Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Delima Bhd is a public listed company incorporated in 2010 and is involved in the business of trading, and manufacturing pharmaceutical and health products.

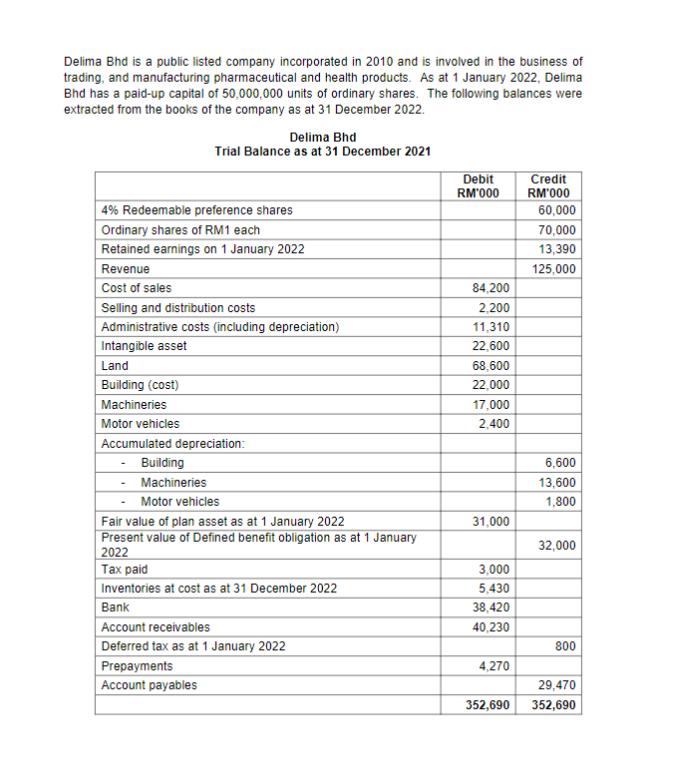

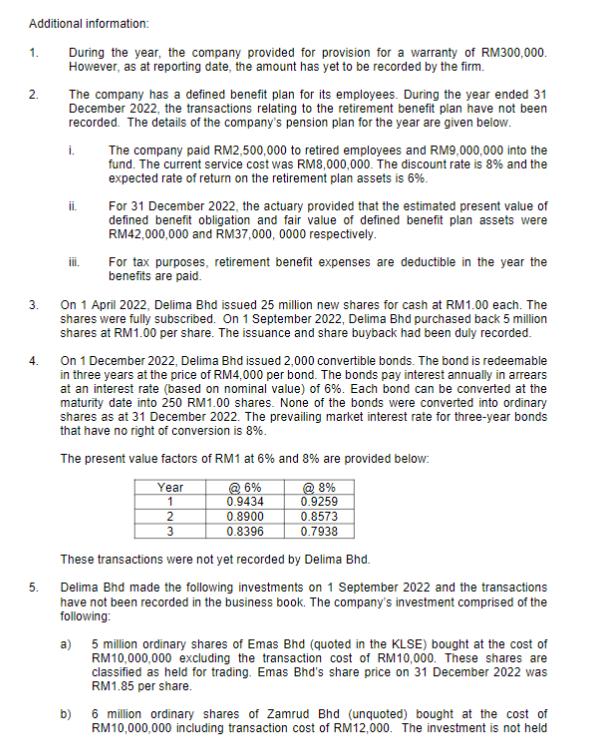

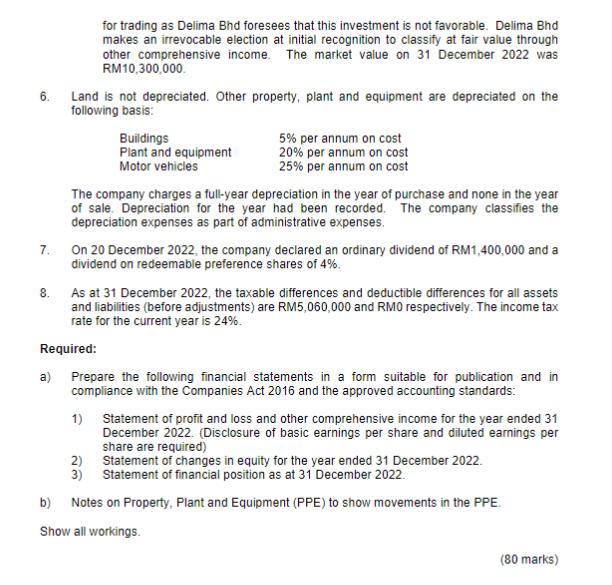

Delima Bhd is a public listed company incorporated in 2010 and is involved in the business of trading, and manufacturing pharmaceutical and health products. As at 1 January 2022, Delima Bhd has a paid-up capital of 50,000,000 units of ordinary shares. The following balances were extracted from the books of the company as at 31 December 2022. Delima Bhd Trial Balance as at 31 December 2021 4% Redeemable preference shares Ordinary shares of RM1 each Retained earnings on 1 January 2022 Revenue Cost of sales Selling and distribution costs Administrative costs (including depreciation) Intangible asset Land Building (cost) Machineries Motor vehicles Accumulated depreciation: Building Machineries Motor vehicles Fair value of plan asset as at 1 January 2022 Present value of Defined benefit obligation as at 1 January 2022 Tax paid Inventories at cost as at 31 December 2022 Bank Account receivables Deferred tax as at 1 January 2022 Prepayments Account payables Debit RM'000 84,200 2,200 11,310 22,600 68,600 22,000 17,000 2,400 31,000 3,000 5,430 38,420 40,230 4,270 Credit RM'000 60,000 70,000 13,390 125,000 6,600 13,600 1,800 32,000 800 29,470 352,690 352,690 Additional information: During the year, the company provided for provision for a warranty of RM300,000. However, as at reporting date, the amount has yet to be recorded by the firm. 1. 2. 3. 4. The company has a defined benefit plan for its employees. During the year ended 31 December 2022, the transactions relating to the retirement benefit plan have not been recorded. The details of the company's pension plan for the year are given below. 1. ii. iii. The company paid RM2,500,000 to retired employees and RM9,000,000 into the fund. The current service cost was RM8,000,000. The discount rate is 8% and the expected rate of return on the retirement plan assets is 6%. For 31 December 2022, the actuary provided that the estimated present value of defined benefit obligation and fair value of defined benefit plan assets were RM42,000,000 and RM37,000, 0000 respectively. For tax purposes, retirement benefit expenses are deductible in the year the benefits are paid. On 1 April 2022, Delima Bhd issued 25 million new shares for cash at RM1.00 each. The shares were fully subscribed. On 1 September 2022, Delima Bhd purchased back 5 million shares at RM1.00 per share. The issuance and share buyback had been duly recorded. On 1 December 2022, Delima Bhd issued 2,000 convertible bonds. The bond is redeemable in three years at the price of RM4,000 per bond. The bonds pay interest annually in arrears at an interest rate (based on nominal value) of 6%. Each bond can be converted at the maturity date into 250 RM1.00 shares. None of the bonds were converted into ordinary shares as at 31 December 2022. The prevailing market interest rate for three-year bonds that have no right of conversion is 8%. The present value factors of RM1 at 6% and 8% are provided below: @ 6% 0.9434 Year 1 2 3 0.8900 0.8396 @8% 0.9259 0.8573 0.7938 These transactions were not yet recorded by Delima Bhd. 5. Delima Bhd made the following investments on 1 September 2022 and the transactions have not been recorded in the business book. The company's investment comprised of the following: a) 5 million ordinary shares of Emas Bhd (quoted in the KLSE) bought at the cost of RM10,000,000 excluding the transaction cost of RM10,000. These shares are classified as held for trading. Emas Bhd's share price on 31 December 2022 was RM1.85 per share. b) 6 million ordinary shares of Zamrud Bhd (unquoted) bought at the cost of RM10,000,000 including transaction cost of RM12,000. The investment is not held 6. 7. 8. Land is not depreciated. Other property, plant and equipment are depreciated on the following basis: for trading as Delima Bhd foresees that this investment is not favorable. Delima Bhd makes an irrevocable election at initial recognition to classify at fair value through other comprehensive income. The market value on 31 December 2022 was RM10,300.000. Buildings Plant and equipment Motor vehicles The company charges a full-year depreciation in the year of purchase and none in the year of sale. Depreciation for the year had been recorded. The company classifies the depreciation expenses as part of administrative expenses. 5% per annum on cost 20% per annum on cost 25% per annum on cost On 20 December 2022, the company declared an ordinary dividend of RM1,400,000 and a dividend on redeemable preference shares of 4%. As at 31 December 2022, the taxable differences and deductible differences for all assets and liabilities (before adjustments) are RM5,060,000 and RM0 respectively. The income tax rate for the current year is 24%. Required: 1) a) Prepare the following financial statements in a form suitable for publication and in compliance with the Companies Act 2016 and the approved accounting standards: 2) 3) Statement of profit and loss and other comprehensive income for the year ended 31 December 2022. (Disclosure of basic earnings per share and diluted earnings per share are required) Statement of changes in equity for the year ended 31 December 2022. Statement of financial position as at 31 December 2022 b) Notes on Property, Plant and Equipment (PPE) to show movements in the PPE. Show all workings. (80 marks)

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a Financial Statements 1 Statement of Profit and Loss and Other Comprehensive Income for the Year Ended 31 December 2022 Delima Bhd Statement of Profit and Loss and Other Comprehensive Income For the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started