Question

Delicious Snacks, Inc. is considering adding a new line of candies to its current product line. The company already paid $500,000 for a marketing research

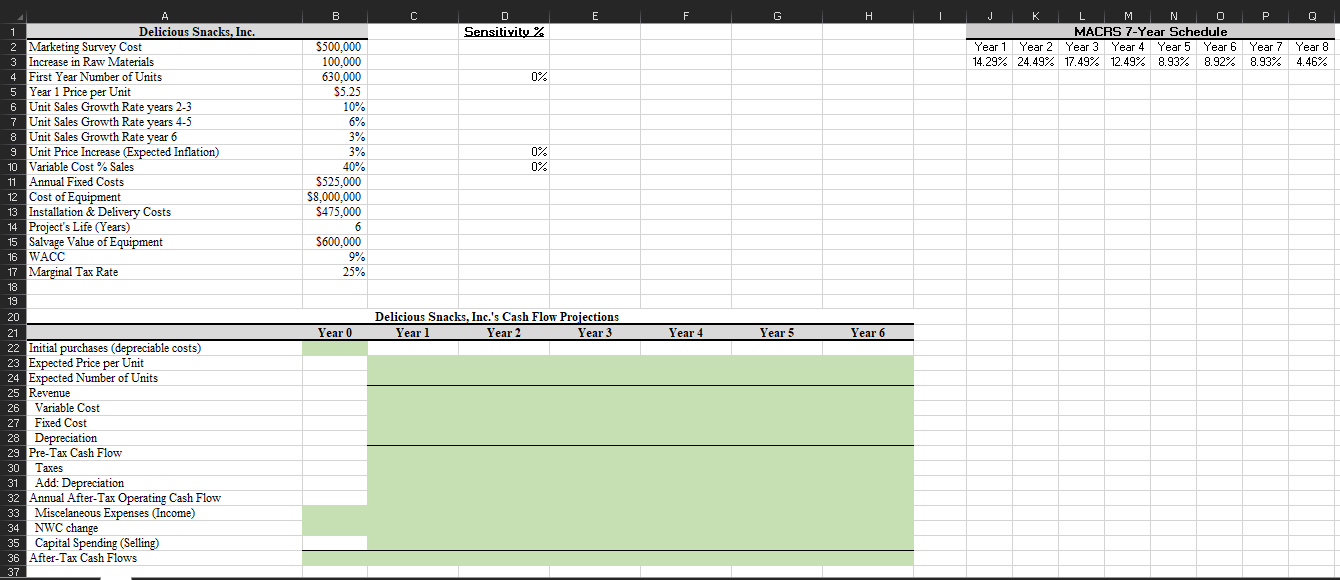

Delicious Snacks, Inc. is considering adding a new line of candies to its current product line. The company already paid $500,000 for a marketing research study that provided evidence about the demand for this product at this time. The new line will require an additional investment of $100,000 in raw materials at time zero to produce the candies. The project's life is 6 years and the firm estimates sales of 630,000 packages at a price of $5.25 per unit the first year; but this volume is expected to grow at 10% per year for the next two years, 6% per year for the following two years, and finally at 3% during the last year of the project. The price per unit is expected to grow at the historical average rate of inflation of 3% per year. The variable costs will be 40% of sales and the fixed costs will be $525,000. The equipment required to produce the candies will cost $8 million and will require an additional $475,000 to have it delivered and installed. This equipment will be depreciated to zero using the MACRS 7-year class life. After 6 years, the equipment is expected to be sold at a price of $600,000. The cost of capital is 9% and the firm's marginal tax rate is 25%.

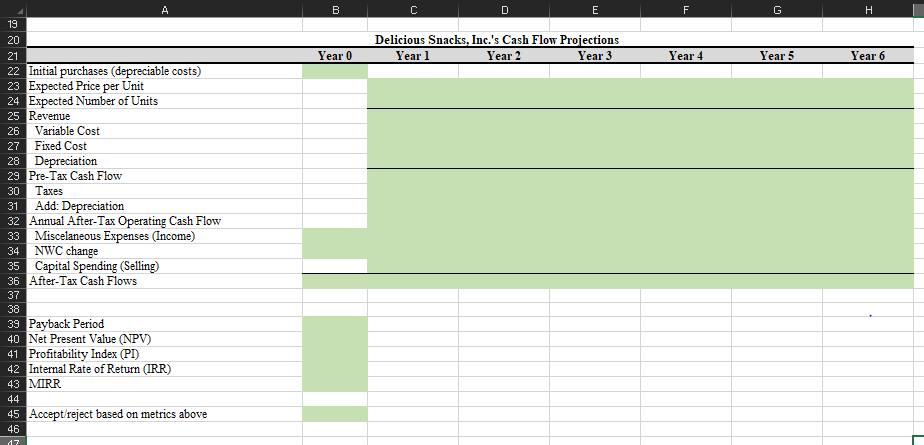

a) Calculate the projected after-tax cash flows for years 0-6. If a cell is shaded and you don't need an input for that cell, enter zero or leave blank.

b) Determine the payback period, NPV, PI, IRR, and MIRR of the new line of candies. Should the firm accept or reject the project based on these metrics?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started