Answered step by step

Verified Expert Solution

Question

1 Approved Answer

delete this already solved this Question 2 Consider this problem from last week's LRP. Consider two stocks with returns modeled as independent random exponential variables

delete this already solved this

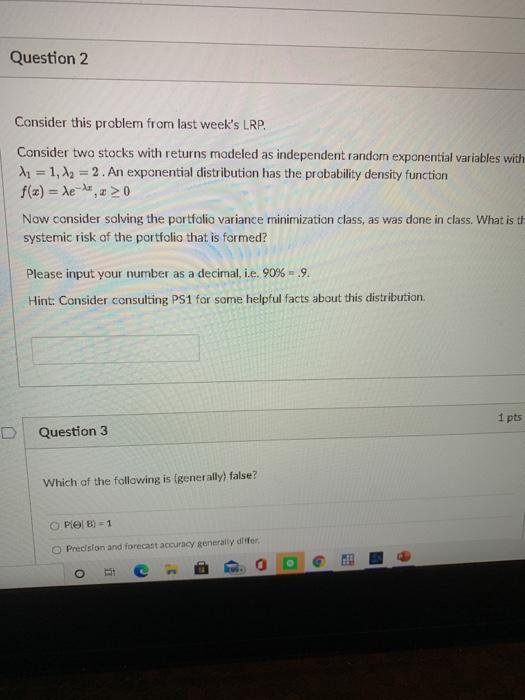

Question 2 Consider this problem from last week's LRP. Consider two stocks with returns modeled as independent random exponential variables with X = 1, y = 2. An exponential distribution has the probability density function f(x) = de- , > 0 Now consider solving the portfolio variance minimization class, as was done in class. What is th systemic risk of the portfolio that is formed? Please input your number as a decimal, i.e. 90% = 9. Hint: Consider consulting PS1 for some helpful facts about this distribution 1 pts Question 3 Which of the following is (generally) false? Ple B) - 1 O Precision and forecast accuracy generally differ O G c Question 2 Consider this problem from last week's LRP. Consider two stocks with returns modeled as independent random exponential variables with X = 1, y = 2. An exponential distribution has the probability density function f(x) = de- , > 0 Now consider solving the portfolio variance minimization class, as was done in class. What is th systemic risk of the portfolio that is formed? Please input your number as a decimal, i.e. 90% = 9. Hint: Consider consulting PS1 for some helpful facts about this distribution 1 pts Question 3 Which of the following is (generally) false? Ple B) - 1 O Precision and forecast accuracy generally differ O G c Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started