Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Delivered $5,000 worth of goods to a customer A. for cash Example Transactions Collected $12,000 from customers for magazine subscriptions that will begin being

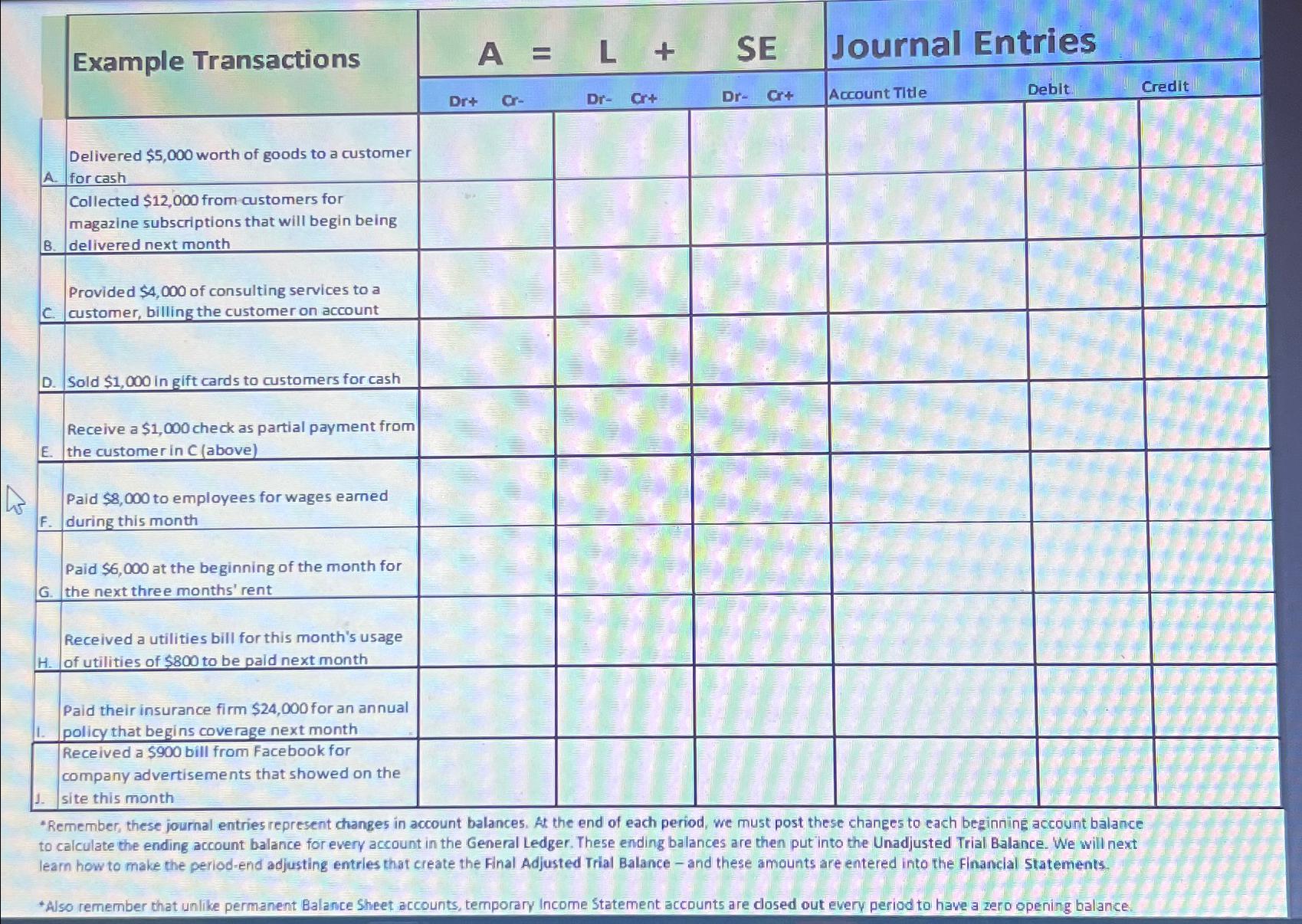

Delivered $5,000 worth of goods to a customer A. for cash Example Transactions Collected $12,000 from customers for magazine subscriptions that will begin being B. delivered next month Provided $4,000 of consulting services to a C. customer, billing the customer on account D. Sold $1,000 in gift cards to customers for cash Receive a $1,000 check as partial payment from E. the customer in C (above) Paid $8,000 to employees for wages earned F. during this month Paid $6,000 at the beginning of the month for the next three months' rent G. Received a utilities bill for this month's usage H. of utilities of $800 to be paid next month L J. Paid their insurance firm $24,000 for an annual policy that begins coverage next month Received a $900 bill from Facebook for company advertisements that showed on the site this month A = L + Dr+ Dr- SE Dr- Cr+ Journal Entries Account Title Debit Credit *Remember, these journal entries represent changes in account balances. At the end of each period, we must post these changes to each beginning account balance to calculate the ending account balance for every account in the General Ledger. These ending balances are then put into the Unadjusted Trial Balance. We will next learn how to make the period-end adjusting entries that create the Final Adjusted Trial Balance - and these amounts are entered into the Financial Statements. *Also remember that unlike permanent Balance Sheet accounts, temporary Income Statement accounts are closed out every period to have a zero opening balance.

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Lets analyze the example transactions and determine the journal entries for each transaction A Deliv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started