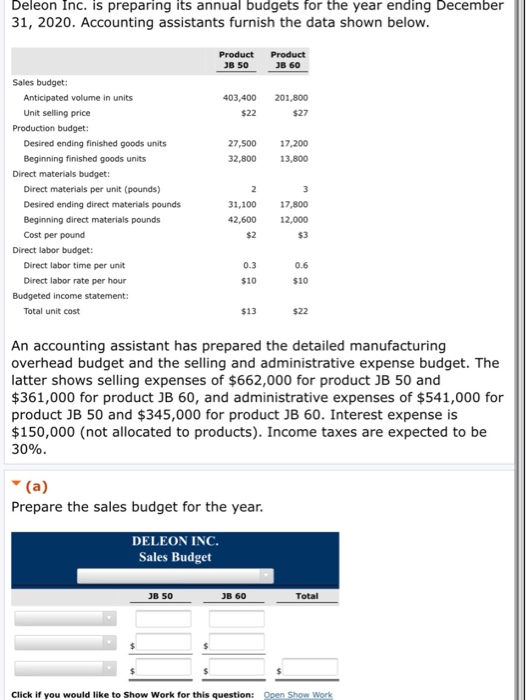

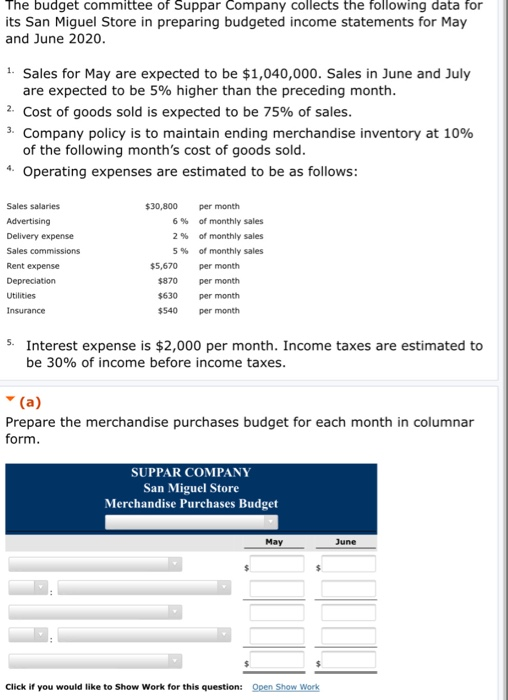

Deleon Inc. is preparing its annual budgets for the year ending December 31, 2020. Accounting assistants furnish the data shown below. Product JB 50 Product JB 60 403,400 $22 201,800 $27 27,500 32,800 17,200 13,800 Sales budget: Anticipated volume in units Unit selling price Production budget: Desired ending finished goods units Beginning finished goods units Direct materials budget: Direct materials per unit (pounds) Desired ending direct materials pounds Beginning direct materials pounds Cost per pound Direct labor budget: Direct labor time per unit Direct labor rate per hour Budgeted income statement: Total unit cost 2 31,100 42,600 $2 3 17,800 12,000 $3 0.3 0.6 $10 $10 $13 $22 An accounting assistant has prepared the detailed manufacturing overhead budget and the selling and administrative expense budget. The latter shows selling expenses of $662,000 for product JB 50 and $361,000 for product JB 60, and administrative expenses of $541,000 for product JB 50 and $345,000 for product JB 60. Interest expense is $150,000 (not allocated to products). Income taxes are expected to be 30%. (a) Prepare the sales budget for the year. DELEON INC. Sales Budget JB 50 JB 60 Total Click if you would like to show Work for this question: Open Show Work The budget committee of Suppar Company collects the following data for its San Miguel Store in preparing budgeted income statements for May and June 2020. 1. Sales for May are expected to be $1,040,000. Sales in June and July are expected to be 5% higher than the preceding month. 2. Cost of goods sold is expected to be 75% of sales. 3. Company policy is to maintain ending merchandise inventory at 10% of the following month's cost of goods sold. * Operating expenses are estimated to be as follows: Sales salaries Advertising Delivery expense Sales commissions Rent expense Depreciation Utilities Insurance $30,800 per month 6% of monthly sales 2% of monthly sales 5% of monthly sales $5,670 per month $870 per month $630 per month $540 per month 5. Interest expense is $2,000 per month. Income taxes are estimated to be 30% of income before income taxes. (a) Prepare the merchandise purchases budget for each month in columnar form. SUPPAR COMPANY San Miguel Store Merchandise Purchases Budget May June Click if you would like to show Work for this question: Open Show Work