Answered step by step

Verified Expert Solution

Question

1 Approved Answer

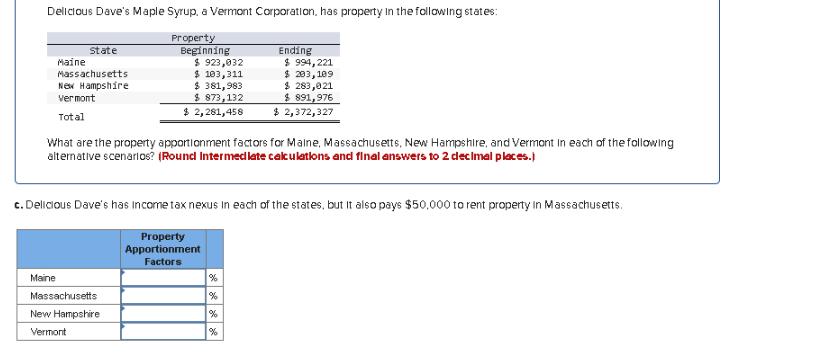

Delicious Dave's Maple Syrup, a Vermont Corporation, has property in the following states: Property Beginning Maine State Massachusetts New Hampshire Vermont Total $ 923,032

Delicious Dave's Maple Syrup, a Vermont Corporation, has property in the following states: Property Beginning Maine State Massachusetts New Hampshire Vermont Total $ 923,032 $ 103,311 $ 381,983 $ 873,132 $ 2,281,458 Ending $ 994,221 $203,109 $283,021 $ 891,976 $ 2,372,327 What are the property apportionment factors for Maine, Massachusetts, New Hampshire, and Vermont In each of the following alternative scenarios? (Round Intermed late calculations and final answers to 2 decimal places.) c. Delicious Dave's has income tax nexus in each of the states, but it also pays $50,000 to rent property in Massachusetts. Maine Massachusetts New Hampshire Vermont Property Apportionment Factors % % % %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the property apportionment factors for each state we need to calculate the percentage o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started