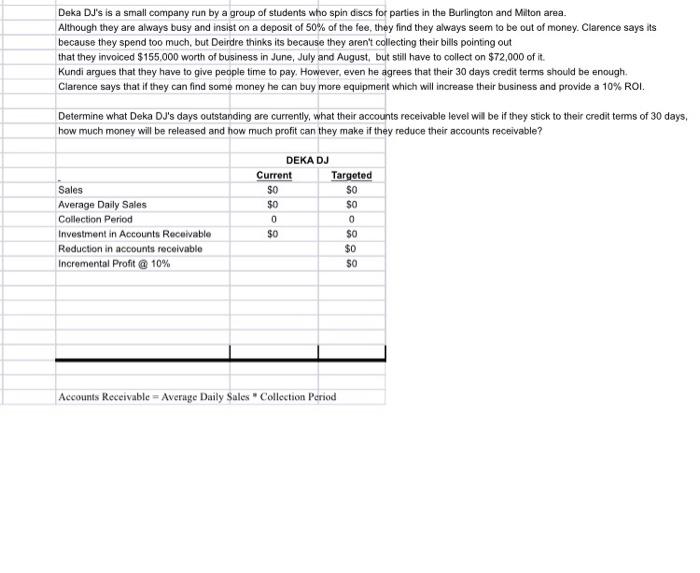

Deka DJ's is a small company run by a group of students who spin discs for parties in the Burlington and Milton area. Although they are always busy and insist on a deposit of 50% of the fee, they find they always seem to be out of money. Clarence says its because they spend too much, but Deirdre thinks its because they aren't collecting their bills pointing out that they invoiced $155.000 worth of business in June, July and August, but still have to collect on $72,000 of it. Kundi argues that they have to give people time to pay. However, even he agrees that their 30 days credit terms should be enough. Clarence says that if they can find some money he can buy more equipment which will increase their business and provide a 10% ROI. Determine what Deka DJ's days outstanding are currently, what their accounts receivable level will be if they stick to their credit terms of 30 days, how much money will be released and how much profit can they make if they reduce their accounts receivable? DEKA DJ Current Targeted SO SO Average Daily Sales $0 SO Collection Period Investment in Accounts Receivable SO SO Reduction in accounts receivable $0 Incremental Profit @ 10% $0 Sales 0 0 Accounts Receivable Average Daily Sales Collection Period Deka DJ's is a small company run by a group of students who spin discs for parties in the Burlington and Milton area. Although they are always busy and insist on a deposit of 50% of the fee, they find they always seem to be out of money. Clarence says its because they spend too much, but Deirdre thinks its because they aren't collecting their bills pointing out that they invoiced $155.000 worth of business in June, July and August, but still have to collect on $72,000 of it. Kundi argues that they have to give people time to pay. However, even he agrees that their 30 days credit terms should be enough. Clarence says that if they can find some money he can buy more equipment which will increase their business and provide a 10% ROI. Determine what Deka DJ's days outstanding are currently, what their accounts receivable level will be if they stick to their credit terms of 30 days, how much money will be released and how much profit can they make if they reduce their accounts receivable? DEKA DJ Current Targeted SO SO Average Daily Sales $0 SO Collection Period Investment in Accounts Receivable SO SO Reduction in accounts receivable $0 Incremental Profit @ 10% $0 Sales 0 0 Accounts Receivable Average Daily Sales Collection Period