reference: 1.11 Direction: Buy EUR/ Sell USD Notional: 5.00M Contract rate: 1.12 USD equivalent: $5.60M Tenor: 6 months

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Option Details Option Type Call Option Strike Price 110 Below the spot rate of 111 Expiration Date 6 months from the trade date Premium Cost 200000 Co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started