Question: Del Arbr Ltd (hereafter referred to as DA) is a property development company listed on the JSE. The company was founded by Mr Labuschagne

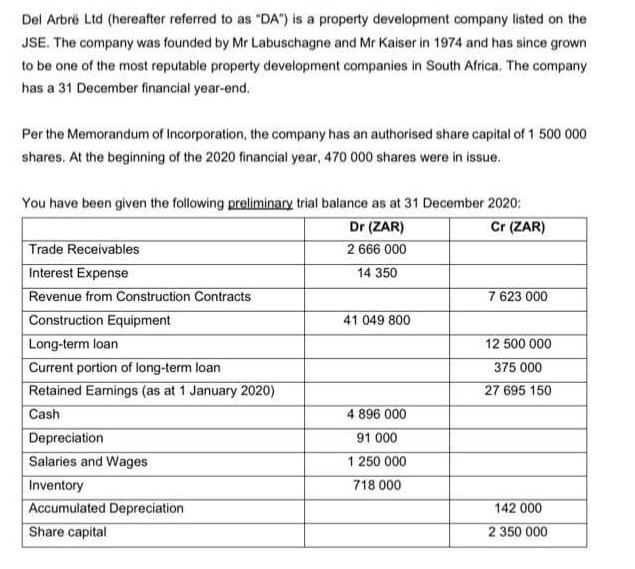

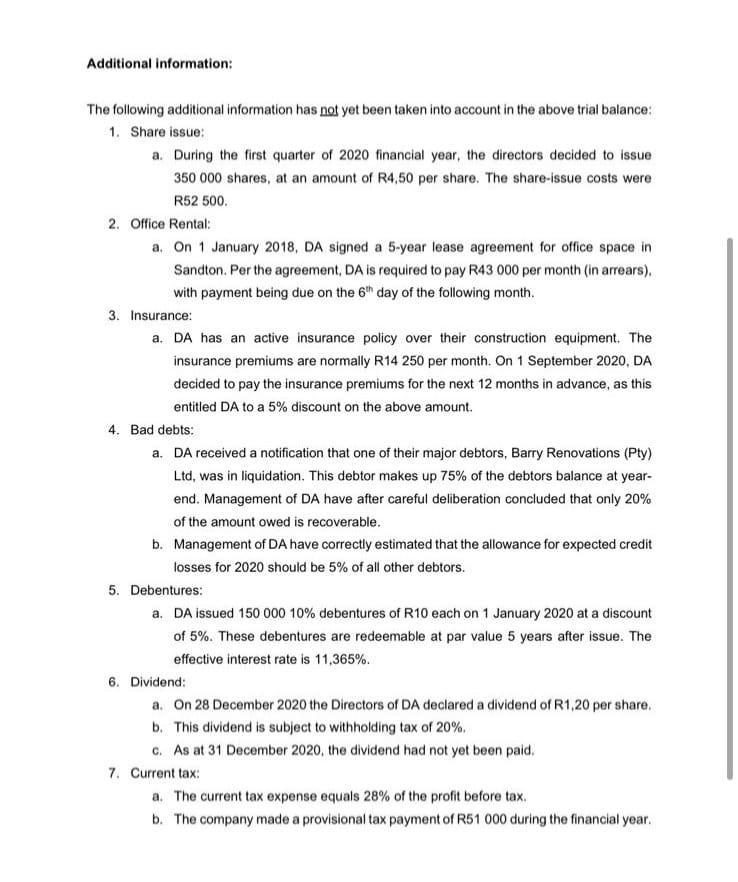

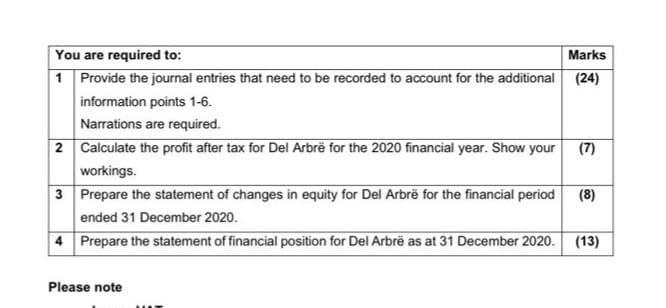

Del Arbr Ltd (hereafter referred to as "DA") is a property development company listed on the JSE. The company was founded by Mr Labuschagne and Mr Kaiser in 1974 and has since grown to be one of the most reputable property development companies in South Africa. The company has a 31 December financial year-end. Per the Memorandum of Incorporation, the company has an authorised share capital of 1 500 000 shares. At the beginning of the 2020 financial year, 470 000 shares were in issue. You have been given the following preliminary trial balance as at 31 December 2020: Dr (ZAR) Cr (ZAR) Trade Receivables Interest Expense 2 666 000 14 350 Revenue from Construction Contracts Construction Equipment 7 623 000 41 049 800 Long-term loan 12 500 000 Current portion of long-term loan 375 000 Retained Earnings (as at 1 January 2020) 27 695 150 Cash 4 896 000 Depreciation 91 000 Salaries and Wages 1 250 000 Inventory 718 000 Accumulated Depreciation Share capital 142 000 2 350 000 Additional information: The following additional information has not yet been taken into account in the above trial balance: 1. Share issue: a. During the first quarter of 2020 financial year, the directors decided to issue 350 000 shares, at an amount of R4,50 per share. The share-issue costs were R52 500. 2. Office Rental: a. On 1 January 2018, DA signed a 5-year lease agreement for office space in Sandton. Per the agreement, DA is required to pay R43 000 per month (in arrears), with payment being due on the 6th day of the following month. 3. Insurance: a. DA has an active insurance policy over their construction equipment. The insurance premiums are normally R14 250 per month. On 1 September 2020, DA decided to pay the insurance premiums for the next 12 months in advance, as this entitled DA to a 5% discount on the above amount. 4. Bad debts: a. DA received a notification that one of their major debtors, Barry Renovations (Pty) Ltd, was in liquidation. This debtor makes up 75% of the debtors balance at year- end. Management of DA have after careful deliberation concluded that only 20% of the amount owed is recoverable. b. Management of DA have correctly estimated that the allowance for expected credit losses for 2020 should be 5% of all other debtors. 5. Debentures: a. DA issued 150 000 10% debentures of R10 each on 1 January 2020 at a discount of 5%. These debentures are redeemable at par value 5 years after issue. The effective interest rate is 11,365%. 6. Dividend: a. On 28 December 2020 the Directors of DA declared a dividend of R1,20 per share. b. This dividend is subject to withholding tax of 20%. c. As at 31 December 2020, the dividend had not yet been paid. 7. Current tax: a. The current tax expense equals 28% of the profit before tax. b. The company made a provisional tax payment of R51 000 during the financial year. You are required to: Marks 1 Provide the journal entries that need to be recorded to account for the additional (24) information points 1-6. Narrations are required. 2 Calculate the profit after tax for Del Arbr for the 2020 financial year. Show your (7) workings. 3 Prepare the statement of changes in equity for Del Arbr for the financial period (8) ended 31 December 2020. 4 Prepare the statement of financial position for Del Arbr as at 31 December 2020. (13) Please note

Step by Step Solution

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Requirement 1 Additional journal entries 1 additional issuance of shares Cash R 1522500 Share PremiumDiscount R 227500 Share Capital R 1750000 2 rent in arrears Rent Expense R 516000 Retained Earnings ... View full answer

Get step-by-step solutions from verified subject matter experts