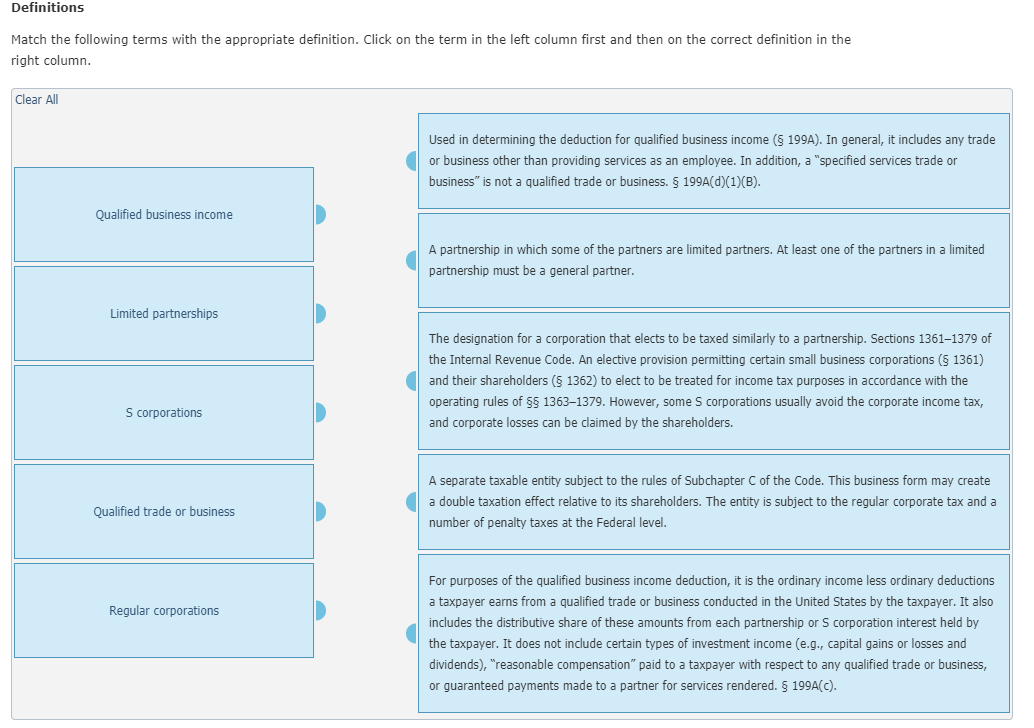

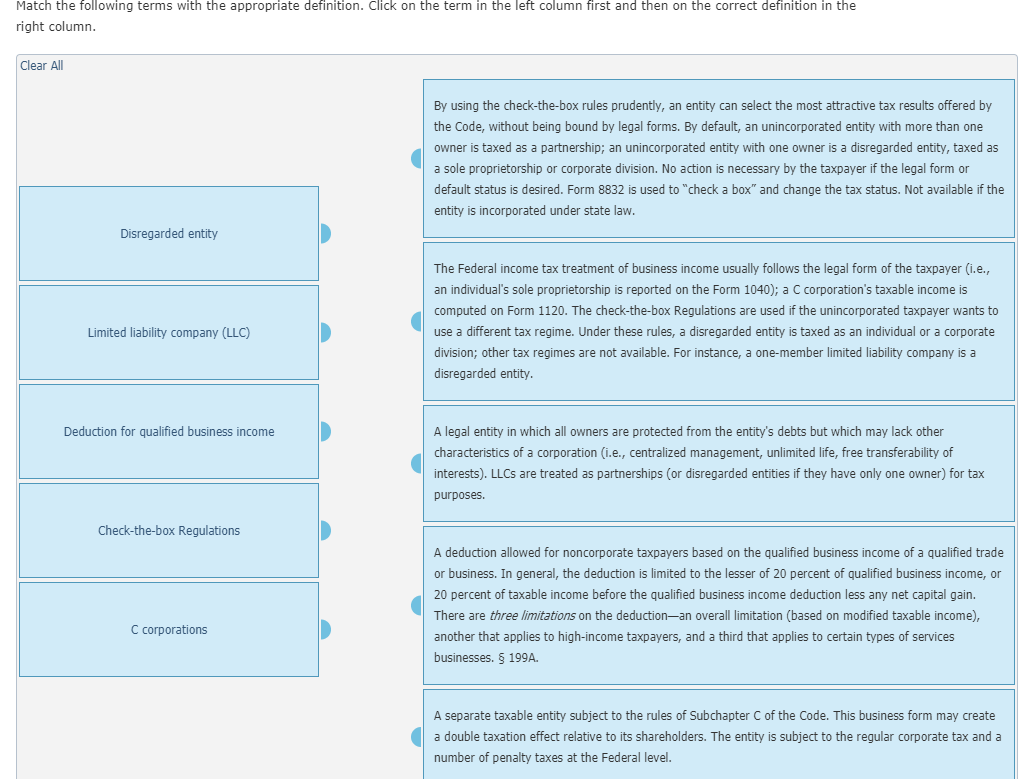

Definitions Match the following terms with the appropriate definition. Click on the term in the left column first and then on the correct definition in the right column. Clear All Used in determining the deduction for qualified business income ( 199A). In general, it includes any trade or business other than providing services as an employee. In addition, a "specified services trade or business" is not a qualified trade or business. 199A(d)(1)(B). Qualified business income A partnership in which some of the partners are limited partners. At least one of the partners in a limited partnership must be a general partner. Limited partnerships The designation for a corporation that elects to be taxed similarly to a partnership. Sections 1361-1379 of the Internal Revenue Code. An elective provision permitting certain small business corporations ( 1361) and their shareholders ($ 1362) to elect to be treated for income tax purposes in accordance with the operating rules of $5 13631379. However, some s corporations usually avoid the corporate income tax, and corporate losses can be claimed by the shareholders. S corporations A separate taxable entity subject to the rules of Subchapter C of the Code. This business form may create a double taxation effect relative to its shareholders. The entity is subject to the regular corporate tax and a number of penalty taxes at the Federal level. Qualified trade or business Regular corporations For purposes of the qualified business income deduction, it is the ordinary income less ordinary deductions a taxpayer earns from a qualified trade or business conducted in the United States by the taxpayer. It also includes the distributive share of these amounts from each partnership or s corporation interest held by the taxpayer. It does not include certain types of investment income (e.g., capital gains or losses and dividends), "reasonable compensation" paid to a taxpayer with respect to any qualified trade or business, or guaranteed payments made to a partner for services rendered. $ 199A(C). Match the following terms with the appropriate definition. Click on the term in the left column first and then on the correct definition in the right column. Clear All By using the check-the-box rules prudently, an entity can select the most attractive tax results offered by the Code, without being bound by legal forms. By default, an unincorporated entity with more than one owner is taxed as a partnership; an unincorporated entity with one owner is a disregarded entity, taxed as a sole proprietorship or corporate division. No action is necessary by the taxpayer if the legal form or default status is desired. Form 8832 is used to check a box" and change the tax status. Not available if the entity is incorporated under state law. Disregarded entity The Federal income tax treatment of business income usually follows the legal form of the taxpayer (i.e., an individual's sole proprietorship is reported on the Form 1040); a C corporation's taxable income is computed on Form 1120. The check-the-box Regulations are used if the unincorporated taxpayer wants to use a different tax regime. Under these rules, a disregarded entity is taxed as an individual or a corporate division; other tax regimes are not available. For instance, a one-member limited liability company is a disregarded entity. Limited liability company (LLC) Deduction for qualified business income A legal entity in which all owners are protected from the entity's debts but which may lack other characteristics of a corporation (i.e., centralized management, unlimited life, free transferability of interests). LLCs are treated as partnerships (or disregarded entities if they have only one owner) for tax purposes. Check-the-box Regulations A deduction allowed for noncorporate taxpayers based on the qualified business income of a qualified trade or business. In general, the deduction is limited to the lesser of 20 percent of qualified business income, or 20 percent of taxable income before the qualified business income deduction less any net capital gain. There are three limitations on the deduction-an overall limitation (based on modified taxable income), another that applies to high-income taxpayers, and a third that applies to certain types of services businesses. $ 199A. C corporations A separate taxable entity subject to the rules of Subchapter C of the Code. This business form may create a double taxation effect relative to its shareholders. The entity is subject to the regular corporate tax and a number of penalty taxes at the Federal level